U.S. inflation is coming down

This previous week, the spotlight of the macro releases is actually U.S. inflation knowledge. The Fed has been elevating charges for over a yr, and we’re beginning to see indicators of disinflation, however it’s too early for the Fed to declare victory.

CPI inflation fell under expectations for February; over the yr, inflation slowed to five% from 6%, the biggest single drop in inflation this cycle. On the identical time, power is in deflation for the primary time since 2021 (-0.5%). Does this echo the OPEC + announcement cuts that financial demand is deteriorating?

Then again, we have now seen a 32% decline within the oil worth (YOY), and CPI inflation is just 5%. That is the primary time ever oil is down over 15% whereas CPI stays above 5%.

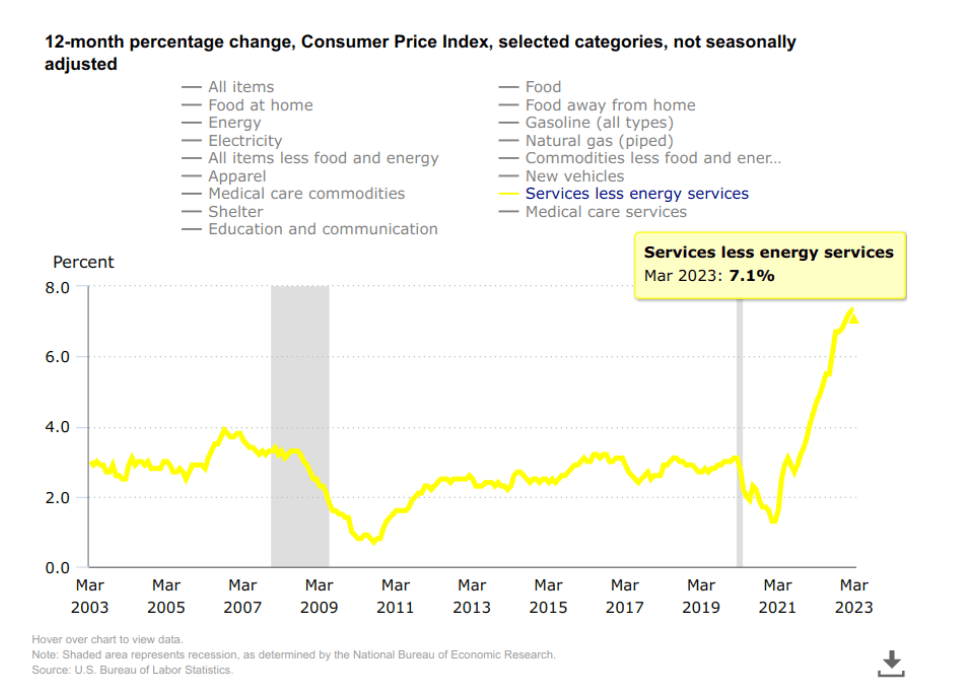

Moreover, core inflation stays sticky, with providers inflation nonetheless above 7%, which stays too excessive for the feds liking. Core CPI elevated from +0.1% to five.6% y/y. The fed should proceed on a hawkish path to keep away from the errors of the 70s and 80s. Nevertheless, credit score uncertainty will play an enormous issue within the quick to medium time period.

Fed Minutes

Minutes of the final FOMC got here out after the Wednesday CPI print, revealing a few elements. One is employees projected a “delicate recession” later this yr. Whereas “all” officers backed the 25bps price hike final month. The FOMC maintains each lowering inflation whereas observing financial coverage carefully.

