Introduction

On the finish of February, the Bitcoin community’s computing energy reached its all-time excessive of 320 EH/s.

The milestone sparked a cross-industry dialog in regards to the implications of such a excessive hash fee, with many exterior of the crypto area fearing its influence on the setting.

And whereas most Bitcoin critics are inclined to overuse the time period “environmental influence” with out giving a lot depth to what it encompasses, there has all the time been legit concern over Bitcoin’s power utilization.

Bitcoin mining is an energy-intensive course of. Bitcoin mining is a extremely aggressive and environment friendly {industry}, so miners will all the time search the most cost effective and most considerable power sources. As probably the most inexpensive electrical energy comes from coal-powered vegetation, environmental activists are fearful that a rise in Bitcoin’s hash fee comes with elevated demand for the dirtiest power sources.

Many of those critics depend on the controversial Cambridge Bitcoin Electricity Consumption Index. The index makes use of numerous comparisons as an instance simply how a lot energy Bitcoin consumes, typically cherry-picking knowledge and offering outdated info.

The worldwide effort towards Bitcoin’s power consumption culminated final yr when Greenpeace revealed a manifesto proposing an answer to Bitcoin’s proof-of-work algorithm. Referred to as “Change the Code, Not the Local weather,” the manifesto requires Bitcoin to “change” to a proof-of-stake consensus algorithm like Ethereum.

The governmental push to manage the crypto {industry} additional fueled protests towards Bitcoin. Because the starting of 2023, numerous organizations and teams have lobbied for tighter regulation and bans on Bitcoin mining.

On this report, CryptoSlate dives deep into the expansion of Bitcoin’s hash fee to see the way it’s turning into a internet constructive for the worldwide combat to scale back air pollution.

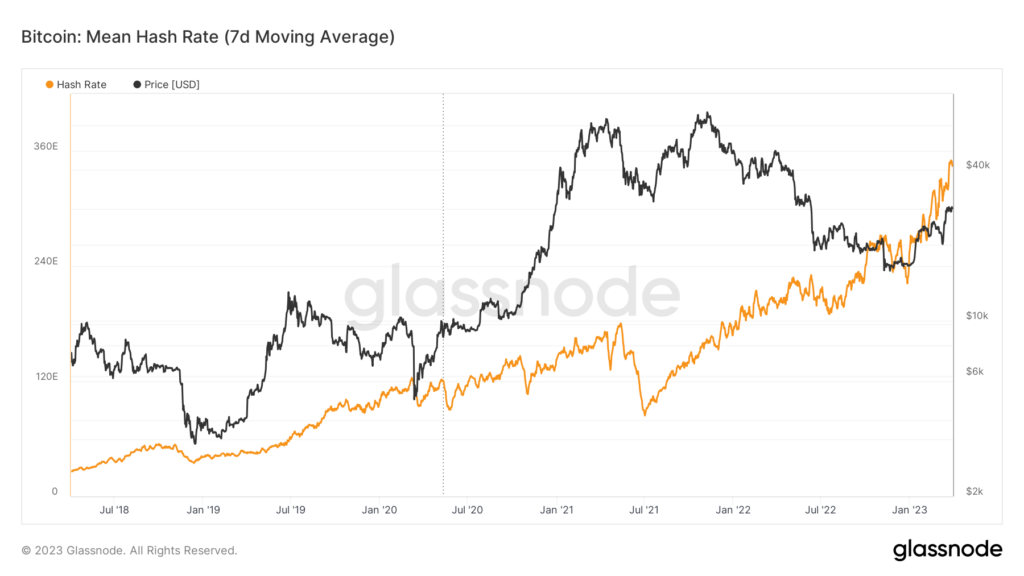

The constant progress of Bitcoin’s hash fee

The processing energy of the Bitcoin community has been rising persistently. Nevertheless, the hash fee is liable to the identical sort of volatility as Bitcoin’s worth is, with giant fluctuations typically correlating with broader market actions.

Quick-term corrections in hash fee correlate with drops in Bitcoin’s worth. Equally, sharp upward changes observe worth will increase.

Bitcoin’s March rally introduced on the third most aggressive hash fee progress up to now 5 years.

Such a pointy spike within the hash fee prompted many to marvel the place the expansion got here from.

