The monetary world depends closely on indicators to gauge market sentiment and predict future traits. Amongst these, the Volatility Index, generally generally known as the VIX, stands out as a outstanding measure of market nervousness.

Originating from the Chicago Board Choices Trade, the VIX is an index that represents the market’s expectation of 30-day forward-looking volatility. Calculated from the implied volatilities of a variety of S&P 500 index choices, a excessive VIX sometimes indicators heightened investor fears, whereas a low studying suggests a peaceful market.

Alternatively, the S&P 500 Index, or SPX, serves as a beacon for the general well being of the U.S. inventory market. Comprising 500 of the most important U.S. firms by market capitalization, its actions are watched carefully by merchants, analysts, and institutional traders alike. Traditionally, the VIX and the SPX have shared an inverse relationship: because the SPX rises, indicating bullish sentiment, the VIX often decreases, suggesting diminished market nervousness, and vice versa.

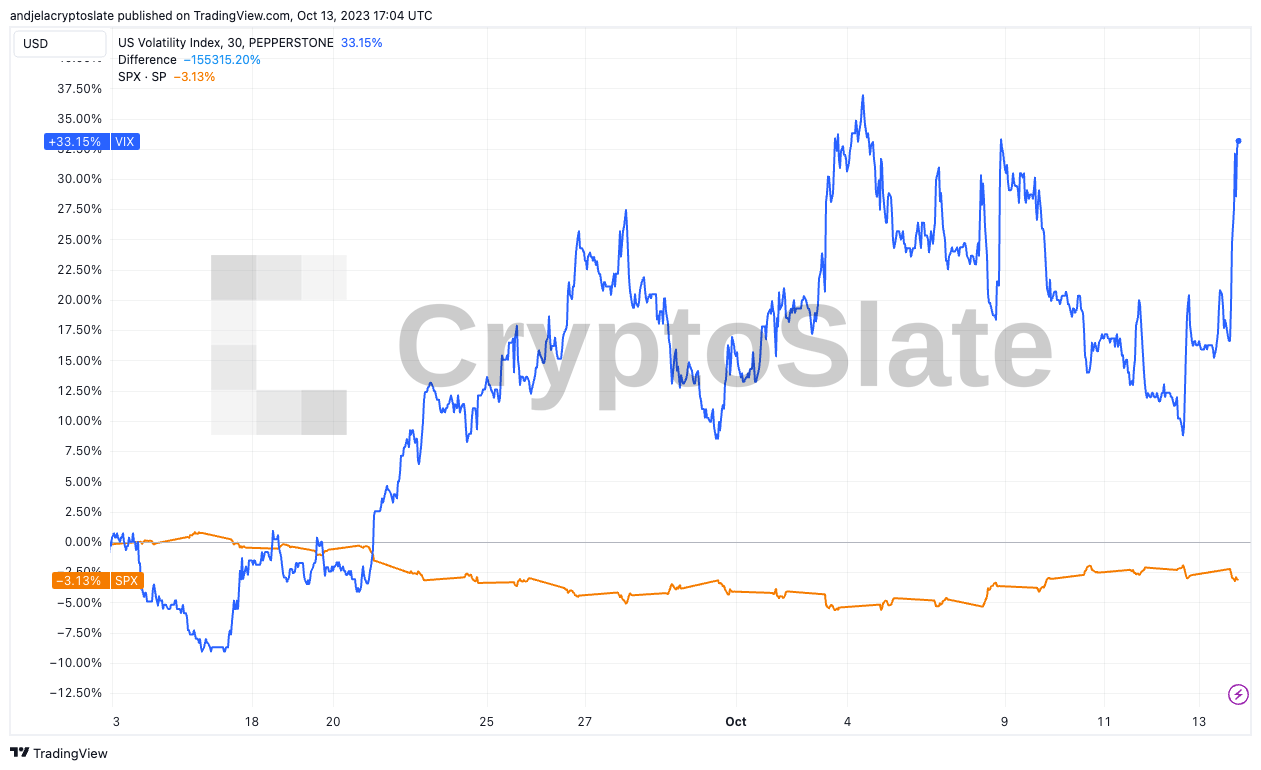

But, latest market knowledge paints an uncommon image. Over 3 months, the SPX witnessed a decline of three.37%, a transparent indication of some bearish sentiment. Nonetheless, the VIX skyrocketed throughout the identical interval, rising 38.41%.