China and Russia see inflation drop too

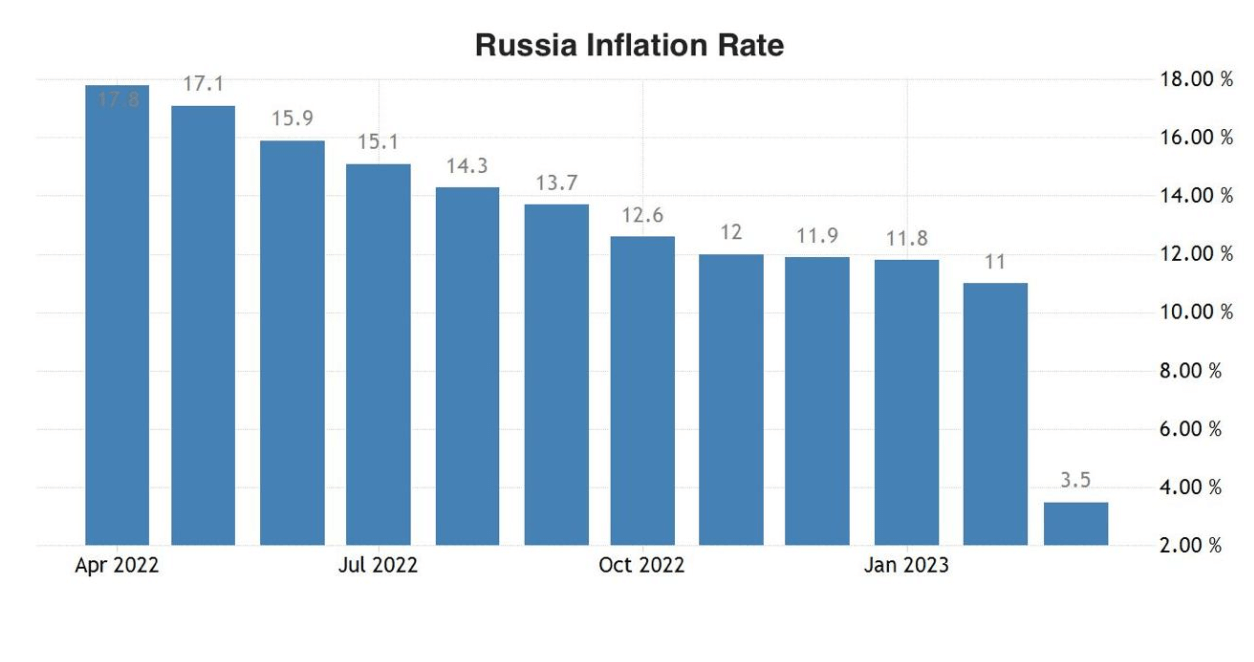

Russia’s inflation slowed to three.5% from double digits of roughly 11% in February, reaching the bottom stage in nearly three years.

