The U.S. financial system grew at an annualized tempo of 1.1% in Q1 2023, which got here in slower than expectations and was forecasted to return in at 1.9%. Stagflation is now a priority for the U.S.; this GDP print was considerably smaller than the earlier two quarters, 2.6% and three.2%, respectively.

Subsequent week’s FOMC assembly, which takes place on Could 3, is predicted to boost charges by an additional 25bps taking the federal funds fee to five.00%.

The U.S.

Debt ceiling drama

What’s the debt restrict? In response to the U.S. Division of Treasury, it’s “The debt restrict is the overall amount of cash that the US authorities is allowed to borrow to satisfy its current authorized obligations, together with Social Safety and Medicare advantages, army salaries, curiosity on the nationwide debt, tax refunds, and different funds”.

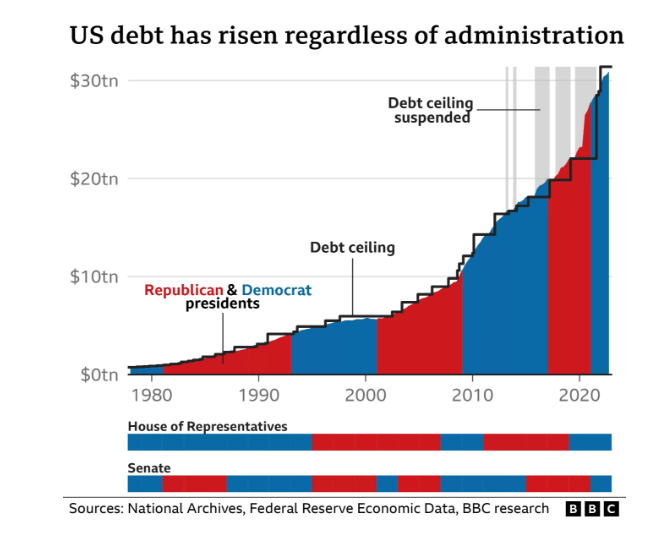

In response to data from 1960 and corroborated by Lyn Alden, Congress has raised the debt ceiling 78 occasions, which has been raised by Democrats and Republicans 29 and 49 occasions, respectively.

You will have heard the information that the U.S. is approaching the debt ceiling, and this has precipitated uncertainty available in the market. The bottom case and what we anticipate is for the U.S. debt ceiling to be raised and to kick the can down the street; this recreation of rooster will most definitely go on into the eleventh hour. We have now beforehand highlighted that the Treasury General account has been depleted, heading to 0, which has dislocated the market.

Nonetheless, each Democrats and Republicans are miles other than agreeing. Democrats insist on elevating the debt ceiling with none circumstances. Republicans are calling for spending cuts.