Whereas many steered that it may consequence from nation-states launching mining operations, probabilities for which are minuscule. As a substitute, the sharp improve in hash fee is more than likely a results of a number of compounding elements, with Bitcoin’s rising worth being the main one.

As Bitcoin’s worth will increase, so does the profitability of older, much less environment friendly ASIC miners. Because of this, mining operations with many retired ASICs have more than likely returned the machines on-line to reap additional earnings. Moreover, Bitmain’s latest Hydro ASIC miners are exponentially extra environment friendly, providing over 250 TH/s per machine.

Chasing profitability additionally means monitoring low cost and considerable energy sources. With extremely versatile and cell infrastructure, miners can rapidly change their location to learn from decrease electrical energy prices.

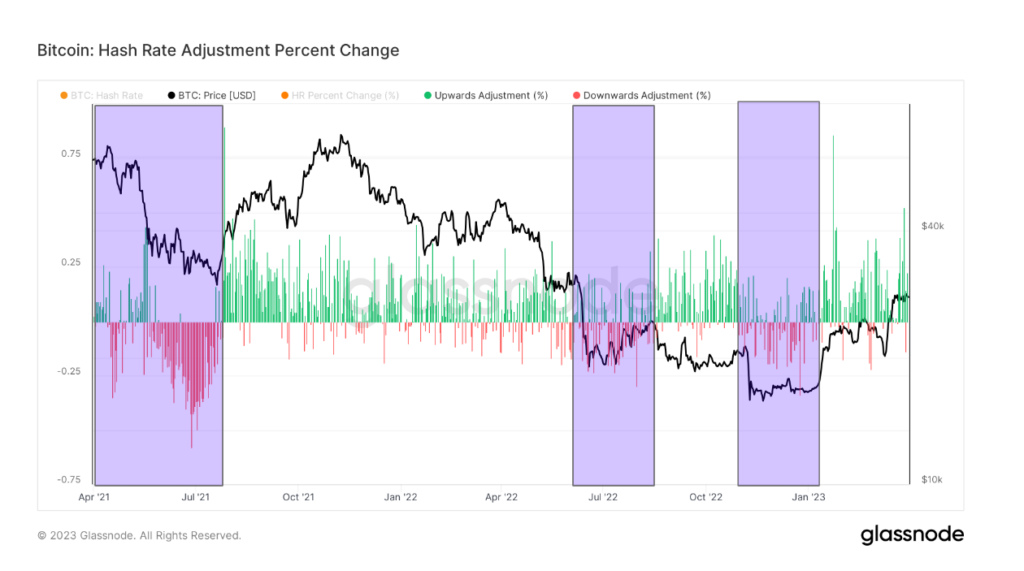

Hash fee volatility exhibits the stabilizing energy of Bitcoin mining

This was the case with Riot Blockchain, one in every of Texas’s most vital Bitcoin mining operations.

The general public mining firm has established long-term fixed-rate energy contracts with ERCOT, guaranteeing steady electrical energy costs all year long. That is normal follow for giant industrial shoppers corresponding to manufacturing vegetation and knowledge facilities. Nevertheless, not like different giant shoppers, Bitcoin miners can shut their operations down pretty rapidly and simply.

In occasions of considerably elevated demand, miners can flip their machines off and allow extra energy within the grid. This occurred with Riot in July 2022, when the corporate voluntarily curtailed its power consumption throughout an surprising warmth wave that drove demand up. Because of this, the corporate curtailed 11,717 MWh of power, sufficient to energy over 13,000 common properties in Texas for one month.

This earned Riot $9.5 million in energy credit, or roughly $1,122 per MWh curtailed. If the corporate directed the power to mining Bitcoin as a substitute, it might have earned round $140 per MWh.

Bitcoin miners proved they performed a vital position in Texas’s power infrastructure once more in December 2022, when a number of giant operations shut down to scale back electrical energy demand. On the time, Texas confronted a extreme winter storm that led to a number of weeks of freeze warnings throughout the state.

Nearly all giant mining operations in Texas shut down or restricted their manufacturing. Riot Blockchain shut down a complete facility in Rockdale, whereas Compass Mining shut down all however one in every of its Texas websites. Core Scientific, which filed for chapter then, curtailed operations throughout the storm. Genesis and Rhodium additionally agreed to close down 99% of their operations.

