Prior to now week, MakerDAO has skilled a drop in complete worth locked (TVL), the provision of DAI, and annualized price earnings, signaling some potential bother for one of many world’s largest stablecoin issuers.

Moreover, MKR’s worth decreased by 25% throughout the identical timeframe. Regardless of DAI’s current return to parity with the US greenback, there’s rising uncertainty about whether or not it should stay pegged, inflicting a decline in MakerDAO’s TVL during the last seven days.

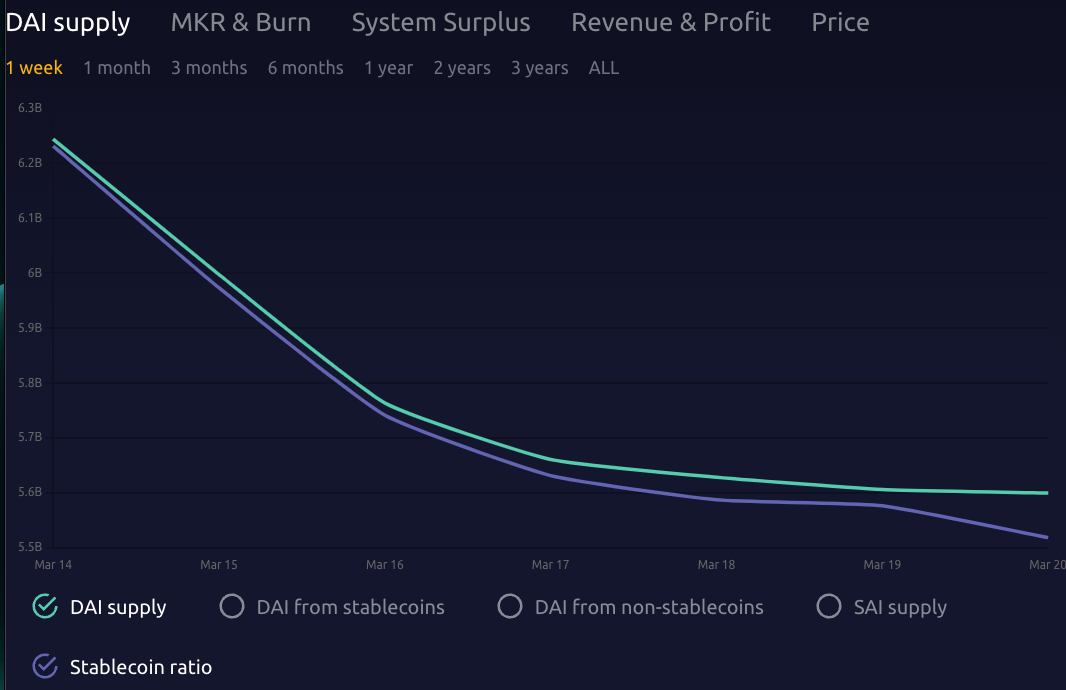

On-chain information means that MakerDAO’s lower in asset worth might be traced again to a discount in collateralized loans on the platform. This drop in loans seems to be pushed by issues in regards to the sustainability of the DAI stablecoin, which prior to now week has seen a 13% decline in provide, per Marker Burn information.

Downward strain on DAI

Because of this, the provision of DAI additionally decreased, with Maker Burn information displaying a 13% drop since March 13. At the moment, the provision of DAI stablecoin is at 5.6 billion tokens. When the provision of DAI declines, it signifies a lower in circulation, presumably because of a discount in demand as noticed prior to now week, or because of a flight into different crypto property, corresponding to Bitcoin and Ethereum, each have which have surged prior to now week.

