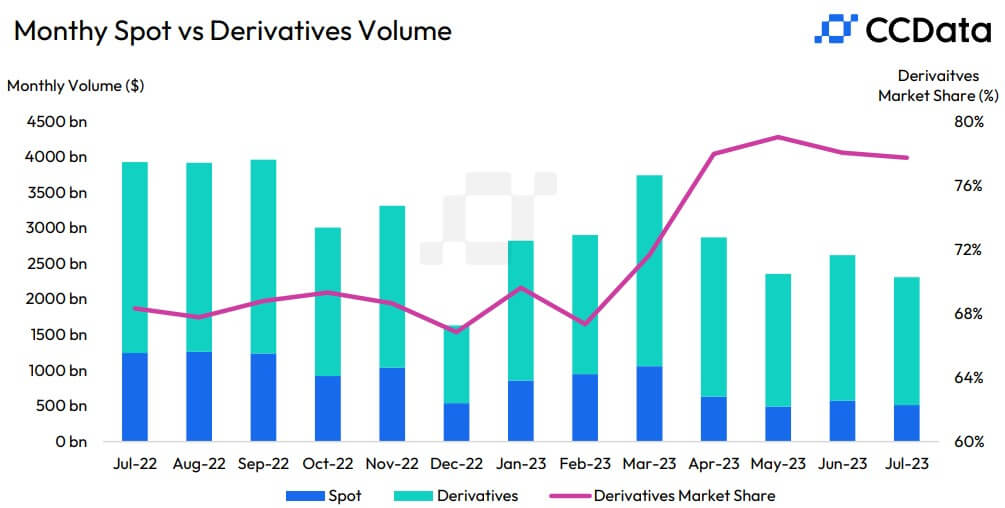

Crypto buying and selling on centralized exchanges declined by 12% to $2.36 trillion. That is the bottom quantity recorded because the starting of the 12 months, indicating a major downturn in buying and selling exercise, in keeping with CCData.

A breakdown of those buying and selling actions confirmed that spot buying and selling quantity fell 10.5% to $515 billion —the second-lowest since March 2019. Then again, derivatives quantity fell 12.7% to $1.85 trillion, which is the second-lowest quantity since December 2020.

The crypto analysis agency attributed the diminished quantity to the dearth of value motion volatility in vital crypto property, together with Bitcoin (BTC) and Ethereum (ETH), which historically drive buying and selling volumes. CryptoSlate Perception reported that BTC’s value motion in July was “carefully confined” because the flagship digital asset had “nearly no change in its value” on some days.

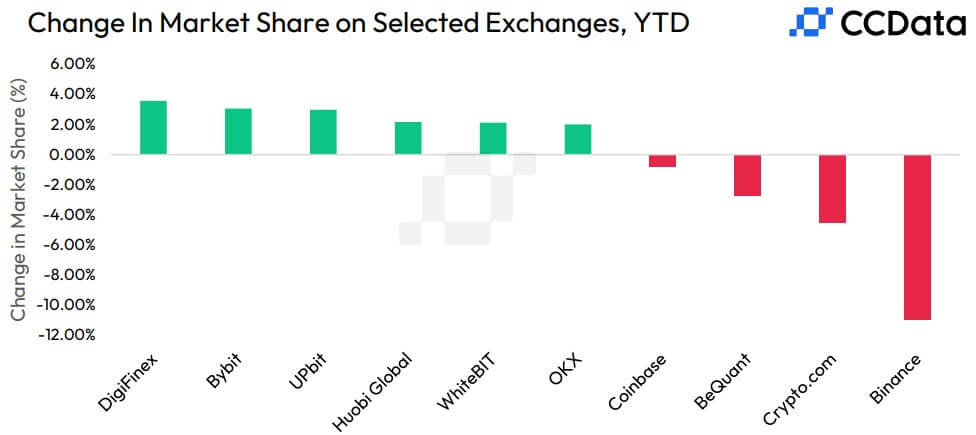

Binance’s market share continues to fall

CCData reported that Binance’s market share has fallen for the fifth consecutive month regardless of being the most important crypto alternate by buying and selling quantity.

In accordance with the report, Binance recorded $208 billion in spot buying and selling actions in July, far forward of different rivals like Coinbase, Kraken, UpBit, and so forth. Nevertheless, its market share fell to 40.4% in July, its lowest since final August.

In July, Binance’s regulatory struggles grew to become extra pronounced because it exited a number of European markets, together with the Netherlands, Cyprus, Germany, and the U.K., over its incapability to get applicable licensing inside these jurisdictions.

Whereas the alternate additionally scored minor victories with current regulatory approvals in Dubai and Japan, confidence within the platform stays shaken because the U.S. Division of Justice reportedly weighs fraud fees towards the platform.

South Korean exchanges come to fore

CCData famous that South Korean exchanges, together with UpBit, Bithumb, and CoinOne, bucked the overall decline pattern to see an uptick of their volumes in the course of the earlier month.

Per the report, UpBit t is now the second-largest alternate by buying and selling quantity after it outtraded extra storied rivals like Coinbase and OKX in the course of the interval. The alternate’s quantity rose 42.3% to $29.8 billion, whereas its rivals’ quantity declined. The elevated quantity additionally means the platform accounts for roughly 6% of the full buying and selling volumes throughout centralized exchanges.

Moreover, Bithumb and CoinOne noticed their volumes rise 27.9% and 4.72% to $6.09 billion and $1.39 billion, respectively.

Discussion about this post