Coinbase CEO Brian Armstrong offered $1.8 million value of the corporate’s shares in April, in keeping with Dataroma data.

In accordance with the information, Armstrong offered a complete of 29,730 Coinbase shares — which add as much as $1,860,444 in worth — in six transactions on April 12.

The current gross sales proceed the CEO’s earlier dumping of the corporate’s inventory. CryptoSlate reported that Armstrong offered 89,196 Coinbase shares for $5.8 million in March — nearly half of those gross sales have been made 24 hours earlier than the U.S. SEC issued a warning to the alternate.

On the time, a number of members of the crypto neighborhood had raised points in regards to the timing of the gross sales — with some speculating that Armstrong was dumping on the general public.

Earlier than then, Armstrong had persistently offered Coinbase shares since November 2022, when he introduced that he would fund scientific analysis and improvement by two startups — NewLimit and Analysis Hub.

On the time, Armstrong pledged to promote 2% of his stake on the crypto agency.

In the meantime, Armstrong is just not the one Coinbase govt promoting the corporate’s shares. The alternate’s chief authorized officer Grewal Paul offered over $300,00 value of the corporate shares in March, in keeping with Dataroma data.

Coinbase shares on the ascendancy

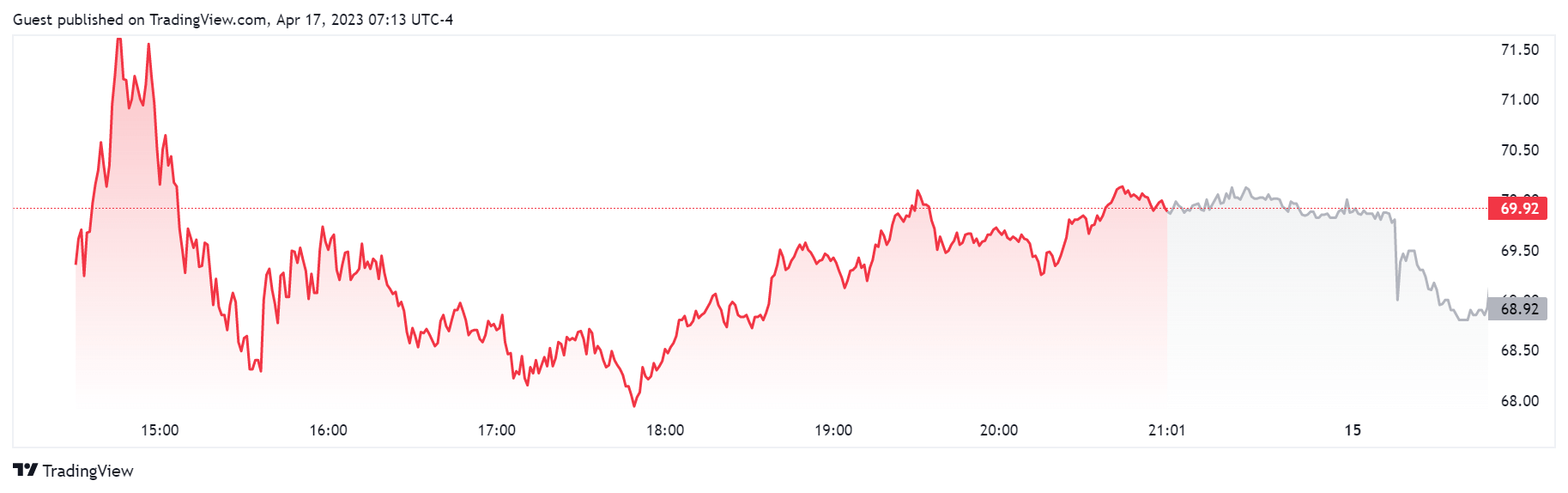

Coinbase’s COIN inventory is likely one of the best-performing crypto shares in 2023. For context, the inventory is up 17% up to now week and over 12% within the final month.

The alternate’s inventory has risen by roughly 92% on the years-to-date-metrics, in keeping with Tradingview data.

The inventory efficiency has coincided with Bitcoin’s (BTC) return to above $30,000 and a renewed curiosity in digital property amongst traders.

The submit Coinbase CEO Brian Armstrong has dumped $1.8M worth of stocks in April appeared first on CryptoSlate.

Discussion about this post