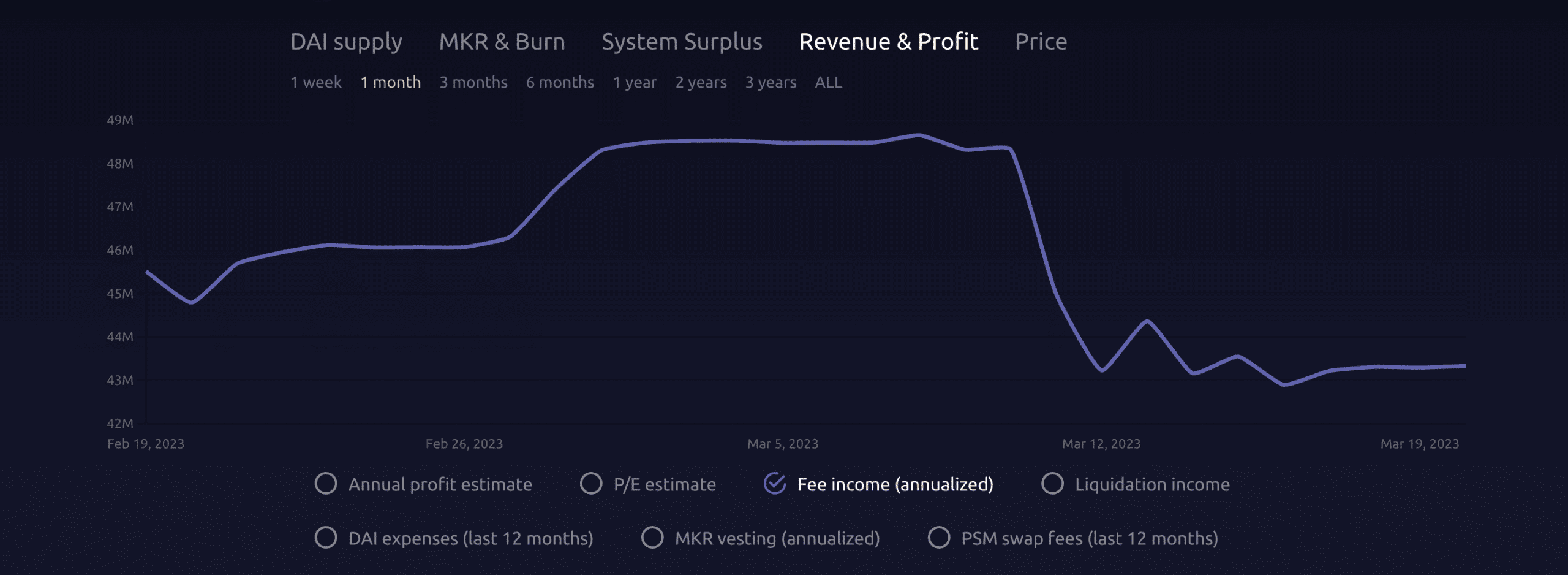

What this doubtlessly means for MakerDAO annualized earnings spreads

The lower in DAI’s provide over the previous week has led to a decline in MakerDAO’s annualized price earnings. MakerDAO generates earnings by way of charges when customers open a Collateralized Debt Place (CDP) and generate DAI, which is then paid in MKR tokens.

As the soundness price is paid in DAI and transformed to MKR, a lower in DAI provide can result in a discount in stability charges and, subsequently, a decline within the quantity of MKR tokens distributed as price earnings. Maker Burn information signifies that because the collapse of Silicon Valley Financial institution, MakerDAO’s annualized price earnings has decreased by 10%.

As DAI and different stablecoins lower, Tether will increase

Based on information from CryptoSlate, Tether’s USDT provide has reached 74 billion for the primary time since Might 2022.

Over the past month, Tether’s provide has elevated by roughly 5 billion because of regulatory scrutiny and banking points confronted by its stablecoin rivals, corresponding to BUSD and USDC.

In distinction, USDC, BUSD, and DAI provides have decreased this 12 months, whereas USDT’s provide has grown by 10%, with USDT’s market dominance reaching 56.4% final week, its highest level since July 2021.

Discussion about this post