Digital asset funding merchandise noticed minor outflows totaling $17 million from Feb. 27 to March 3, which marks the fourth consecutive week of outflows, in accordance with CoinShares knowledge.

“Volumes throughout funding merchandise had been low at $844 million for the week,” the report cites, as regional sentiments begin to change. Final week, the U.S. recorded $7.6 million in inflows, whereas Europe recorded $23 million value of outflows.

Blockchain fairness traders additionally confirmed a bullish sentiment all through the week, recording $1.6 million value of inflows.

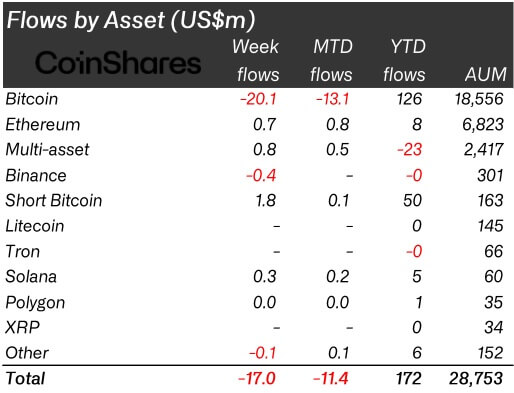

Flows by asset

Bitcoin (BTC) – primarily based funding merchandise recorded $20.1 million value of outflows, whereas short-bitcoin noticed inflows totaling $1.8 million, as CoinShares data revealed.

Based on the info, Binance (BNB) and Cosmos (ATOM) additionally recorded outflows value $0.38 million and $0.21 million, respectively.

Alternatively, nearly all of altcoins noticed inflows throughout the identical week. Ethereum (ETH) and Solana (SOL) primarily based funding merchandise recorded $0.7 million and $0.3 million in inflows, respectively. Multi-asset merchandise additionally grew by a further $0.8 million.

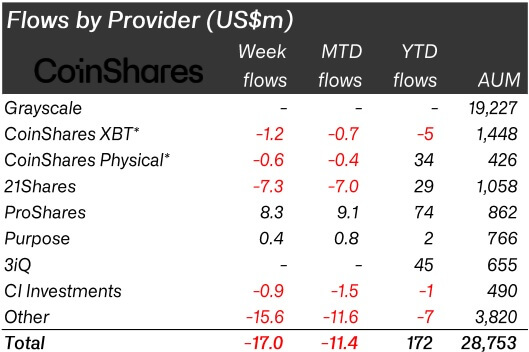

Flows by supplier

The report additionally revealed that almost all of the suppliers recorded outflows regardless of the optimistic sentiment altcoins skilled.

All vital suppliers, apart from ProShares and Objective, have recorded outflows throughout the week of Feb. 26 to Mar. 3. CoinShares XBT and Bodily noticed a mixed $1.8 million in outflows.

21Shares, CI Investments, and others recorded $7.3 million, $0.9 million, and $15.6 million, respectively. ProShares and Objective, alternatively, grew by a further $8.3 million and $0.4 million, respectively.

Discussion about this post