Trade charge volatility has lengthy been a serious headache for cross-border companies. Traditionally, corporations have sought safety by buying overseas change (FX) insurance coverage or choices, however most of those monetary merchandise function like large “black bins”, Finofo‘s co-founder and CFO Charles Maranda informed TechCrunch in an interview.

Maranda’s firm goals to supply extra transparency and management to customers within the opaque FX world, an unlimited trade that recorded $156 trillion in international cross-border fee flows final 12 months.

“The fundamental concept is we’ve to democratize this course of for companies. Proper now, in case you are a enterprise, both your CFO is aware of about [FX], which is sort of uncommon, particularly for SMBs, otherwise you rent a non-bank FX dealer who’s simply going to advocate this and that contract and ask you to signal with out actually understanding your small business,” instructed Maranda, who beforehand labored as a monetary engineer on the Nationwide Financial institution of Canada.

With the flood of cash and expertise pouring into crypto, “it appears to us that for fairly a while, the mental capability of the world stopped caring about this current monetary system and as a substitute tried to construct a model new one,” he added. “It’s forgetting that there’s nonetheless lots to construct for this current system, particularly for companies.”

Maranda co-founded the startup with two buddies — Prateek Sodhi, a veteran of the Canadian FX sector and Malav Shah, a former engineer at Pinterest and Facebook.