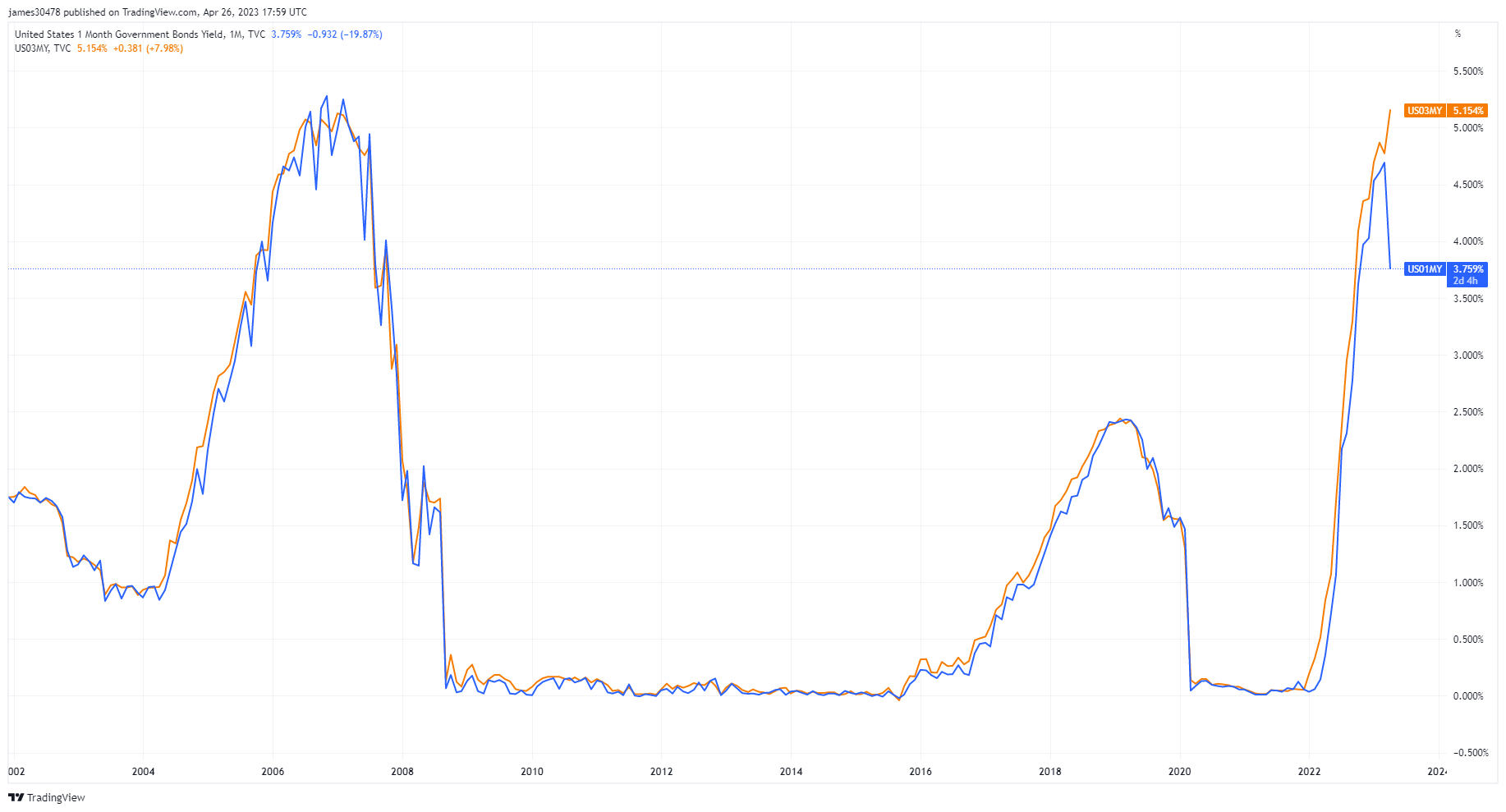

The longer this continues, places additional strain on monetary markets, which will be greatest seen by the unfold between the one and three-month U.S. treasury payments. The unfold between the 2 yields needs to be zero. As you’ll be able to see, the demand for the US 1-month T-bill, which matures earlier than the U.S. treasury runs out of money, is at 3.759%. On the identical time, the 3-month T-bill faces the potential of default except Congress raises the debt ceiling, which is yielding 5.154%. Buyers are involved concerning the potential of a default, the earliest the Treasury would now not have the ability to pay its payments would come as early as June, however we imagine the ceiling shall be prolonged.