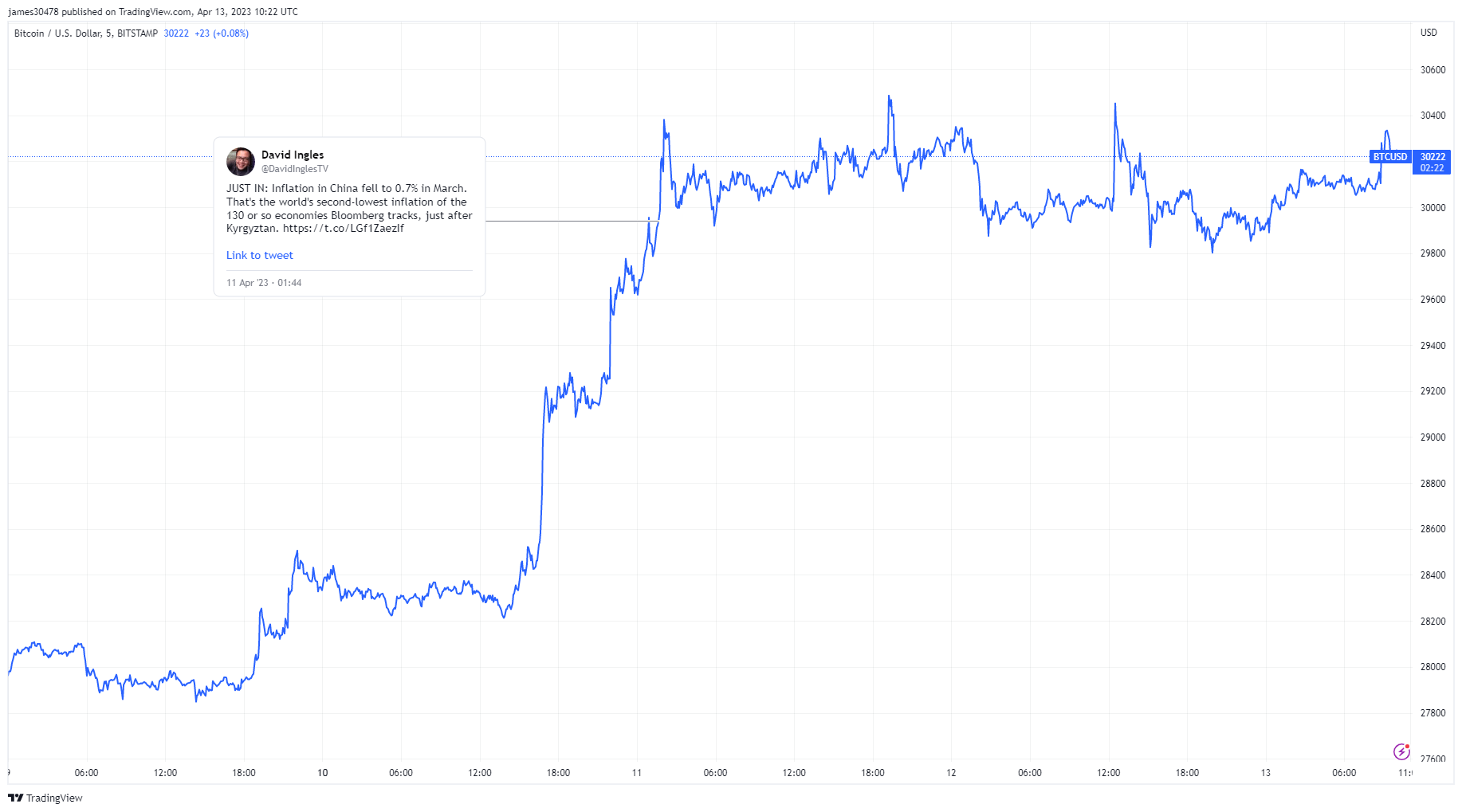

Whereas China’s inflation dropped earlier within the week, PPI noticed deflation, whereas CPI noticed a discount to 0.7%, which occurred at an identical time as Bitcoin, exceeding $30,000 throughout Asia buying and selling hours.

