On July 30, the quantity of Bitcoin held by long-term holders reached an all-time excessive. Based on information from blockchain analytics agency Glassnode, long-term holders now possess 14.55 million BTC, marking a brand new report in Bitcoin’s historical past.

Lengthy-term holders (LTHs) are outlined as addresses which have held onto their Bitcoin for over 155 days taking part in an important function within the Bitcoin market attributable to their tendency to carry onto their belongings by means of market volatility and thereby lowering the obtainable provide and probably exerting upward stress on costs.

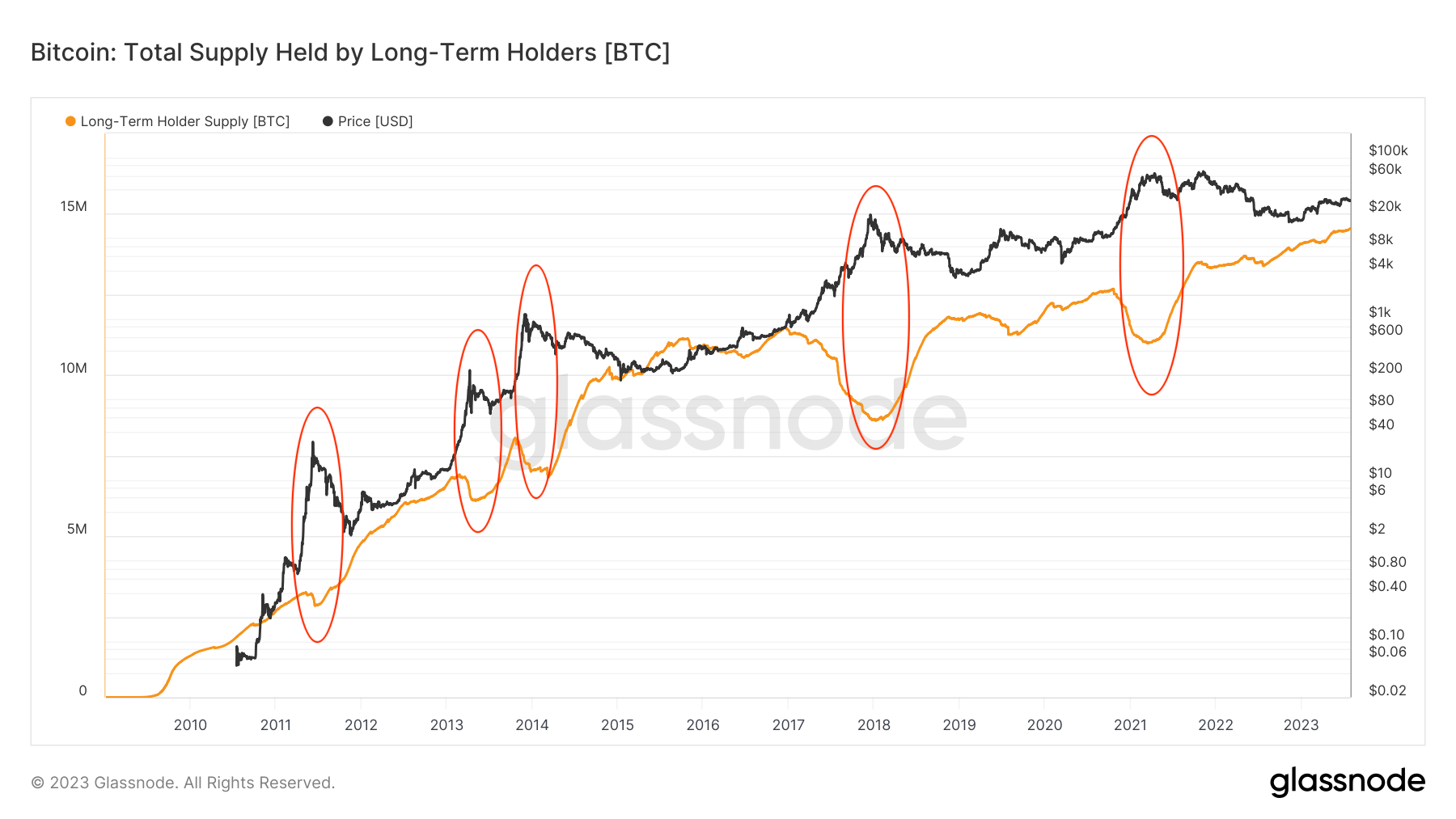

Traditionally, the availability of Bitcoin held by long-term holders has adopted a cyclical sample, growing throughout bear markets and reducing throughout bull runs.

