Fast Take

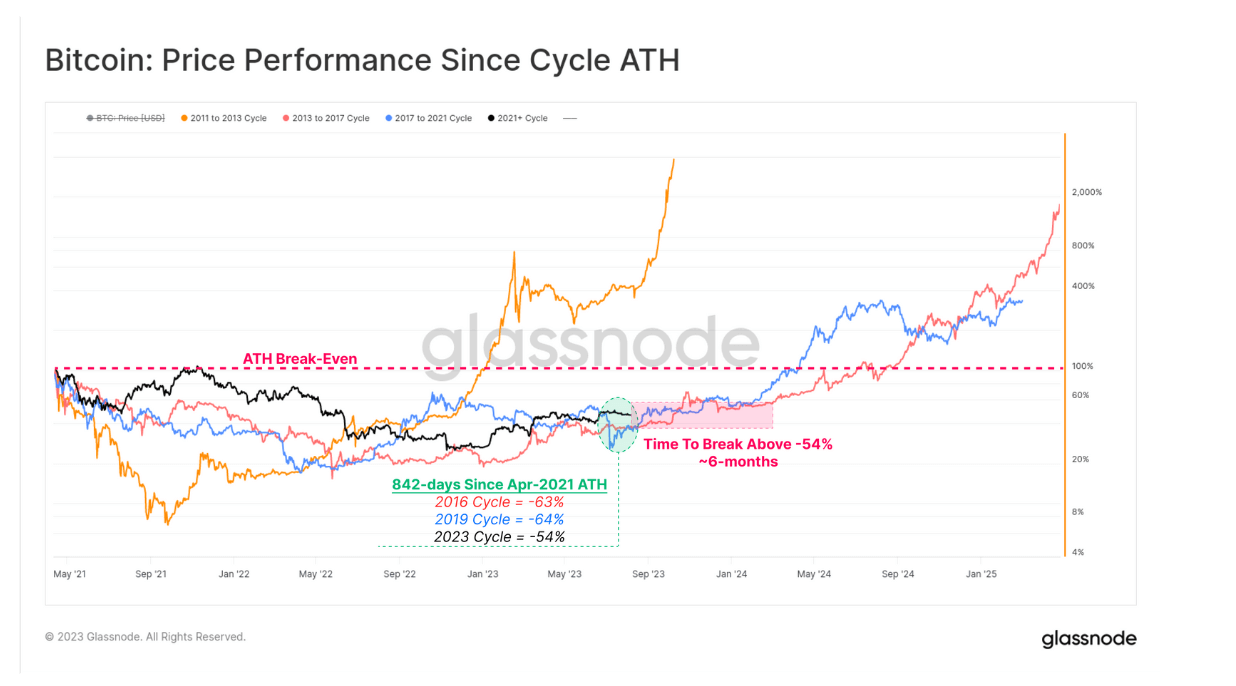

A notable lack of volatility marks Bitcoin’s present cycle, because the main cryptocurrency meanders under the $30,000 mark. On this part, even minor value dips spur expectations of extra vital falls, once more bringing earlier assist ranges into focus. Nevertheless, investor optimism appears to emerge when it inches upwards, sparking requires a breach of the 30k threshold. In keeping with Glassnode information, it has been practically 842 days since Bitcoin hit its all-time excessive in April 2021.

Apparently, the truth that Bitcoin is buying and selling about 54% under its peak is a notable enchancment over earlier cycles. This sideways motion, nevertheless, might probably unsettle even essentially the most steadfast traders. Notably, Glassnode identifies that restoration past the 54% mark took roughly six months in previous cycles, putting us on the doorstep of the subsequent halving occasion slated for April 2024. Moreover, Bitcoin’s realized and implied volatility metrics proceed to edge towards document lows, mirroring ranges unseen since 2016/2017. Realized volatility, reflecting previous value modifications, stands at 35%, whereas the anticipatory measure of implied volatility has dipped to 30%, a brand new low.

The publish Bitcoin circling the $30,000 mark nine months ahead of next halving appeared first on CryptoSlate.

Discussion about this post