Introduction

Silvergate financial institution introduced it might start winding down operations and bear voluntary liquidation.

On March 8, the financial institution mentioned it was exploring the way it might resolve claims and make sure the continued residual worth of its asset whereas repaying all deposits to shoppers. The choice was made in gentle of “current trade and regulatory developments,” its holdings firm Silvergate Capital mentioned.

The announcement got here days after the financial institution introduced it might halt the Silvergate Change Community (SEN), its real-time settlement service. On March 3, Silvergate submitted an SEC submitting stating that it confronted inquiries from the U.S. Division of Justice (DOJ) and would file a late 10-Okay report.

Whereas the financial institution’s troubles culminated on March 8 with the liquidation announcement, it has struggled for a number of months. Because the collapse of FTX in November 2022, the financial institution has seen its inventory worth depreciate by over 94%.

Essentially the most important 24-hour loss was recorded between March 1 and March 2, when the NASDAQ-listed SI dropped 57%.

The information despatched shockwaves by means of the crypto market, because the U.S. financial institution served because the spine for the crypto market, offering monetary companies to most giant crypto corporations and exchanges within the nation.

Bitcoin dropped to its January low of $19,680 after buying and selling flat at round $21,000 for over a month. The overall crypto market cap dipped beneath $1 trillion, struggling to retain $880 billion at press time.

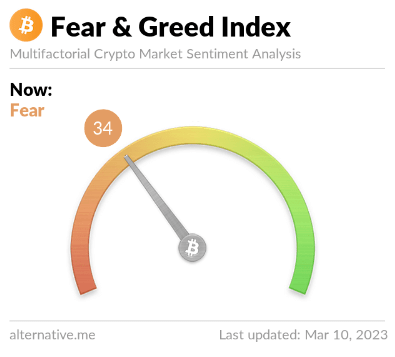

The crypto worry and greed index has step by step decreased and reveals worry. Declining buying and selling volumes and rising change withdrawals present investor sentiment is worsening day by day.

Regardless of nonetheless being operational, Silvergate has had a profound impact in the marketplace. It triggered a domino impact that may have an effect on not solely cryptocurrency corporations within the U.S. however your complete banking sector within the nation.

On this report, CryptoSlate dives deep into Silvergate to see what introduced the previous banking big to its knees and the way different banks might share its future.

How Silvergate received large

Silvergate was based in 1988 and started an initiative to service cryptocurrency shoppers in 2013 after its CEO Alan Lane personally invested in Bitcoin. Additional analysis into cryptocurrencies confirmed that the market was lacking banking companies, a gap Silvergate was the primary and the quickest to fill.

Silvergate’s determination to cease its mortgage operations in 2005 helped it climate the storm brought on by the subprime mortgage meltdown. When the Nice Monetary Disaster hit in 2008, the financial institution was among the many few within the nation who might lend. Nevertheless, the financial institution lacked buyer deposits to fund these loans and was searching for methods to draw new prospects.

The crypto trade within the U.S. was full of corporations with nowhere to go. With Silvergate positioning itself as the only savior of what can solely be described as a banking disaster in crypto, it noticed its deposits double in a 12 months. In 2018, it serviced over 250 worldwide shoppers within the crypto house. As of September 2022, Silvergate had 1,677 prospects utilizing SEN.

This was primarily as a result of Silvergate’s modern method to servicing the trade. As an alternative of simply offering custody companies to crypto shoppers, the financial institution created the Silvergate Change Community (SEN), a real-time settlement service that enabled the seamless movement of {dollars} and euros between crypto corporations. The service was revolutionary on the time, as no different financial institution had real-time cost capabilities that may match the 24/7 cost wants of the crypto trade.

The financial institution’s companies shortly grew to accommodate the rising urge for food of the trade — it noticed a whole lot of thousands and thousands of {dollars} in extra investments and started offering Bitcoin-collateralized loans to shoppers.

