Seven days after the brand new Bitcoin ETFs launched, I analyzed how they may put stress on Bitcoin’s provide dynamics in an article known as “If BlackRock continues 6k BTC daily buys, we get a supply crunch within 18 months; here’s why.’ On the day of publication, Jan. 18, Bitcoin closed at $41,248 after falling from a excessive of $49,000 on Jan. 11. Since then, the flagship digital asset has soared 37% to interrupt $57,000.

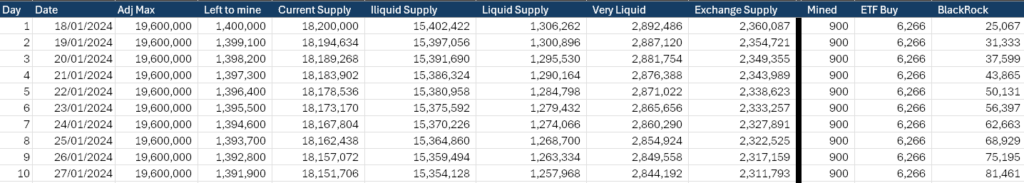

Whereas Bitcoin had fallen constantly after the ETF launched, CryptoSlate famous the persistent BTC inflows, which, on the time, averaged round 6,266 BTC per day for BlackRock alone. The evaluation recognized that have been such inflows proceed, the liquid provide of Bitcoin could possibly be absorbed this yr, with the trade balances or very liquid provides targetable by mid-2025.

As famous on the time, the evaluation was purely hypothetical and didn’t think about the outflows from Grayscale GBTC. Moreover, it solely checked out BlackRock, the most important fund’s inflows, to simplify the info at that time. The train aimed to emphasise the potential for a supply squeeze and the shortage of liquid Bitcoin to facilitate persistent ETF stress on the availability. On Jan. 18, BlackRock had 25,067 BTC beneath administration, valued at $1 billion.

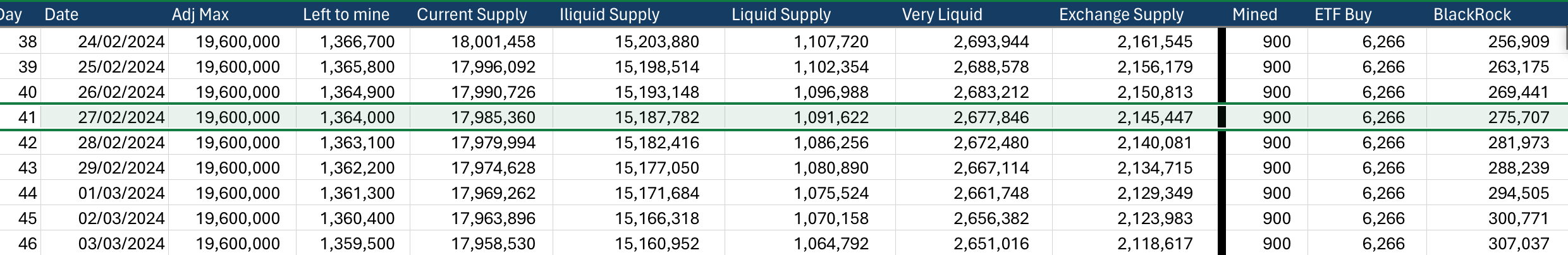

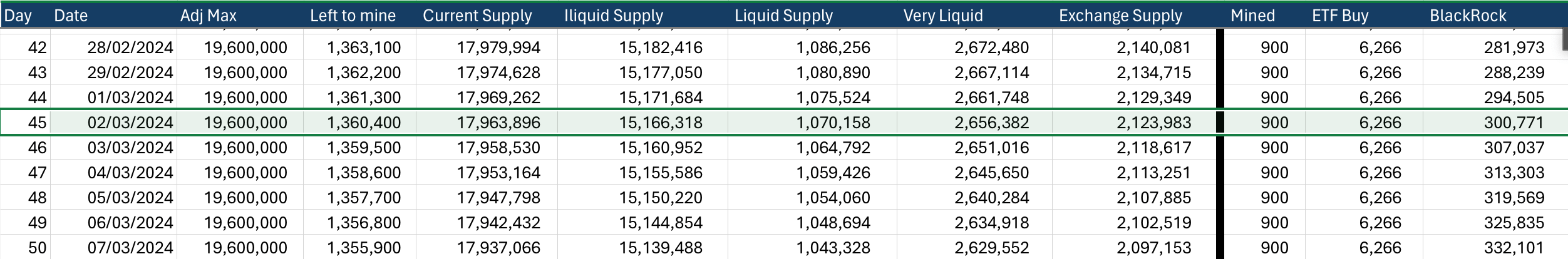

Curiously, whereas the inflows into BlackRock didn’t keep the 6,266 BTC each day common stress, inflows into the Newborn Nine have surpassed this stage. BlackRock at present has 130,231 BTC beneath administration, whereas the fund would have 275,707 BTC if it continued at 6,266 BTC each day. Nevertheless, on Jan. 18, 6,266 BTC was valued at $258 million, which might now signify an influx of $357 million, given the dramatic value surge.

It’s necessary to keep in mind that the spot Bitcoin ETFs are bought with {dollars} and denominated in {dollars} in a brokerage account. Thus, whereas inflows into the ETF have been constant in greenback phrases, they’ve been decreased when it comes to Bitcoin purchases.

Throughout the New child 9, 303,002 BTC is now held beneath administration per K33 Analysis. Wanting on the CryptoSlate desk used for the Jan. 18 article, this aligns with inflows projected for BlackRock by March 2, 2024.

Utilizing this knowledge, ought to the New child 9 proceed to absorb Grayscale’s declining outflows and buy extra Bitcoin from the broader market at this tempo, 1 million BTC could possibly be beneath administration by June. Additional, this fee would swallow the BTC equal of your entire present liquid provide of Bitcoin (roughly 1.3 million BTC) by September.

On Feb. 8, I mentioned the potential for the ‘Mother of all Supply Squeezes‘ for Bitcoin, which is akin to the GameStop saga however much more efficient. The value has surged 29% since that article went stay in simply 19 days, a median of 0.65% per day. Bitcoin ETFs have continued to purchase, and Grayscale’s outflows are slowing.

The necessities for a provide squeeze look like current; the one query I see is, at what stage does the demand turn into affected by the worth? Do Bitcoin ETF purchasers proceed to purchase if Bitcoin is at $100,000? Nicely, at that value, BlackRock’s IBIT could be round $60 per share. That doesn’t sound fairly as costly to new investors now, does it?

Discussion about this post