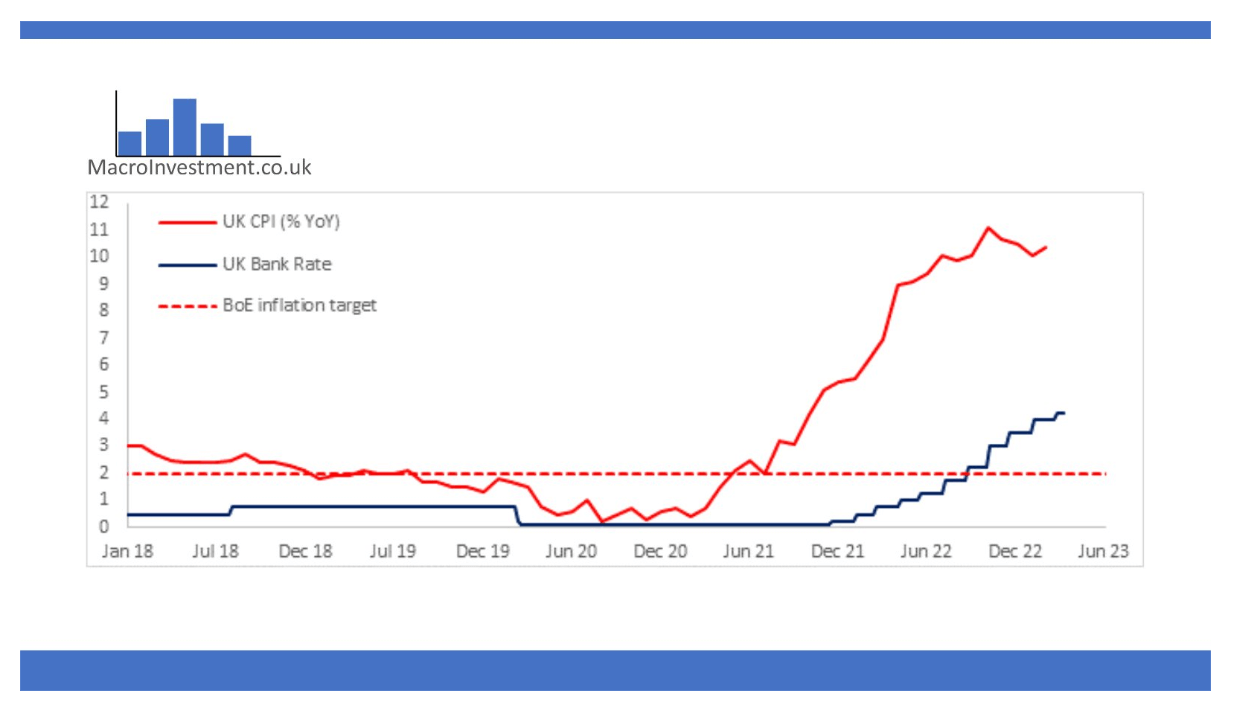

BOE tries and reign in scorching inflation

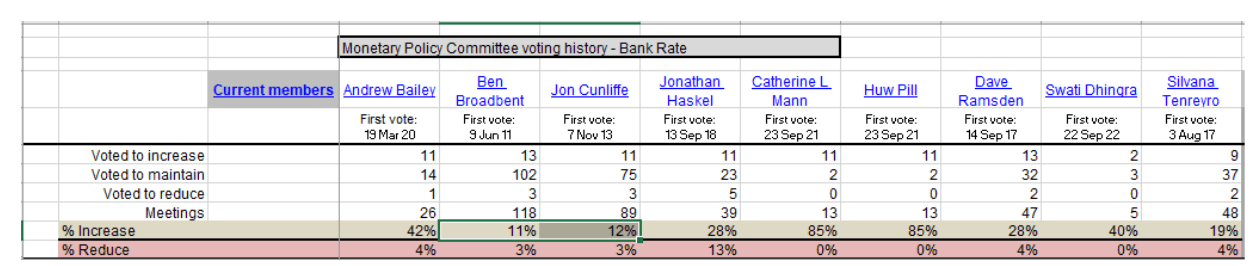

Andrew Bailey spoke on the IMF assembly about his outlook on prioritizing inflation. The BOE has raised eleven instances, bringing the financial institution price to 4.25%, and is predicted to lift one other 25bps on Might 11. The UK presently has the best inflation out of the G7, however in a flip of occasions, SIlvana Tenreryo was changed.

She was essentially the most dovish MPC member and has voted in opposition to each hike since September. Megan Greene is her substitute, who later mentioned, “Financial institution of England will find yourself having to hike extra to carry inflation again in keeping with their goal”.