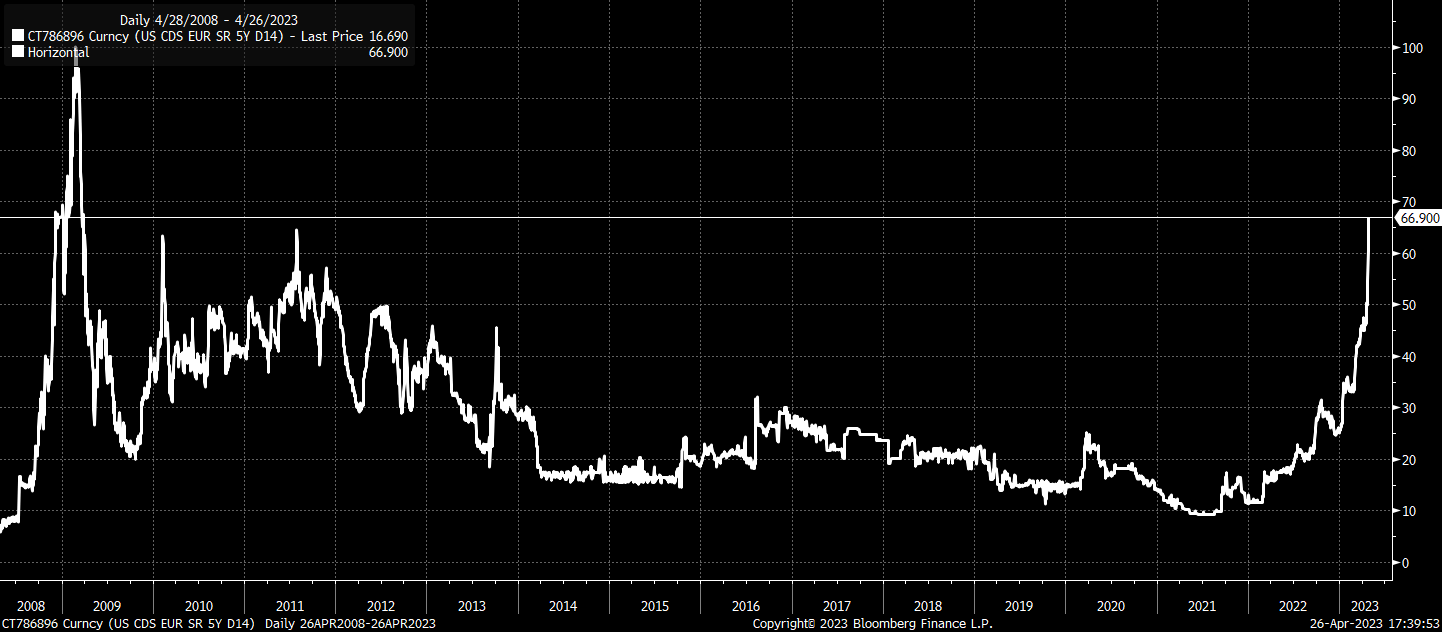

U.S. Treasuries are the inspiration of the whole monetary system, so a everlasting default would disrupt the whole system. Nonetheless, a small non permanent default would have an effect on U.S. credit score, which will be seen with the 5 yr US CDS unfold at its highest ranges since 2009.

First Republic Financial institution

Why would the regional financial institution disaster be over when charges are nonetheless rising and elevated? Shares in First Republic Financial institution are nearly down 95% up to now six months. Because the federal funds fee is approaching 5%, deposit flights are an actual challenge for banks. First Republic Financial institution reported an enormous deposit flight.

The disaster may deepen if the FDIC or a non-public group finds no decision. In response to Macro Funding, if FRB held to maturity property are offered, the realized losses on these property would wipe out the worth of its fairness. It’s extra probably that the Fed and Treasury might want to arrange a bailout much like Credit score Suisse.

The U.Ok.

BOE doesn’t take the blame for inflation

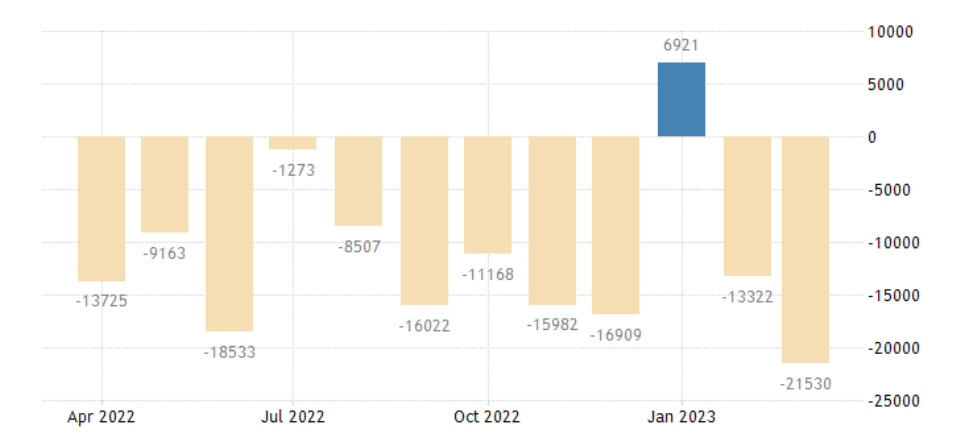

UK public sector borrowing elevated yearly, totaling £21.5 billion, equal to five.5% of the GDP, a deficit of £21.53 billion. As well as, curiosity prices soared over 47% increased than final 12 months to over £106.6 billion.

It was per week to neglect for the policymakers in cost, who must, fairly frankly want to return to highschool and perceive the basics of economics. Deputy Governor Ben Broadbent outright refused that cash printing throughout covid resulted from this out-of-control inflation. He blamed the price of importing power.

