Abstract

Cash markets proceed to cost in greater peaks for central banks charges, which embrace the U.S. and EU, as financial progress is holding up higher than anticipated as CPI inflation continues to run sizzling, and yields proceed to rise.

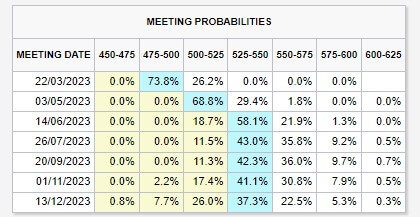

The mantra throughout central banks is ‘Larger for longer’ because the US cash market swaps worth at a peak price of 5.5%. The longer term feds funds price is in step with three further 25 foundation level hikes, with no price cuts till 2024.

The EU

Inflation

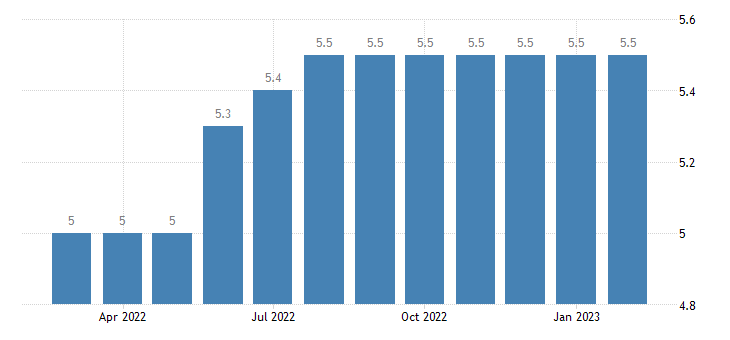

Inflation continues to riot in Europe, as Eurozone headline inflation was forecasted to fall to eight.3%. Nevertheless, it slowed all the way down to solely simply 8.5%. Power inflation dropped significantly to 13.7% from 19%. Nevertheless, the problem that raised concern was core inflation rising to a report excessive of 5.6% in opposition to 5.3%.

Sturdy knowledge continues to place stress on ECB

February S&P manufacturing PMIs for the southern area (Italy and Spain) rose excess of anticipated in expansionary territory. On the similar time, Germany’s unemployment remained at 5.5% for seven months, indicating a extra resilient workforce than anticipated.

The U.S.