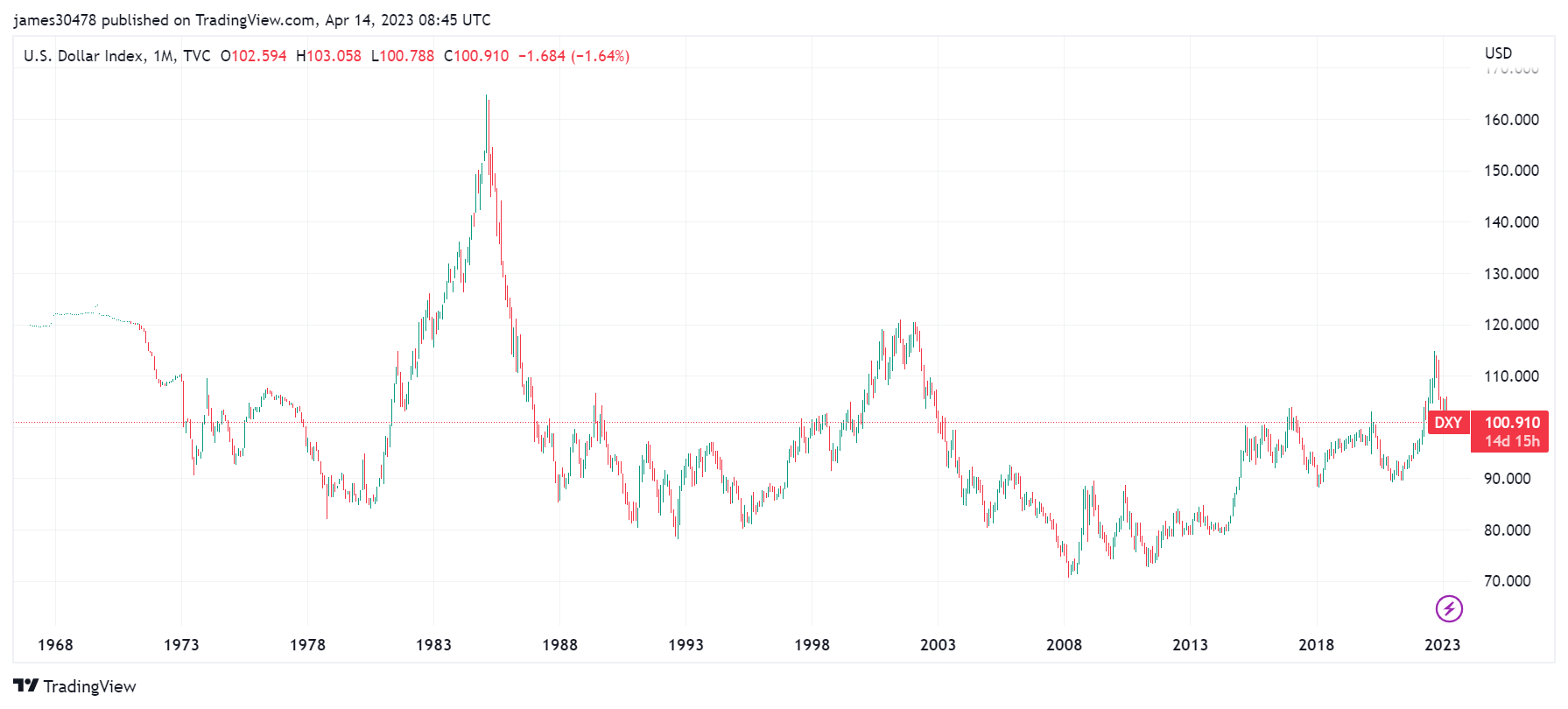

Sinking DXY, banking fears subsided

The DXY index sank to its lowest stage in over a yr, under 101, nearly precisely the place it was a yr in the past. Normally, throughout instances of disaster, traders flock to the greenback as a result of it’s the world’s reserve foreign money. As you may see, throughout instances of recession, the DXY index spikes as traders need to promote and canopy their obligations for {dollars}.

The DXY index has dropped from 114 to 100; up to now few weeks because the banking disaster has subsided, we’re approaching the tip of the speed mountaineering schedule, and the potential of additional de-dollarization echoes continues. However that is most actually not the tip of the greenback.

As credit score and M2 contract additional, we may even see defaults, outright deflation, and unemployment. We then count on to see the DXY run once more and property get crushed.

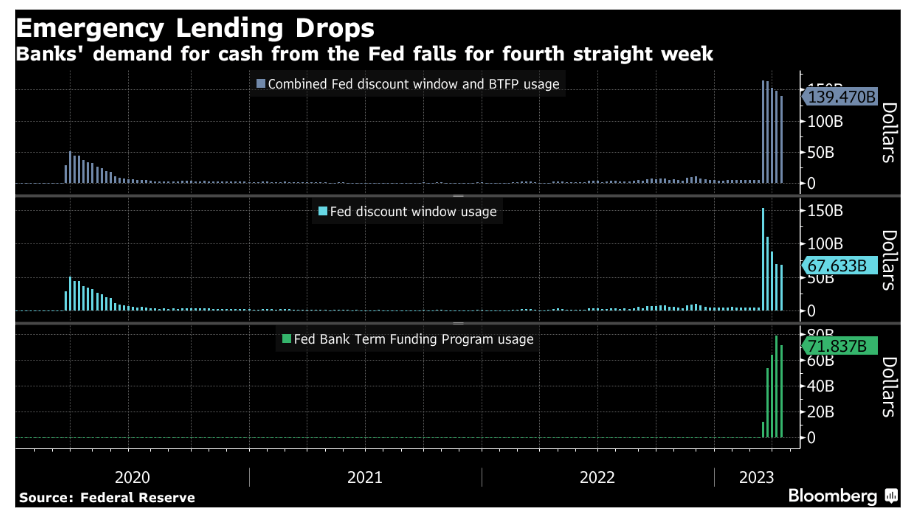

The banking disaster has subsided, whereas the Fed emergency lending packages dropped to $139.5 billion from $148.7 billion final week. Damaged down by; Low cost Window: $67.6B v $69.7 prior week, whereas BTFP: $71.8B v $79B. Because of this, the fed stability sheet has shrunk barely this week.

The publish Weekly MacroSlate: U.S. inflation comes down, but Fed forecasts ‘mild recession’ appeared first on CryptoSlate.

Discussion about this post