Coinbase

The trade needs to withdraw 70,057 ETH (roughly $129 million) of the 88,121 ETH tokens pending withdrawals as of press time.

Coinbase has consistently maintained that it could proceed its staking providers.

In the meantime, this isn’t the primary time regulatory stress compelled a U.S.-based entity to process staked ETH withdrawals. In February, Kraken ended its staking service for U.S. customers and automatically unstaked their property following the completion of the Shanghai improve.

Coinbase redeemed 2% of cbETH on June 6

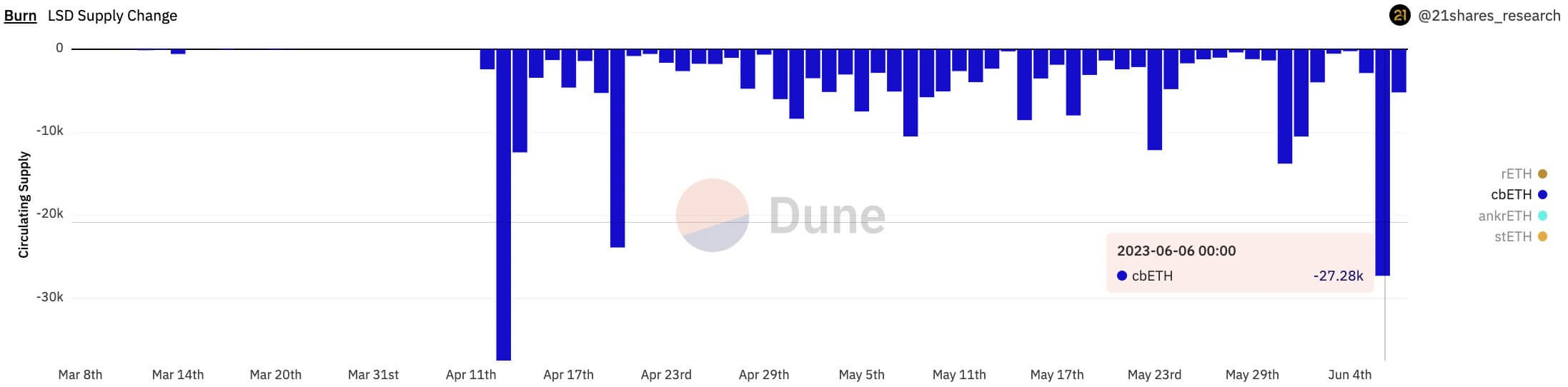

Proof of the SEC’s stress might be seen in Coinbase Wrapped Staked ETH (cbETH) burning. In accordance with 21Shares researcher Tom Wan, Coinbase burnt 2% of its cbETH provide, round 27,280 cbETH tokens, on June 6 following the lawsuit.

Data from Dune analytics confirmed that the pattern continued to June 7, when the trade burnt 8,530 cbETH tokens, taking its whole redemptions to over 35,000 tokens inside two days — its quickest fee in over a month.

In the meantime, Coinbase stays the second-largest entity for ETH liquid staking, behind solely Lido. The full worth of property locked on the crypto trade is $2.1 billion (1.14 million ETH tokens), in accordance with DeFiLlama data.

Will decentralized staking service suppliers revenue?

With the SEC sustaining stress on centralized entities offering providers, a contributor at Alpha Please, Pickle, said the transfer may result in an “elevated migration to different decentralized suppliers” like Lido and others.

Beneath Chair Gary Gensler, the SEC has urged crypto exchanges providing staking applications and interest-bearing merchandise to adjust to securities legal guidelines.

The publish Coinbase to withdraw over 70k staked ETH amid SEC lawsuit appeared first on CryptoSlate.

Discussion about this post