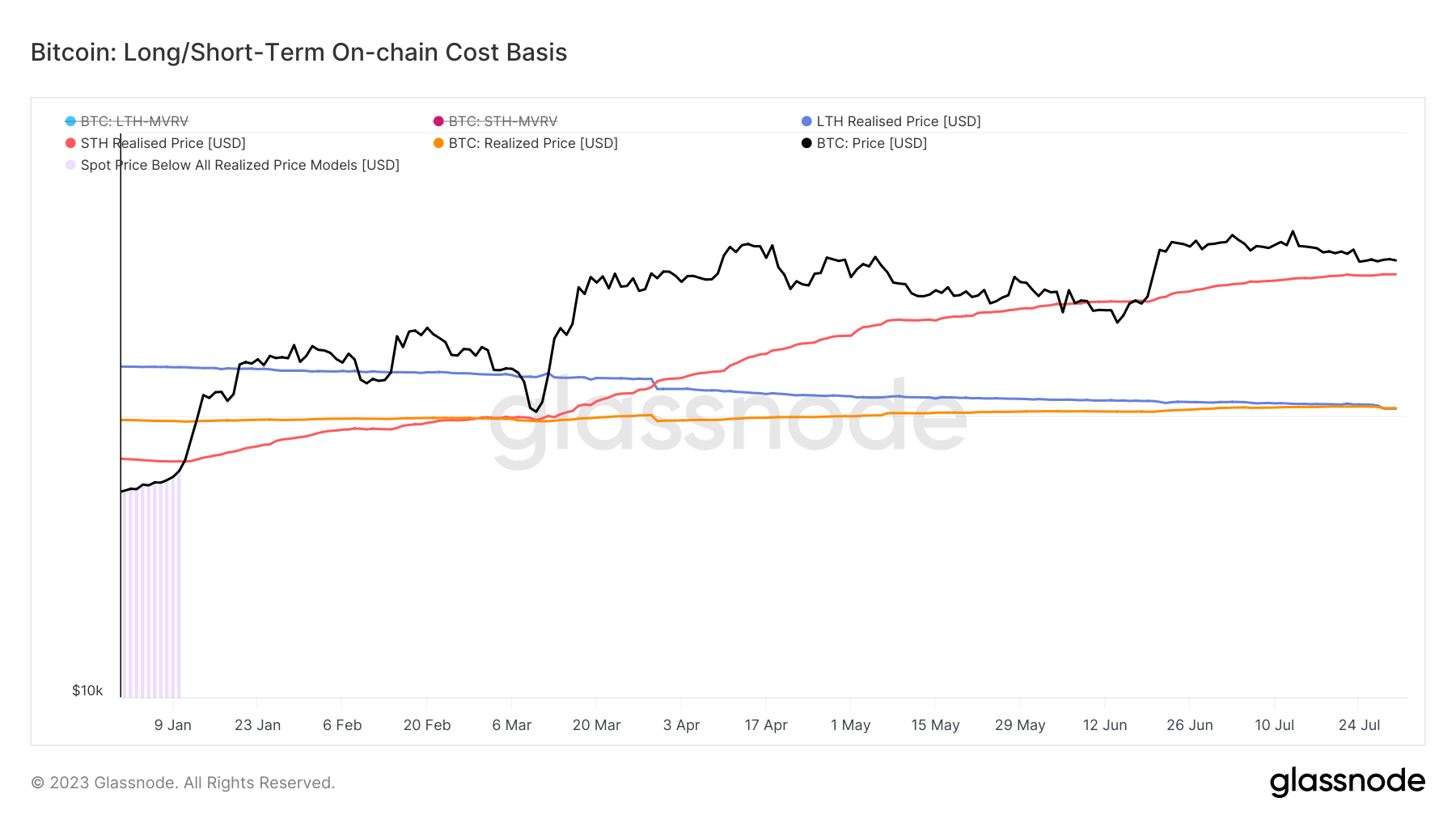

The latest surge in LTH provide occurred when Bitcoin’s value was under $30,000. This accumulation led to a lower within the long-term holders’ realized value to $20,332, down from $22,539 at the beginning of the 12 months. A 9.8% discount within the realized value is noteworthy, exhibiting that long-term holders have been strategically accumulating Bitcoin at lower prices amid the market downturn.

The lower within the LTH realized value may have a profound affect on the Bitcoin market. It means that these holders are undeterred by decrease costs and proceed to build up, probably offering a robust help degree for Bitcoin. This might restrict additional draw back and set the stage for a value rebound.

The latest all-time excessive in Bitcoin’s long-term holder provide may even have far-reaching implications. A rise in long-term holder provide throughout a bear market may sign the beginning of a brand new accumulation part, probably paving the way in which for the following bull run.

Conversely, a lower in long-term holder provide throughout a bull market may point out profit-taking and potential market tops.

The submit Long-term Bitcoin holder supply posts new ATH, undeterred by price appeared first on CryptoSlate.

Discussion about this post