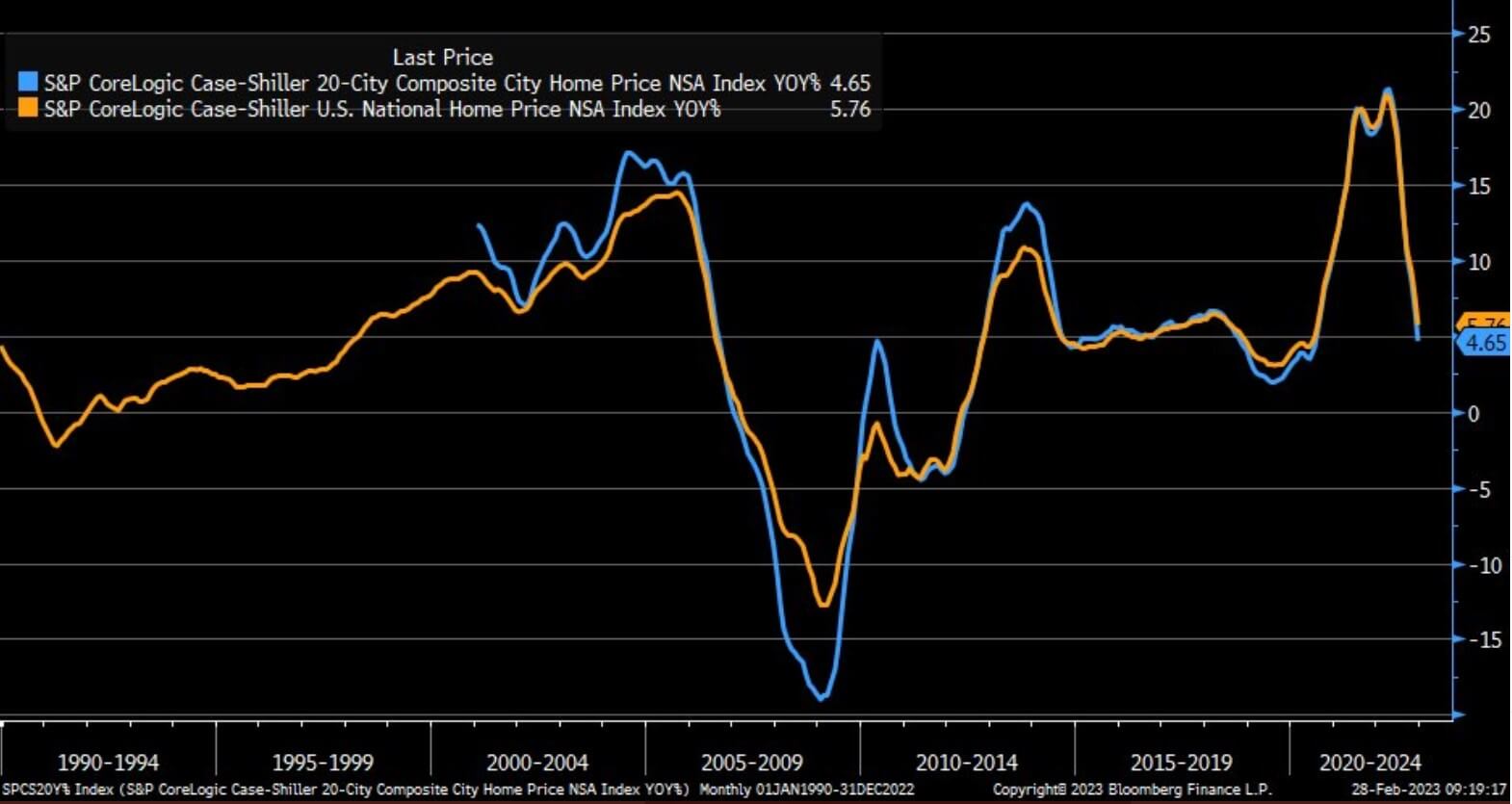

U.S. home worth declines speed up

The S&P CoreLogic 20-city, home worth index fell sooner than anticipated, which noticed the year-over-year worth progress price down from 6.8% to 4.7%. This index is a lagging indicator of costs on a three-month common going way back to Q3 2022.

Whereas 30-year mortgage charges have topped 7% once more, mortgage functions for house purchases fell as a lot as 6% final week, following an 18% drawdown the week prior.

The U.S. financial system continues to be sizzling

ISM providers bought launched in March 3, which confirmed that the U.S. financial system continues to be extraordinarily robust. Providers had been higher than anticipated, decrease costs paid, stronger employment, and stronger new orders.

All eyes on FOMC

The subsequent FOMC assembly, which takes place on March 22, will embrace an replace of the Fed Dot Plot and an replace on the abstract of financial projections, which can have larger significance than only a 25 or 50bps elevate by the fed.

The U.Okay.

Document meals inflation

Troubling occasions are forward for the U.Okay. as store worth inflation accelerated by nearly double digits in February, whereas meals worth inflation reached a report 17.1%, based on the British Retail Consortium.

