Welcome to the CryptoSlate Alpha November Snapshot, a set of the month’s most pivotal analysis, insights, and market stories. This content material, central to understanding the evolving crypto panorama, is on the market solely to our subscribers who stake at the least 20,000 ACS tokens in our Access Protocol pool on Solana.

This version delves into the challenges and alternatives awaiting the crypto sector in 2024. Our key report, “Crypto’s Crucial Year: Overcoming 2024’s Regulatory and Economic Challenges,” examines how the trade prepares for regulatory shifts and financial uncertainties, particularly within the context of the upcoming Bitcoin halving.

We additionally current an in-depth evaluation of outstanding layer-1 blockchains like Solana, Avalanche, and Cosmos and discover the implications of BITO’s efficiency for the way forward for Bitcoin ETFs. Moreover, our insights cowl the intriguing phenomena of yield curve inversions and their affect on crypto markets.

Our analysis articles spotlight important developments such because the declining ETH/BTC ratio, shifts in Bitcoin’s market dominance, surges in Solana’s consumer engagement, and the resilience of Bitcoin at important worth factors. We additionally analyze the repercussions of Binance’s current SEC tremendous and its affect on futures buying and selling.

Be a part of us in exploring November’s important developments within the crypto sphere. With CryptoSlate Alpha, you’re at all times one step forward.

November α Market Stories

Crypto’s crucial year: Overcoming 2024’s regulatory and economic challenges

The crypto trade prepares for a defining 12 months with regulatory hurdles and financial uncertainty forward.

Breaking down L1 blockchains: A deep dive into Solana, Avalanche, and Cosmos

Analyzing the intricacies and improvements of Solana, Avalanche, and Cosmos as they redefine the layer-one blockchain panorama.

What does BITO say about the fate of a spot Bitcoin ETF?

Exploring the efficiency of BITO to know if it might function an indicator for the longer term efficiency of a spot Bitcoin ETF.

Decoding the economic signals of an un-inverting yield curve

Exploring the phenomena of inversion and un-inversion of the yield curve.

November α Analysis Articles

Decline in ETH/BTC ratio shows Bitcoin’s rising market dominance

Ethereum’s post-Merge droop versus Bitcoin’s rally mirrored in a declining ETH/BTC ratio.

U.S. reclaims dominance in Bitcoin market despite supply shift

Shift in Bitcoin’s provide and worth affect factors to a concentrated U.S. market energy.

Solana’s user engagement surges with influx of new participants

A multi-tiered consumer base emerges as Solana experiences important engagement and transactional variance.

Bitcoin miners see 19-month high in revenue as halving nears

A surge in Bitcoin miner revenues suggests a worthwhile lead-up to the community’s halving occasion.

Bitcoin’s resilience at $37k backed by strong accumulation trend

Bitcoin holders develop their grip amid market restoration.

Binance turmoil leads to record futures activity – analyzing the impact

Buying and selling volumes in Bitcoin futures and perpetual contracts surge in wake of Binance’s $4 billion SEC tremendous.

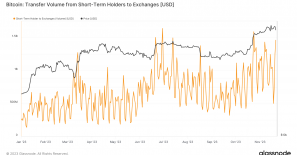

Surge in Bitcoin exchange deposits breaks six-month withdrawal streak

Bitcoin holders pivot to exchanges, reversing six-month withdrawal development.

Transactions on Avalanche surge by 3,040% in November

Additional, Avalanche’s increasing consumer base reveals 30x improve in transactions per second.

Surge in Bitcoin hash rate signals strong miner commitment before 2024 halving

Bitcoin’s impending halving triggers a mining frenzy as hash fee hits new highs.

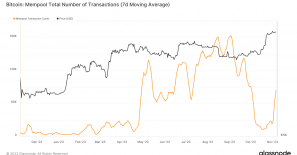

Mempool overload leads to skyrocketing Bitcoin transaction costs

Transaction backlog and charge inflation mark Bitcoin’s community challenges amid rising recognition of Inscriptions.

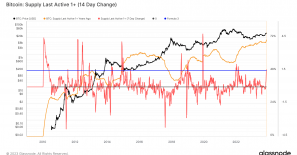

Analyzing Bitcoin’s supply trends as surge in long-term Bitcoin holdings points to investor confidence

Provide shift reveals Bitcoin transferring from short-term trades to long-term holds.

Ethereum’s blue chip DeFi tokens poised for growth

Key metrics predict a optimistic shift for Ethereum’s DeFi ecosystem as consumer adoption aligns with rising transactions.

Ethereum and Solana lead DeFi surge as TVL and DEX activity soar

Solana’s 89.31% TVL development alerts rising star standing in DeFi sector, however Ethereum stays the sector’s greatest participant.

Bitcoin’s realized profits surge as market braces for 2024 halving

Bitcoin’s realized cap has hit $407 billion as buyers lock in income forward of the 2024 halving.

Bitcoin futures volume surges 157% as BTC crosses $37k

The full quantity of Bitcoin futures traded jumped from $27.69 billion to $71.29 billion, exhibiting a rise in speculative exercise.

