The current crypto market rally has pumped the crypto holdings of a number of bankrupt crypto corporations within the final 24 hours, in keeping with the Arkham Intelligence dashboard.

Over the past 24 hours, flagship digital property like Bitcoin (BTC) and Ethereum (ETH) rose by greater than 7%, respectively. The worldwide crypto market cap additionally rallied above $1 trillion through the reporting interval, in keeping with CryptoSlate’s information.

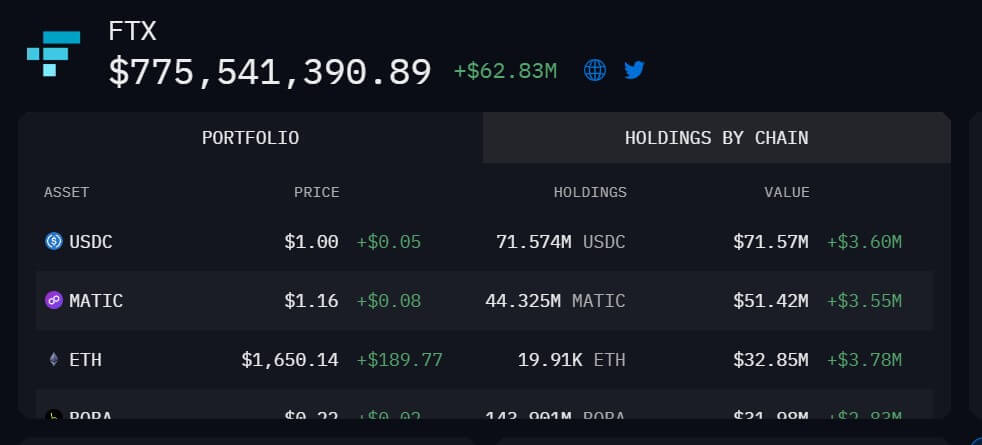

FTX’s holding rise $63 million

Bankrupt crypto alternate FTX’s crypto portfolio rose by roughly $63 million. Except for Euler’s Finance EUL token and Unus Sed Leo’s native token, different digital property within the alternate’s portfolio recorded good points.

The FTX administration has been consolidating the bankrupt’s agency property from completely different on-chain sources into the pockets.

In keeping with the dashboard, FTX’s FTT was liable for a lot of the achieve. The token rose 5.64% within the final 24 hours and added $24.25 million to the bankrupt agency’s portfolio.

Different property just like the embattled USD Coin (USDC) stablecoin added $3.60 million to its holdings. Its ETH holdings grew by $3.78 million, whereas Polygon’s MATIC holdings elevated by $3.55 million.

Its obscure altcoin holdings, like BOBA, added greater than $1.6 million respectively to the agency’s general portfolio.

However, a pockets related to its sister firm, Alameda Analysis, gained $21.19 million, primarily from its BitDAO (BIT), USDC, and ETH holdings.

Celsius, Voyager holdings enhance over $50M every

A take a look at the crypto holdings of different bankrupt crypto lending corporations like Celsius Community and Voyager confirmed that in addition they benefited from the pump.

A pockets related to Celsius Community increased by $133.15 million to over $1 trillion. The bankrupt lender good points principally got here from its staked Ethereum (stETH) holding, which rose by $82.36 million. Its Celsius (CEL) token added $29.32 million, whereas its ETH holdings elevated by roughly $10 million.

Apart from that, its different property, USDC, Chainlink (LINK), Wrapped Ethereum (wETH), and many others., recorded over one million achieve.

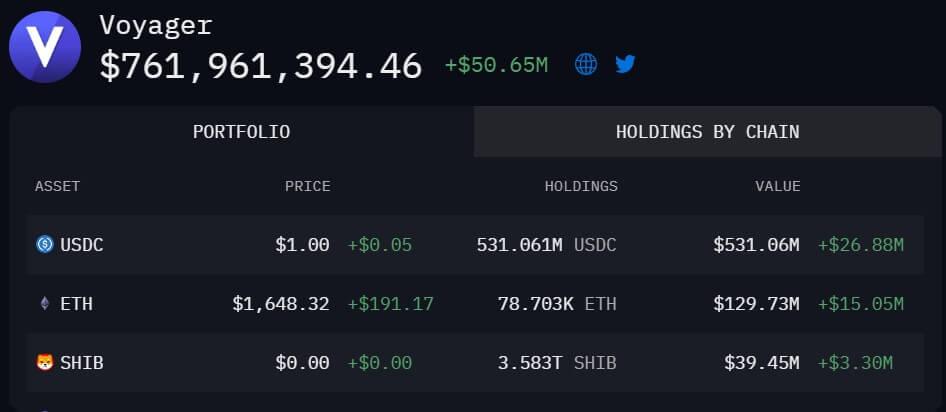

In the meantime, the dashboard reveals Voyager Digital’s property rallied by $50.65 million. The bankrupt agency had been liquidating its property into USDC and had earlier recorded a lack of round $45 million, Arkham Intelligence tweeted on March 11.

However with the stablecoin regaining its peg alongside the broader market rally, its USDC holdings grew $26.88 million whereas its Ethereum and Shiba Inu (SHIB) holdings spiked by $15.05 million and $3.30, respectively.

Discussion about this post