From one incompetent policymaker to the following, Chief Economist Huw Tablet adopted up this week by saying that individuals within the UK “want to just accept that they’re worse off and cease attempting to keep up their actual spending energy”. He blames individuals for pushing for increased wages contributing to increased inflation. He additionally expects inflation to return right down to 2% within the subsequent two years. He can now be added to the “inflation is transitory” group with Jerome Powell.

Japan

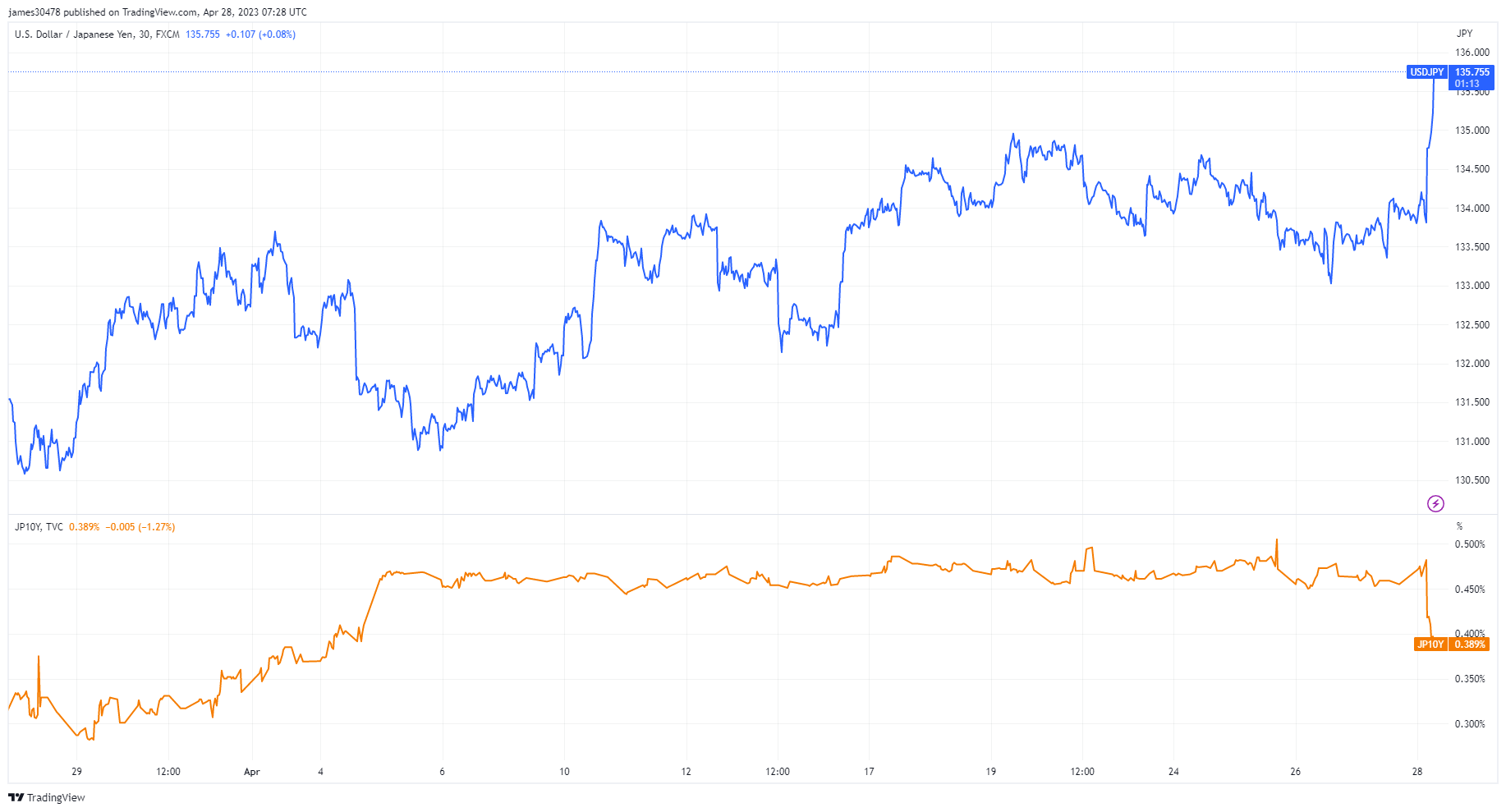

The Financial institution of Japan met once more on Friday and unsurprisingly dedicated to a stimulus-first method to keep up yield curve management on the 10-year bond. Consequently, this despatched the Yen and yields sharply decrease.

Discussion about this post