Left to proper: Malav Shah, CTO, and Prateek Sodhi, CEO / Picture: Finofo

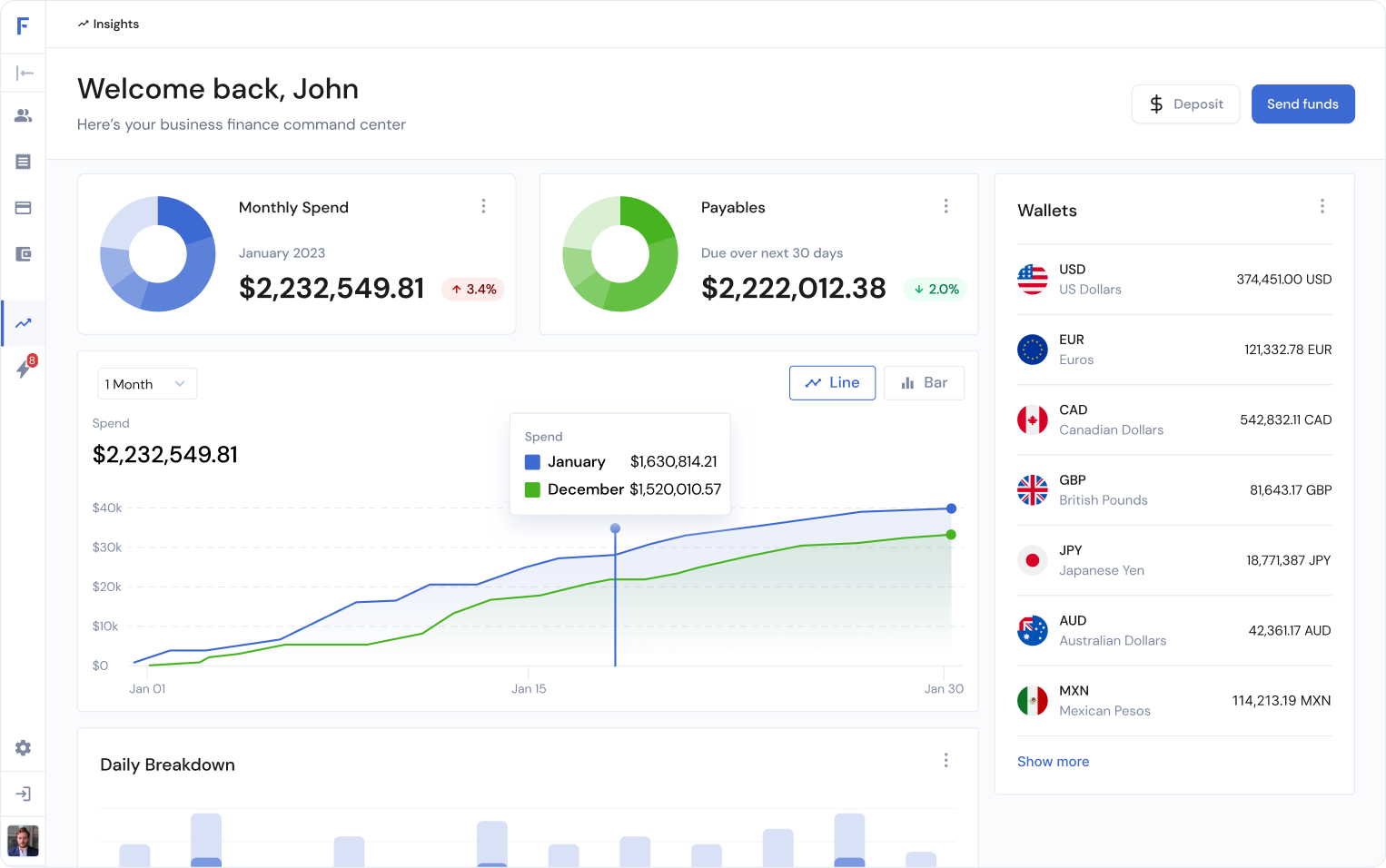

Finofo is unveiling right this moment its free-to-use platform for companies to get multi-currency accounts to ship and obtain cash globally, convert currencies in addition to automate accounts payables.

“We don’t put any barrier by a SaaS charge so corporations can begin utilizing our product instantly,” stated the founder.

For certain, the FX enterprise comes with a mature income mannequin already. Finofo monetizes like banks and non-bank foreign exchange brokers by interchange spreads — the distinction between the purchase and promote costs of a foreign money pair — and fee charges. Although Finofo is “considerably cheaper than banks” based on Maranda, it’s nonetheless a probably profitable enterprise.

At a 0.5% unfold, for instance, which is taken into account fairly low, a dealer could possibly be making $50,000 yearly from only one small-and-medium enterprise buyer, which might simply change $10 million a 12 months for its cross-border enterprise.

The following step on Finofo’s product roadmap is to use its proprietary algorithm to investigate clients’ monetary information and make suggestions for monetary planning. It takes their accounting information, together with invoices and funds spreadsheets, upon which the engine can calculate the optimum time and sort of FX contracts for foreign money conversion.

Finofo’s product screenshot / Picture: Finofo

The objective of the monetary planning product, stated Maranda, is to assist companies perceive the chance from foreign money fluctuation and handle it successfully. “This stands in stark distinction to conventional monetary establishments that depend on a one-size-fits-all method and aggressive gross sales techniques.”

Ultimately, Finofo needs to grow to be some form of a “tremendous app” for enterprise monetary operations the place they’ll plan, strategize, and execute all choices on one platform.

At present, monetary planning processes are scattered throughout an array of platforms and accomplished manually, the founder noticed. Take an organization that should ship funds to a provider in China in USD for instance. It first must pay money for an bill, which is perhaps a PDF or a slip together with the transport. Then, somebody inside the firm has to manually enter the bill info into the accounting system and the banking platform to be accepted by a supervisor excessive up. When the fee lastly will get greenlighted, choices nonetheless must be made round foreign money conversion: Can we use an current monetary contract? Can we have already got USD to pay for that?

“There’s a whole lot of forwards and backwards inside the crew,” stated Maranda. “So we making an attempt to regroup that and add the planning part to grow to be an excellent app.”

Finofo has raised some preliminary capital to work on its imaginative and prescient. Together with its product launch, it introduced right this moment the completion of a $1.25 million pre-seed spherical led by Inspire Enterprise Capital, with participation from SaaS Enterprise Capital, Candy Spot Capital and Desjardins, a serious Canadian monetary establishment.

Left to proper: Charles Maranda, CFO, and Prateek Sodhi, CEO / Picture: Finofo

Established by first-time founders, Finofo managed to get a16z’s consideration by chilly messaging a fintech associate on the agency on Twitter. The investor ultimately handed on the deal as Finofo was “too early-stage,” but it surely performed an important position in facilitating introductions to different buyers who ended up becoming a member of the spherical.

Run by a crew of seven individuals most of whom are based mostly in Calgary, Finofo is concentrating on the Canadian market first by an area banking associate; it’s additionally registered with the Monetary Transactions and Experiences Evaluation Centre of Canada, or FINTRAC, the nation’s monetary intelligence unit.

Profitable person belief for a monetary planning app that additionally handles transactions is undoubtedly a difficult activity. To that finish, Finofo is allocating loads of assets to customer support and schooling by “at all times being obtainable and discovering an answer on the spot,” Maranda stated. “It’s a must to do the factor that doesn’t scale first.”

Discussion about this post