BlackRock Ethereum ETF sparks surge in ETH/BTC ratio

The ETH/BTC ratio’s spike and the elevated buying and selling exercise imply heightened market consideration for Ethereum following BlackRock’s ETH ETF submitting.

Bitcoin’s climb above $35,000 followed by surprisingly measured market

The put/name ratio’s gradual improve displays a market that, whereas nonetheless bullish, is changing into extra cautious.

Rising Bitcoin Inscriptions activity signals shift in transaction types

A surge in Bitcoin Inscription exercise is putting stress on the community.

Gold remains stable while volatility rocks Bitcoin and Ethereum’s 2023

Gold’s regular efficiency contrasts with Bitcoin and Ethereum’s excessive volatility, underscoring differing funding narratives.

Perpetual futures market paints a rosy medium-term picture for Bitcoin

Excessive demand for Bitcoin futures signifies over-leveraged market ramping up for a bull run.

A month in review: Solana’s DeFi protocols break new ground

Solana’s DeFi protocols see spectacular consumer development and token appreciation.

Unpacking Solana’s surge in the shadow of Bitcoin rally

The numerous development in TVL, pushed largely by Marinade Finance, highlights Solana’s potential, but in addition raises questions on its reliance on a number of main protocols.

Grayscale’s GBTC paradox: Performance at a discount

Persistent low cost on Grayscale Bitcoin Belief might counsel rising market want for a U.S. spot Bitcoin ETF.

November Prime α Insights

Long-term holder trends suggest crypto markets could be headed for a bull run

Unpacking Bitcoin’s earlier cycles reveals long-term developments that might doubtlessly sign new market phases.

Upcoming Bitcoin halving may put Ethereum’s inflation rate in the shadow

Bitcoin’s upcoming 2024 halving anticipated to outshine Ethereum’s inflation fee.

After FTX shock, Bitcoin holders brace for the long haul with record dormancy

Lengthy-term holder milestone nears as 15 million Bitcoin stay steadfast amid market shifts.

Bitcoin miners transfer 8,000 BTC amid transaction fee surge

Bitcoin miner balances see sharp drop amid transaction charge spikes and potential promoting anticipation.

Bitcoin and crypto overcoming hurdles pre-2024 halving

Crypto markets navigate regulatory pressures, eyeing potential enhance from 2024’s financial outlook.

Historic bubbles burst while Bitcoin bounces back

Not like Tulip Mania, Bitcoin has rebounded from extreme drawdowns a number of occasions.

Market reacts to Binance news as short-term Bitcoin holders cash out

Lengthy-term and short-term Bitcoin holders react markedly to CZ and Binance information, triggering a major sell-off.

Recent on chain data points to an all-cohort Bitcoin accumulation

Bitcoin sees aggressive accumulation akin to bear market bottoms and bull market peaks.

All Bitcoin cohorts are in profit for the first time since October 2021

Worthwhile withdrawals shift crypto market sentiment as buyers pivot to features.

Bitcoin price rally ignites bullish sentiment across US and Asia

U.S. and Asian markets showcase sturdy bullish developments as Bitcoin soars previous $35,000.

Inscriptions cause sudden surge in Bitcoin mempool transactions

A surge in Inscriptions pushed the 7-day common Bitcoin mempool transaction depend above 70,000.

Surging to $113 trillion, Bitcoin on-chain settlement showcases extraordinary growth

Bitcoin adoption milestone: 50 million addresses with non-zero balances imminent

Year-end Bitcoin options poised for bullish close with $5.7 billion expiry

Bitcoin merchants are exhibiting optimism with roughly $350 million guess on a $45K strike worth for year-end 2023.

Gold and Bitcoin rally as traditional economic indicators falter

Rising inflation and US debt shift focus to arduous belongings like gold and Bitcoin, with Bitcoin hovering 120% 12 months up to now.

Historical correlation between elections and recessions raises concerns ahead of 2024

Historic information reveals that U.S. elections and recessions have sometimes occurred inside shut temporal proximity to one another.

Market maturity: Bitcoin investors stay calm amid 5% value fluctuation

Regardless of Bitcoin’s dip, short-term holders’ losses restricted in comparison with previous sell-offs.

Aging population could increase sell pressure on stocks and bonds

Child boomer retirement developments might set off asset liquidation amid shifting demographics

Bitcoin’s 4-year compound growth doubles since September low

Bitcoin experiences a 50% improve in 4-year compound development, igniting debates on future profitability.

November sees Bitcoin soar 7%, topping year-to-date highs amid U.S. bullishness

Amidst turbulent liquidations, Bitcoin achieves a optimistic November for the primary time since 2017.

Binance sees whale outflows and retail inflows amidst leadership shuffle

Changpeng Zhao’s departure from Binance has been adopted by a cut up in investor conduct, with whales exiting as retail flows in.

The submit November’s CryptoSlate Alpha snapshot: Navigating crypto’s regulatory maze and economic uncertainties appeared first on CryptoSlate.

Discussion about this post