This divergence can be noticed in a narrower 1-month window: the SPX declined by 3%, whereas the VIX surged by 32.8%.

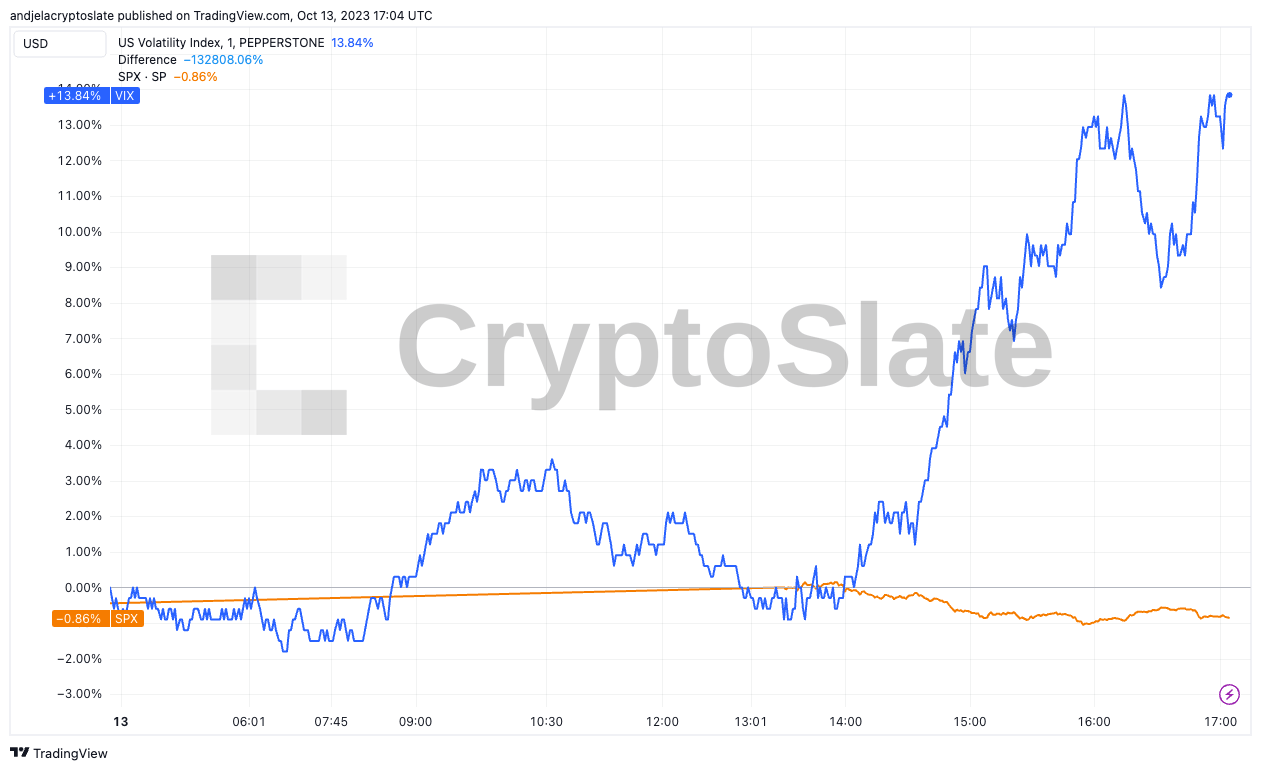

The discrepancy on Oct. 13 was much more pronounced — in only a single buying and selling day, the VIX jumped by an alarming 13.54%. In the meantime, the SPX, quite than reflecting this spike in volatility, remained virtually unchanged, registering a mere 0.82% dip.

This stark divergence prompts questions. A number of components could possibly be contributing to this anomaly. Firstly, the market could be anticipating important future movements within the SPX that aren’t but mirrored in its present worth. Secondly, exterior occasions or geopolitical tensions might affect market derivatives greater than the money market, resulting in an exaggerated VIX. Lastly, structural modifications or shifts in market dynamics and members might alter the standard relationship between the 2 indices.

For traders and market members, such discrepancies are trigger for vigilance. Whereas the VIX’s major position is to measure market sentiment, its present dislocation from the SPX could point out underlying market stresses or potential forthcoming volatility. Merchants would possibly interpret this as an indication to hedge their positions or put together for potential market swings.

The submit VIX surges while SPX remains steady: What’s behind the anomaly? appeared first on CryptoSlate.

Discussion about this post