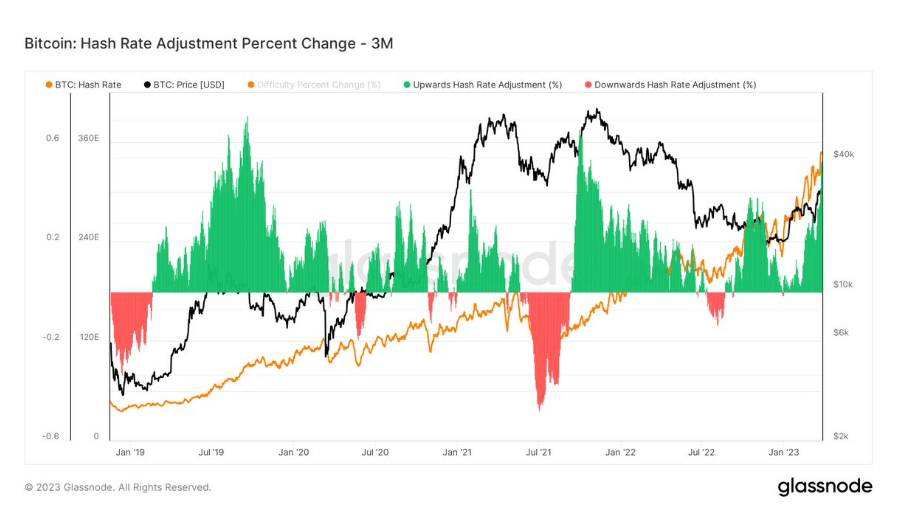

Having so many giant miners shut down notably affected Bitcoin’s hash fee. The graph beneath exhibits drastic downward changes within the hash fee all through December 2022 and July 2022.

Probably the most important downward adjustment in Bitcoin’s hash fee was seen in Might 2021, when the Chinese language authorities enacted a de facto ban on mining.

The pace at which miners may relocate and get their operations again on-line is one other testomony to the {industry}’s flexibility. Information analyzed by CryptoSlate confirmed slightly below three months of downward adjustment earlier than Bitcoin’s whole hash fee started rising.

Rising hash fee may fight world warming

If Bitcoin’s hash fee continues to extend at its 2023 fee, it should attain a Zettahash by the top of 2025. Powering all that processing capability will undoubtedly require an incredible quantity of power.

