Fast Take

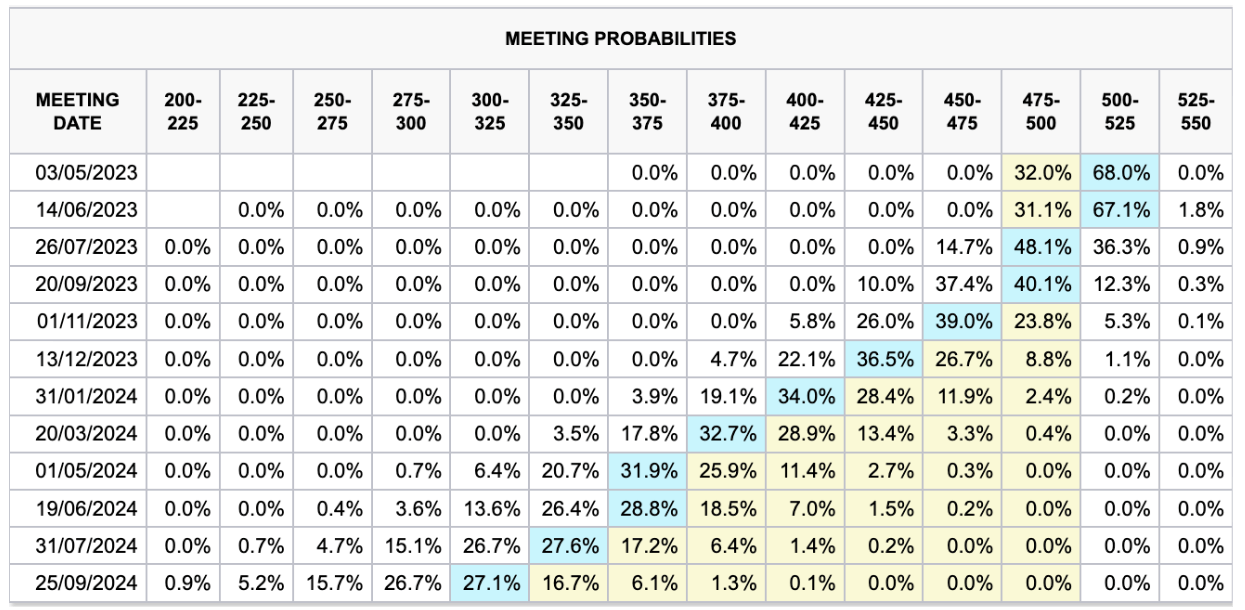

- On the information of as we speak, job report, and unemployment knowledge, the market is now pricing in a 70% likelihood of a 25bps price hike.

- This might take the federal funds price above 5%.

- The market now expects a 25bps hike in Might, a pause in June, and a 25bps reduce in July.

- Nevertheless, we now have a few inflation stories, with CPI on April 12 and PCE on April 28.

- So we anticipate the information to vary because the month rolls on.

The publish Jobs report fuels speculation of impending interest rate hike appeared first on CryptoSlate.

Discussion about this post