The FTX debtors stated they’d paid the 14 consultancy corporations and the legislation corporations dealing with its chapter case over $100 million as of April 30, in keeping with a Might 30 courtroom filing.

Sullivan & Cromwell is high earner

Based on the submitting, FTX paid legislation agency Sullivan & Cromwell (S&C) $39.58 million for its companies, making it the very best earner amongst these corporations.

S&C is the corporate’s restructuring counsel and has performed an lively position in FTX’s chapter case. The legislation agency beforehand described its companies to the bankrupt trade as “one of the sophisticated, multi-disciplinary workouts by any legislation agency.”

The agency was initially met with stiff opposition from Sam Bankman-Fried, who accused the legislation agency of pressuring him to authorize submitting for chapter within the days following FTX’s implosion. S&C’s involvement within the proceedings has additionally been challenged by U.S. lawmakers Thom Tillis, Elizabeth Warren, John Hickenlooper, and Cynthia Lummis, who cited its earlier relationship with FTX in a Jan. 9 letter to the court.

One other top-earning agency within the FTX’s chapter case is Alvarez & Marsal North America, appearing as a monetary advisor to the chapter case. The agency has earned $32.7 million.

Others like Landis Rath & Cobb, Quinn Emanuel Urquhart & Sullivan, AlixPartners, Kroll, Jefferies LLC, and others have earned between $257,149 and $5.01 million.

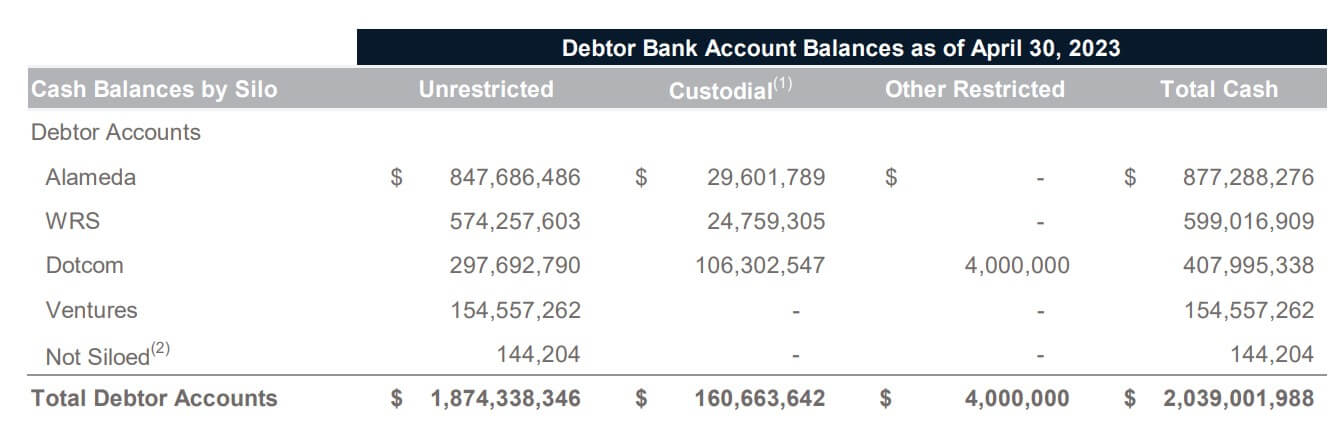

FTX has $2.03B in financial institution

The debtors in FTX’s chapter reported that the 4 siloes of the bankrupt crypto empire held $2.03 billion in unnamed banks as of April 30.

A breakdown of those checking account balances confirmed that the Alameda silo, which includes the principal buying and selling agency Alameda Analysis and its subsidiaries, had $877.28 billion in banks. In distinction, the West Realm Shires silo — which incorporates FTX US and Ledger X — had 599.01 billion within the banks.

The Dotcom silo, which includes FTX.com and different exchanges, had $407.99 billion in banks, whereas the FTX Ventures held $154.55 billion in these conventional monetary establishments.

Moreover, Deck Applied sciences, Inc—a separate entity and never one of many 4 silos making up FTX’s primary accounts — has $144,204 in banks.

The FTX debtors stated they maintained accounts in foreign currency echange throughout quite a few entities. The bankrupt agency didn’t present additional info on the names of those banks or the quantity held at every.

Reports revealed a number of U.S. banks’ ties to the bankrupt trade earlier within the 12 months. A lawsuit alleged that the defunct Signature Financial institution aided and abetted the FTX fraud by “allowing” the commingling of the trade customers’ funds via its Signet community.

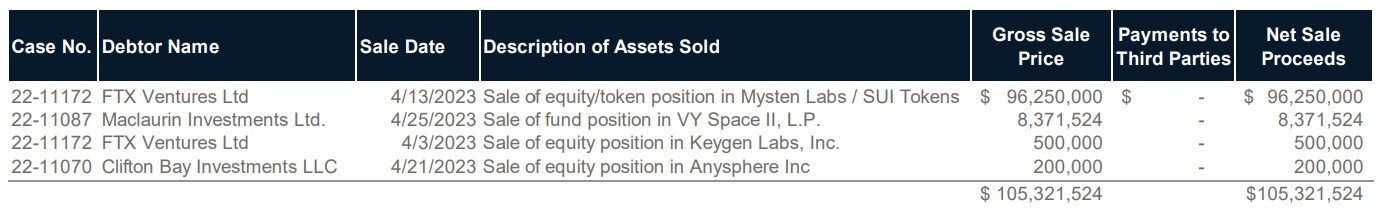

FTX earned $105M

The monetary assertion additional confirmed that the bankrupt agency received $105.32 million via the gross sales of 4 totally different property.

Based on the submitting, the trade earned $96.25 million from the gross sales of its fairness and token place in Mysten Labs’ SUI Tokens. CryptoSlate reported that the bankrupt trade had undervalued its SUI holdings by roughly 1,000 instances, because the tokens would have been value over $1 billion.

In the meantime, the agency offered its fund place in VY House for $8.3 million on April 25 and its fairness place in Keygen Labs and Anysphere for $500,000 and $200,000, respectively.

Different updates

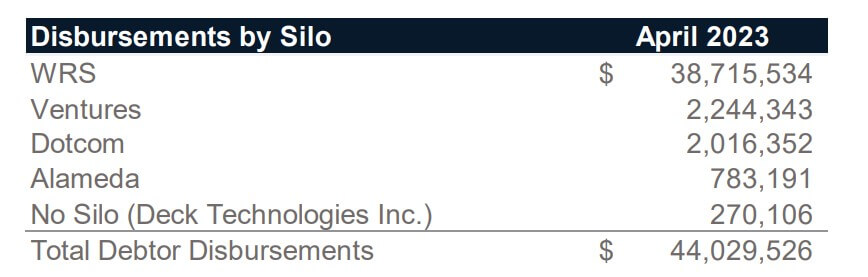

Based on the courtroom submitting, FTX made $44.02 million in disbursements in April. The submitting didn’t embody particulars on when these funds have been made and to whom they have been made.

Moreover, FTX stated it has 107 full-time workers, down from the 320 workers it had when it filed for chapter and paid a complete post-petition taxes of $386,033 in April.

Discussion about this post