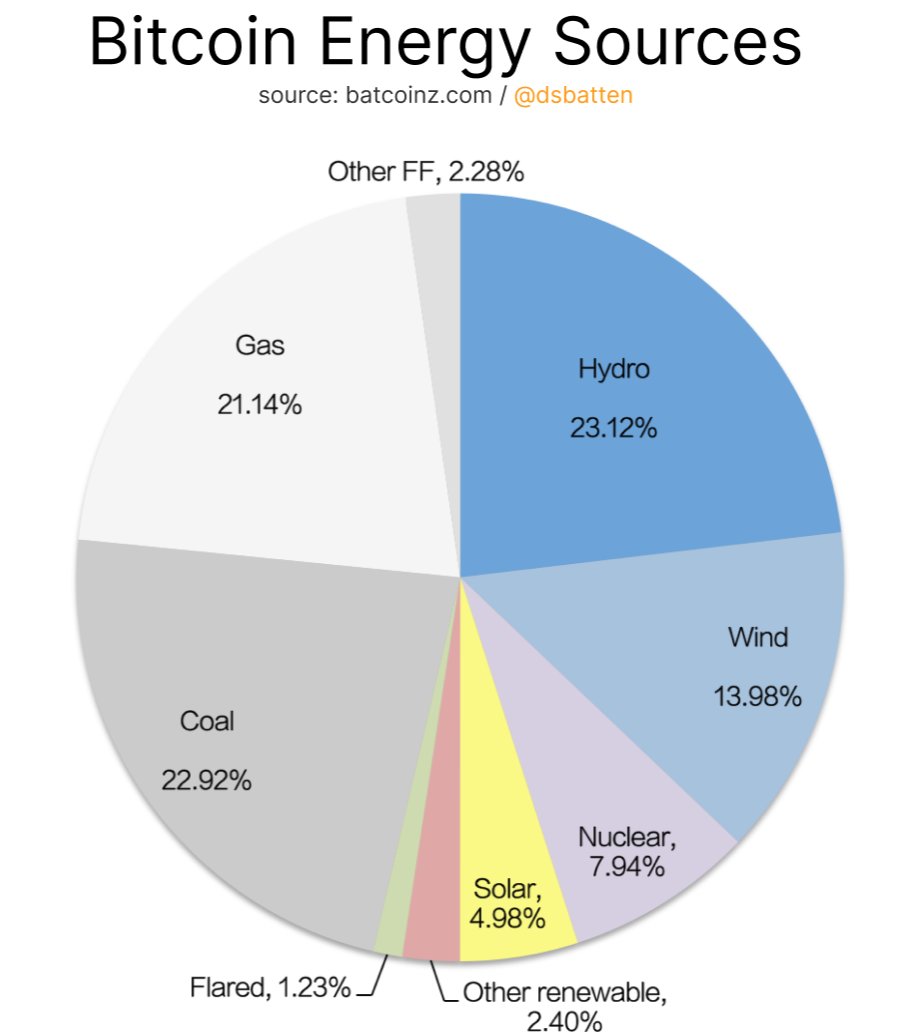

Given Bitcoin’s present power consumption, most of that power may come from sustainable and renewable sources.

Within the first two months of 2023, over 91% of the identified new hash fee getting into the Bitcoin community got here from zero-emission sources. Most notably, Marathon Digital migrated round 300 megawatts from thermal to wind energy, considerably contributing to the metric.

Pushed by revenue, Bitcoin miners will rapidly undertake any power supply that makes financial sense. Sadly, zero-emission power sources like hydropower and wind energy are notoriously exhausting to implement, as variations within the quantity of electrical energy produced drive away large industrial shoppers.

Versatile mining operations are among the many few prepared and capable of settle for that volatility.

Nevertheless, Bitcoin’s most vital environmental influence isn’t utilizing zero-emission power sources however actively decreasing methane emissions.

Whereas carbon dioxide emissions from burning fossil fuels are thought-about the most important polluters as we speak, methane — a byproduct of oil drilling — causes extra important harm to the setting.

Nearly all of the gasoline discovered on oil fields both will get launched into the ambiance or burned, releasing carbon dioxide into the ambiance.

The United Nations Environment Program (UNEP) states that methane is answerable for over 25% of the worldwide warming skilled as we speak. The group estimates methane has a worldwide warming potential of greater than 80 occasions larger than carbon dioxide (CO2) throughout 20 years.

There may be nearly no financial incentive to promote the methane, as it might require multi-million greenback infrastructure to connect with an present pipeline.

Nevertheless, there may be a number of financial incentive to make use of methane to provide electrical energy.

Earlier CryptoSlate research highlighted a number of firms engaged on plug-and-play Bitcoin mining farms that may be arrange straight on oil fields. These turnkey options run the methane discovered on the world by way of turbines, the place it’s combusted to create electrical energy that powers Bitcoin miners.

And whereas combusting methane releases a small quantity of carbon dioxide, its impact on the setting is offset by the way more harmful methane emissions it prevents.

Some researchers estimate that Bitcoin mining alone can cut back methane emissions by 23% through the use of electrical energy generated by way of the clear combustion of methane from landfills and oil fields.

Conclusion

Other than making the Bitcoin community safer and resilient, a rising hash fee additionally has the potential to influence the local weather positively.

Considerations over Bitcoin’s reliance on “soiled” power sources — i.e., coal-based energy — have lengthy been debunked by researchers and analysts within the {industry}. Nevertheless, the newest analysis from Daniel Batten, the co-founder of ClimateTech, discovered that lower than 23% of Bitcoin’s hash fee comes from coal-powered vegetation. In distinction, 23% comes from hydropower, 14% from wind energy, 21% from pure gasoline, and eight% from nuclear energy.

Lower than 4% of the worldwide hash fee comes from flaring and different renewable sources.

If the rising hash fee continues to depend on renewable power sources, most notably flaring, Bitcoin may start having a internet constructive influence on the setting and drastically cut back emissions driving world warming.

Discussion about this post