BOE caught between a rock and a tough place

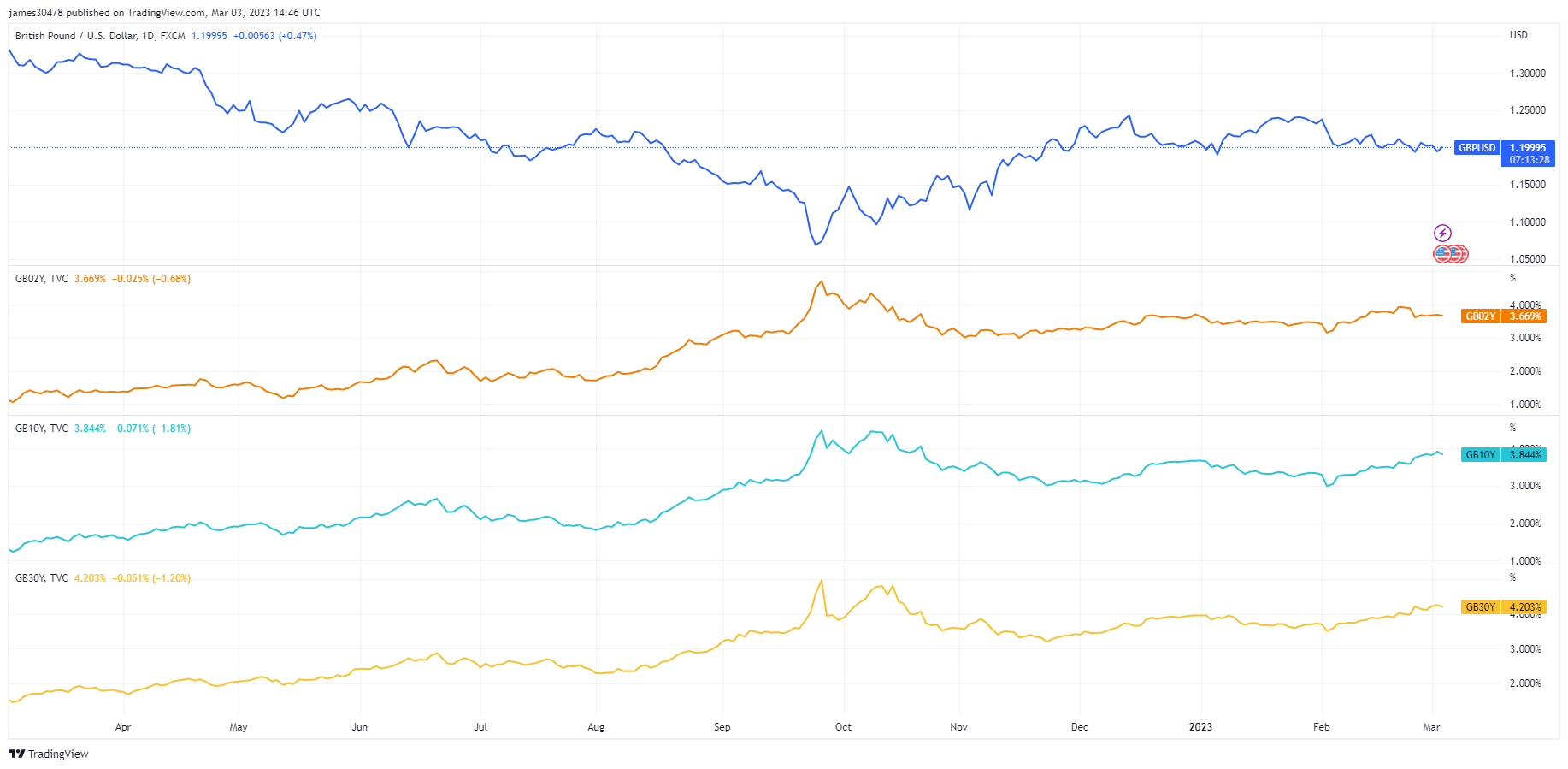

Yields up, GBP down because the BOE struggles in many alternative methods. Not like the Fed and ECB, who’ve devised a hawkish plan for 2023, the BOE continues to flip-flop with no clear course. The pound at $1.199 approaches a year-to-date low whereas the yield curve continues to steepen.

Discussion about this post