As Silvergate charged no charges to make use of SEN and its buyer deposits didn’t bear any rates of interest, it profited by utilizing the deposits to put money into bonds or concern loans to earn cash on the unfold. A Forbes report from October 2022 confirmed that commitments to SEN Leverage reached $1.5 billion, up from $1.4 billion recorded in June.

This modest development mirrored the comparatively flat deposits the financial institution noticed all through 2022. After its parabolic rise in 2020 and 2021 in the course of the bull market, deposits peaked within the first quarter of 2022 because the community grew to become totally saturated.

Silvergate’s fast and painful loss of life

Then, FTX collapsed and started wreaking havoc in the marketplace. Bitcoin dipped to a two-year low of $15,500, dragging the remainder of the market deep into the purple. Over $4 billion value of buyer funds on FTX threatened to be misplaced endlessly, prompting regulators worldwide to maintain a watchful eye on the trade.

And whereas Silvergate had no lending relationship with FTX, it failed to stay immune from the fallout.

It started seeing an alarming improve in withdrawals because the fourth quarter started. CryptoSlate’s analysis on the time famous that the market was turning into frightened that the contagion from FTX might unfold to Silvergate’s different collectors. The financial institution’s ten greatest depositors, which included Coinbase, Paxos, Crypto.com, Gemini, Kraken, Bitstamp, and Circle, accounted for half of its deposits on the finish of the third quarter.

Silvergate started borrowing towards the long-dated belongings it held to fight its dwindling deposits, largely U.S. treasuries and company bonds. Nevertheless, it didn’t maintain the market at bay and stop additional withdrawals, forcing it to start promoting the belongings to pay out its depositors.

With rising rates of interest and dangerously excessive inflation, Silverage reportedly misplaced a minimum of $700 million on promoting $5.2 million value of bonds within the fourth quarter and took one other $300 million on a fair-value adjustment of its remaining portfolio.

Initially of November 2022, Silvergate had $11.9 billion in buyer deposits. By the tip of December 2022, its deposits dropped to $3.8 billion.

The domino impact

Whereas it would take a number of months for Silvergate to wind down its operations, its impact in the marketplace is already evident. Market sentiment appears to have sloped to a brand new low, with each retail and institutional traders dropping the little confidence they’d in banking establishments.

Inventory costs for a few of the different main cryptocurrency banks are starting to indicate this.

Signature Financial institution, one other giant U.S. financial institution centered on offering companies to crypto corporations, noticed its inventory drop over 34% for the reason that starting of February. SBNY posted a 12% loss between March 7 and March 8. This can be a important loss for the financial institution, whose crypto deposits comprise solely 15% of its whole deposits. The financial institution additionally doesn’t interact in crypto-backed lending or maintain cryptocurrencies on its shoppers’ behalf. It additionally signed on a number of giant shoppers that left Silvergate, together with LedgerX and Coinbase.

Regardless of Barron’s assessment that Signature continues to be purchase, anticipating its inventory to regain its ATH in a comparatively quick time-frame, confidence within the sector is at its all-time low.

After a tumultuous week, Silicon Valley Financial institution was closed on Friday, March 10.

The New York-based financial institution noticed its inventory drop over 62% for the reason that starting of March after dropping 12% in February. Shares of SVB Monetary, the financial institution’s holding firm, adopted Signature’s sample — they peaked in October 2021 on the peak of the bull market, posting a 176% YoY development.

The virtually vertical drop within the financial institution’s inventory worth adopted the announcement that the financial institution wanted to lift $2.25 billion in inventory. Broader market turmoil pushed a lot of SVB’s startup and tech shoppers to withdraw their deposits, pushing the financial institution to promote “considerably all” of its available-for-sale securities at a $1.8 billion loss.

The financial institution confronted an ideal storm. Shoppers have been pulling their deposits at an alarming fee as they feared the domino impact brought on by Silvergate. Its shoppers, made up largely of high-growth startups, are seeing a notable lower in VC funding exercise and a rise in money burn because the market begins to decelerate. Morgan Stanley famous that this was the primary driver for the decline in SVB’s consumer funds and on-balance-sheet deposits, despite the fact that they mentioned the financial institution had “greater than sufficient liquidity” to fund these outflows.

