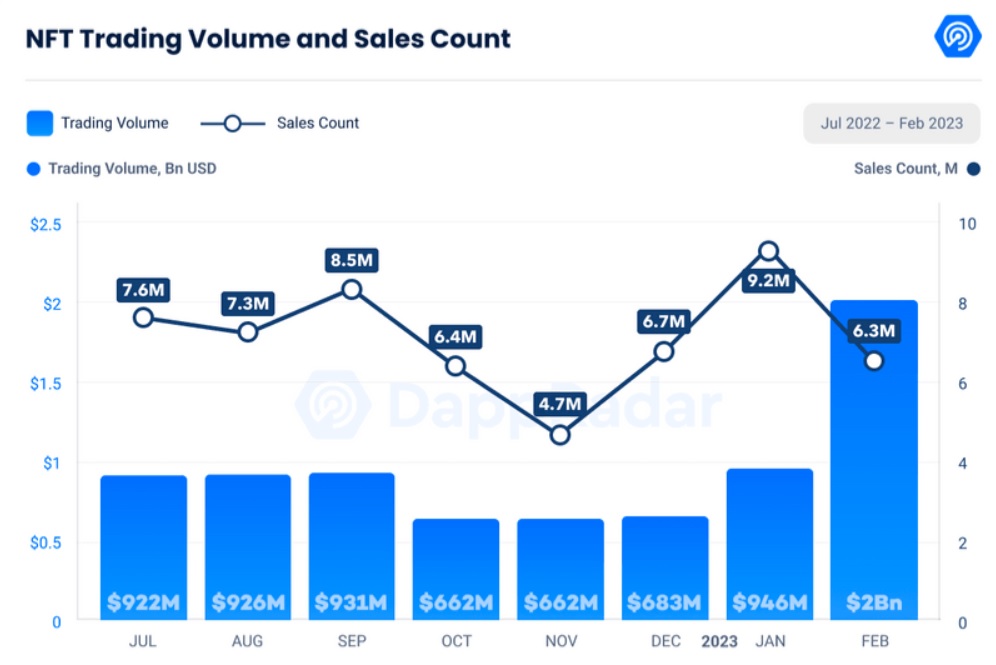

Non-fungible token (NFT) market’s buying and selling quantity elevated to $2 billion in February, reaching its pre-LUNA crash ranges, in response to DappRadar’s Business Report.

The NFT buying and selling quantity recorded a 117% spike from January’s $956 million, because the DappRadar data reveals.

Regardless of the numerous surge within the NFT buying and selling quantity, the gross sales depend recorded a 31.46% lower, falling to six.3 million from January’s 9.2 million.

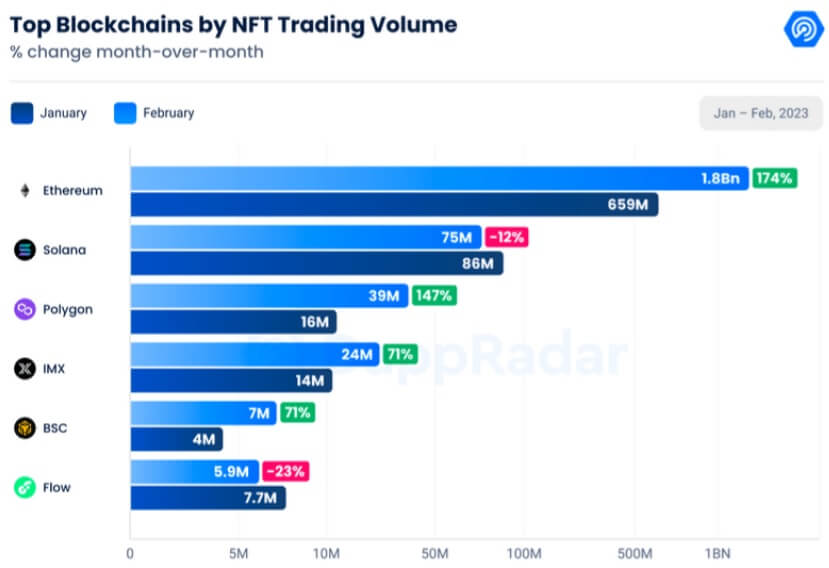

In February, Ethereum (ETH) remained the highest blockchain by NFT buying and selling quantity. The chain recorded $1.8 billion in buying and selling quantity, which marks a 174% improve from the $659 million in January. Primarily based on these numbers, ETH represents 83.36% of the complete NFT market.

Solana (SOL) and Polygon (MATIC) adopted ETH because the second and third chain, with the best NFT buying and selling quantity in February. Although SOL ranked second by facilitating $75 million in buying and selling quantity, it nonetheless recorded a 12% lower from January’s $86 million. MATIC, alternatively, marked a 147% improve in February, reaching $39 million from the $16 million of the earlier month.

Blur vs. OpenSea

In February, Blur triumphed over OpenSea when it comes to buying and selling quantity. Blur facilitated over $1.3 billion in buying and selling quantity all through the month, whereas OpenSea got here second with $587 million. These numbers point out that Blur accounted for 64.8% of the entire NFT market buying and selling quantity, whereas OpenSea represented 28.7% of it.

X2Y2 and LooksRare adopted OpenSea as third and fourth within the rating by recording $39 million and $29 million in buying and selling quantity, representing 1.9% and 1.4% of the entire market, respectively.

Revenue chasers vs. artwork lovers

Although the distinction in buying and selling volumes factors to Blur because the busiest NFT market, OpenSea nonetheless holds essentially the most vital variety of customers. At present, Blur has 96,856 customers versus OpenSea’s 316,199. To meet up with OpenSea on that entrance, Blur has additionally been making an attempt to develop its consumer depend by issuing airdrops to loyal customers.

Referring to this distinction in consumer counts and buying and selling quantity, DappRadar said:

“This [the contrast in numbers] confirms that the buying and selling patterns on Blur are largely pushed by NFT whales farming on the platform relatively than typical buying and selling exercise.”

In assist of this notion of Blur, a whale not too long ago sold 139 NFTs and earned $9.6 million.

A particular a part of the group additionally criticizes Blur for stripping the artwork from NFTs and luring individuals by selling nice returns. A consultant of this crowd, Aaron Sage, not too long ago wrote:

“I simply want the NFT area may change it’s lens to how we was – concerning the artwork and tradition (i.e. ape noises in clubhouse and even the lazy lion twitter raids), however not what it’s right this moment with Blur.“

Discussion about this post