Fast Take

The world of monetary property has a widely known sample: a surge in asset costs previous to anticipated optimistic developments or ‘excellent news,’ adopted by a notable droop when the occasion happens. This phenomenon, also known as ‘purchase the rumor, promote the information,’ suggests the interaction of strategic, maybe institutional, shopping for and retail buyers usually left shopping for on the peak.

As an illustration, the ProShares Bitcoin Technique ETF (BITO) launch in October 2021 coincided with the height of the bull marketplace for crypto. This occasion amassed over $1 billion in trading volume and marked a high within the cycle. Conversely, the BITI ProShares Brief Bitcoin Technique ETF, which affords buyers the chance to guess in opposition to Bitcoin, marked an area trough in June 2022 amidst the Luna collapse.

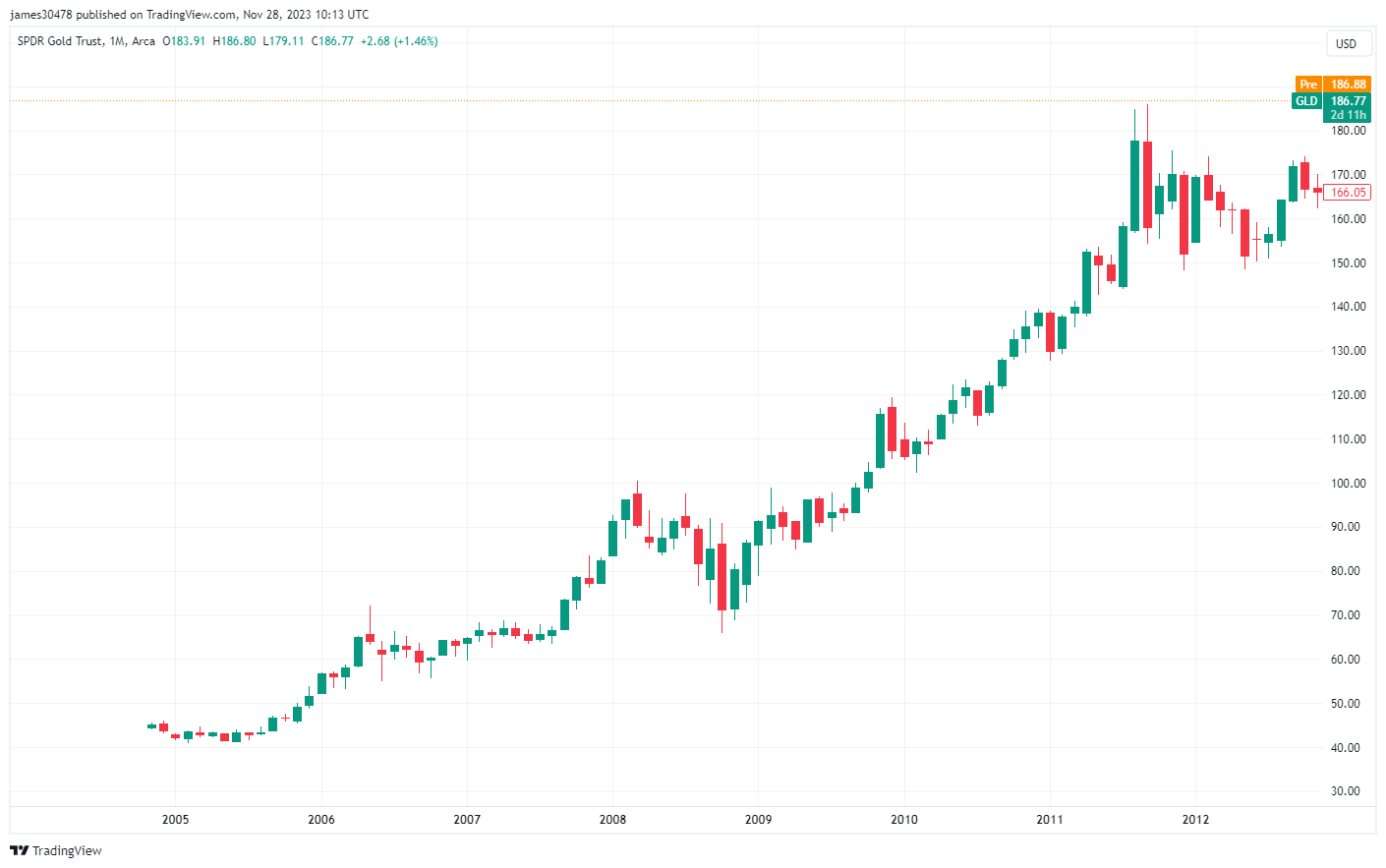

This sample isn’t restricted to digital property. When the Gold ETF (GLD) was launched in November 2004, it opened round $45 and dropped to roughly $41 by Could 2005. Nevertheless, it noticed a powerful 268% enhance over the next seven years.

The publish ProShares ETFs exemplify ‘buy the rumor, sell the news’ in crypto markets appeared first on CryptoSlate.

Discussion about this post