Fast Take

Since 2010, the U.S. monetary panorama has primarily been marked by the Client Value Index (CPI) inflation price outpacing the federal funds price. Nonetheless, this pattern skilled an exception in 2019, and curiously, in Could 2023, when the nation entered a interval of constructive actual charges – a state of affairs the place the federal funds price, at present at 5.33%, exceeds the CPI inflation price, presently recorded at 3.68%. Regardless of this dynamic, yields persistently proceed their upward trajectory throughout the yield curve.

Regardless of constructive actual charges, the continual escalation in yields alerts that the measures taken by the Federal Reserve could also be inadequate in successfully curbing inflation and steering it again in direction of the designated 2% goal.

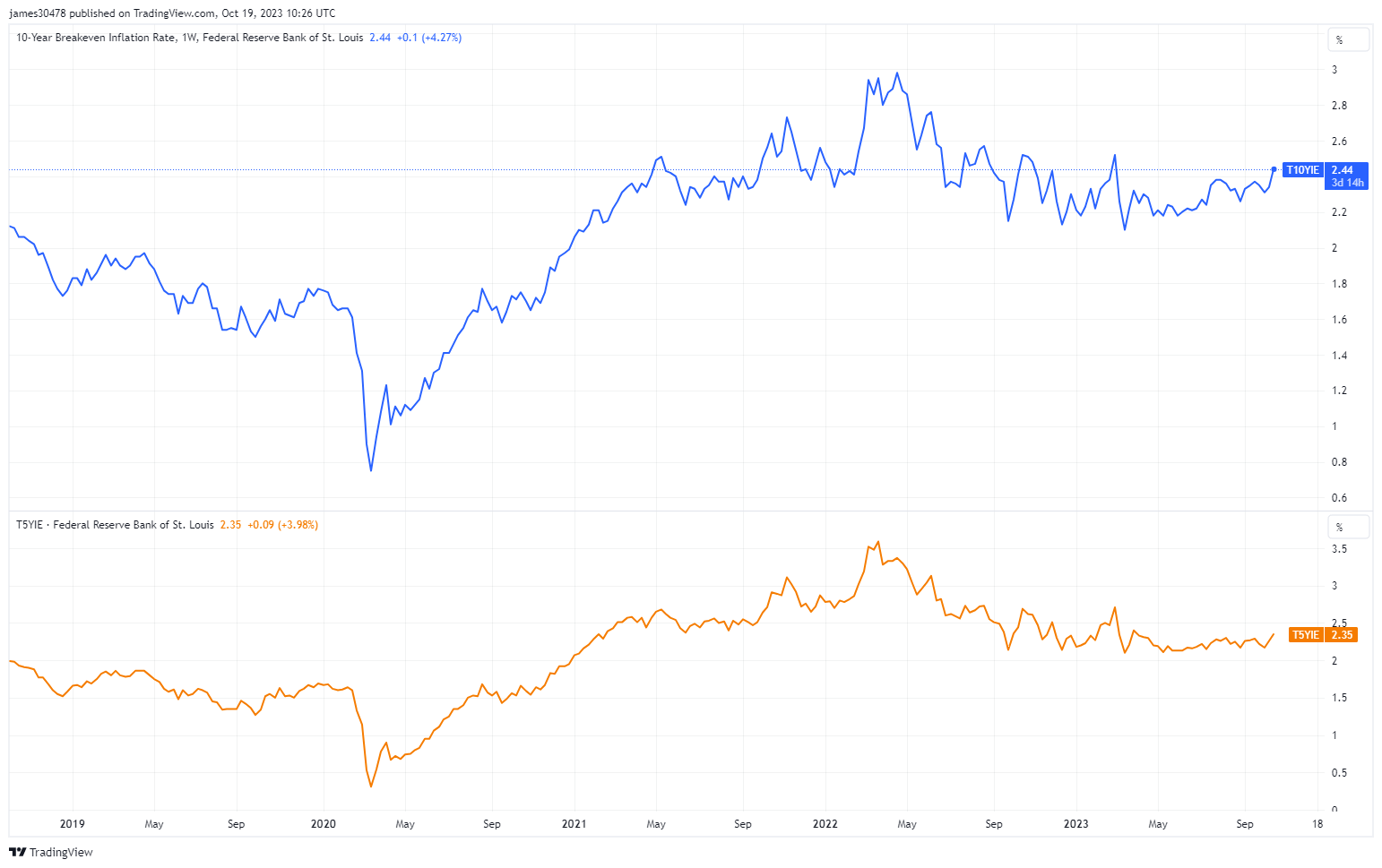

The bond market seems to solid doubt over the U.S. monetary authority’s claims of returning to the two% inflation benchmark. This skepticism is driving yields higher. Reinforcing this sentiment are the surging inflation expectations. In keeping with current information, 10-year inflation expectations have reached 2.44%, marking the second peak this 12 months, whereas the 5-year expectations stand at 2.35%, exceeding the two% goal.

These developments immediate a compelling inference: To curb rising inflation, the Federal Reserve could need to persist in augmenting charges, a method which, satirically, would possibly contribute to the continuous rise of yields.

The publish The 10-year breakeven inflation rate has reached the second-highest level in 2023 appeared first on CryptoSlate.

Discussion about this post