Nevertheless, sources near the financial institution revealed on Friday that the financial institution was reportedly in talks to promote itself as its makes an attempt to lift capital have failed. CNBC reported that “giant monetary establishments” have been wanting on the potential buy of SVB.

Then, the California Division of Monetary Safety and Innovation closed SVB on March 10, appointing the FDIC as a receiver. A brand new financial institution was created — the Nationwide Financial institution of Santa Clara — to carry the insured deposits on behalf of SVB’s shoppers. FDIC famous that the financial institution can be operational as of Monday, with all SVB’s insured depositors having full entry to their insured deposits. Which means shoppers with deposits exceeding $250,000 will obtain a receivership certificates that may allow them to redeem their uninsured funds sooner or later.

Different monetary shares proceed to stumble. Spooked by SVB’s securities sell-off and its subsequent shutdown, traders started dumping shares of different giant banks within the U.S. The 4 greatest banks within the U.S. — JPMorgan, Financial institution of America, Wells Fargo, and Citigroup, misplaced $54 billion in market worth on Thursday, March 9.

JPMorgan suffered probably the most important loss, seeing its market cap drop by round $22 billion. Financial institution of America adopted with a $16 billion loss, whereas Wells Fargo’s market cap was down $10 billion. Citigroup posted a $4 billion loss.

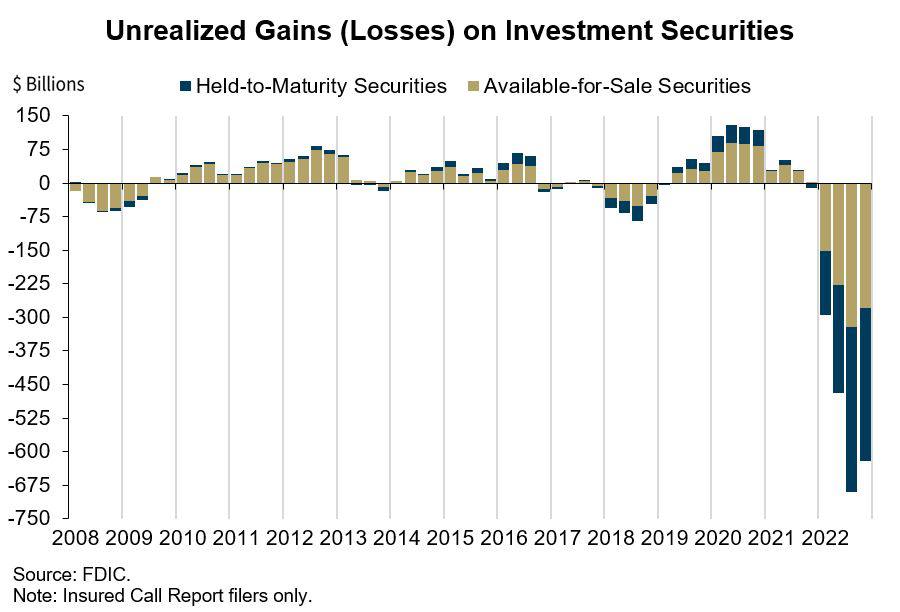

Not one of the giant legacy banks within the U.S. have to date been confronted with deposit withdrawals like those Silvergate and SVB skilled. Nonetheless, traders appear frightened that the banks received’t be capable to meet the outflow demand, as most maintain giant quantities of long-term maturity belongings. Acquired when rates of interest have been traditionally low, these securities are value considerably lower than their face values. The Federal Deposit Insurance coverage Company (FDIC) estimated that U.S. banks held round $620 billion in unrealized losses on these securities on the finish of 2022.

The contagion from Silvergate has unfold to Europe as nicely.

Credit score Suisse, one of many largest banks in Europe, noticed its shares drop to their all-time low on Friday, March 10, main different European banking shares down with it.

And whereas the loss Europe’s STOXX banking index noticed was simply 4.2%, it nonetheless represents the largest one-day slide since June 2022. Different main banks within the E.U. additionally noticed important losses, with HSBC posting a 4.5% loss and Deutsche Financial institution dropping 7.8%.

Regulatory blowback

The collapse of FTX triggered an unprecedented regulatory crackdown on the crypto trade. This has been most obvious within the U.S., the place lawmakers have been preventing a vicious struggle over the right way to regulate the booming market.

The collapse of FTX solely added gas to the hearth, creating an aggressive new motion that set its sights on tightening its reigns on the trade.

Earlier this week, Sen. Elizabeth Warren mentioned that Silvergate’s failure was disappointing however predictable:

“I warned of Silvergate’s dangerous, if not unlawful, exercise — and recognized extreme due diligence failures. Now prospects have to be made entire, and regulators ought to step up towards crypto danger.”

Warren’s criticism wasn’t met with approval, although. Apart from the widely detrimental market response, 4 Republican senators despatched a letter to the Board of Governors of the Federal Reserve condemning the elevated regulatory strain.

Within the letter, they acknowledged that the organized try and de-bank the crypto trade was “disturbingly reminiscent” of Operation Choke Level. They referred to as for the Federal Reserve, FDIC, and OCC to not punish your complete crypto trade because the overreaching conduct of banking regulators will inevitably bleed into different industries.

On March 10, U.S. Treasury Secretary Janet Yellen met with officers from the Federal Reserve, FDIC, and OCC to debate the state of affairs concerning SVB. Later that day, whereas testifying earlier than a Home Methods and Means Committee listening to, she mentioned that U.S. regulators have been monitoring a number of banks affected by current developments.

Conclusion

It took over 4 months of market turmoil to carry Silvergate to its knees. Nevertheless, the domino impact it triggered led to exponentially sooner deaths for different establishments in line behind it.

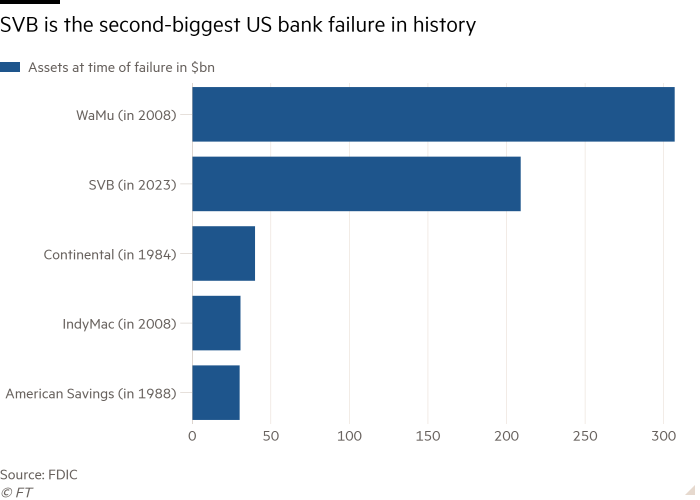

Silicon Valley Financial institution closed down after lower than every week of hypothesis about its solvency. It took hours to change into a poster youngster for the crypto banking disaster — SVB is now the second-biggest financial institution failure within the U.S. ever recorded.

Nevertheless, the domino impact that started with Silvergate hasn’t ended with Silicon Valley Financial institution. The total scope of the blowback is but to be felt as each banks will take months to wind down their operations.

Within the meantime, financial institution runs are set to threaten much more monetary establishments servicing the crypto and tech industries. We are able to count on different small to mid-size banks to wrestle with paying out buyer deposits.

The crypto banking sector’s unlucky however most definitely future might be aggressive centralization and corporatization. As increasingly boutique banks shut down, giant crypto corporations and exchanges will flock to giant legacy banks. Small crypto corporations will proceed to wrestle securing banking companies, resulting in mass relocations or cheaper acquisitions by bigger rivals.

Discussion about this post