Final week, the crypto market skilled a large sell-off that despatched Bitcoin’s value all the way down to as little as $25,000. The sharp market motion ended a number of months of unprecedented calmness within the crypto market.

Earlier CryptoSlate evaluation pinpointed the derivatives market as the first catalyst for the aggressive sell-off. The futures market noticed a big deleveraging event, ensuing within the closure of over $2.5 billion value of perpetual futures contracts closed out in a single day.

Alternatively, the choices market remained remarkably resilient throughout Bitcoin’s value decline. Glassnode information confirmed a constant open curiosity for each call and put options, indicating that these devices had been largely unaffected by the market volatility.

Nevertheless, it wasn’t all clean crusing for choices. One notable shift the market noticed was the aggressive repricing of volatility.

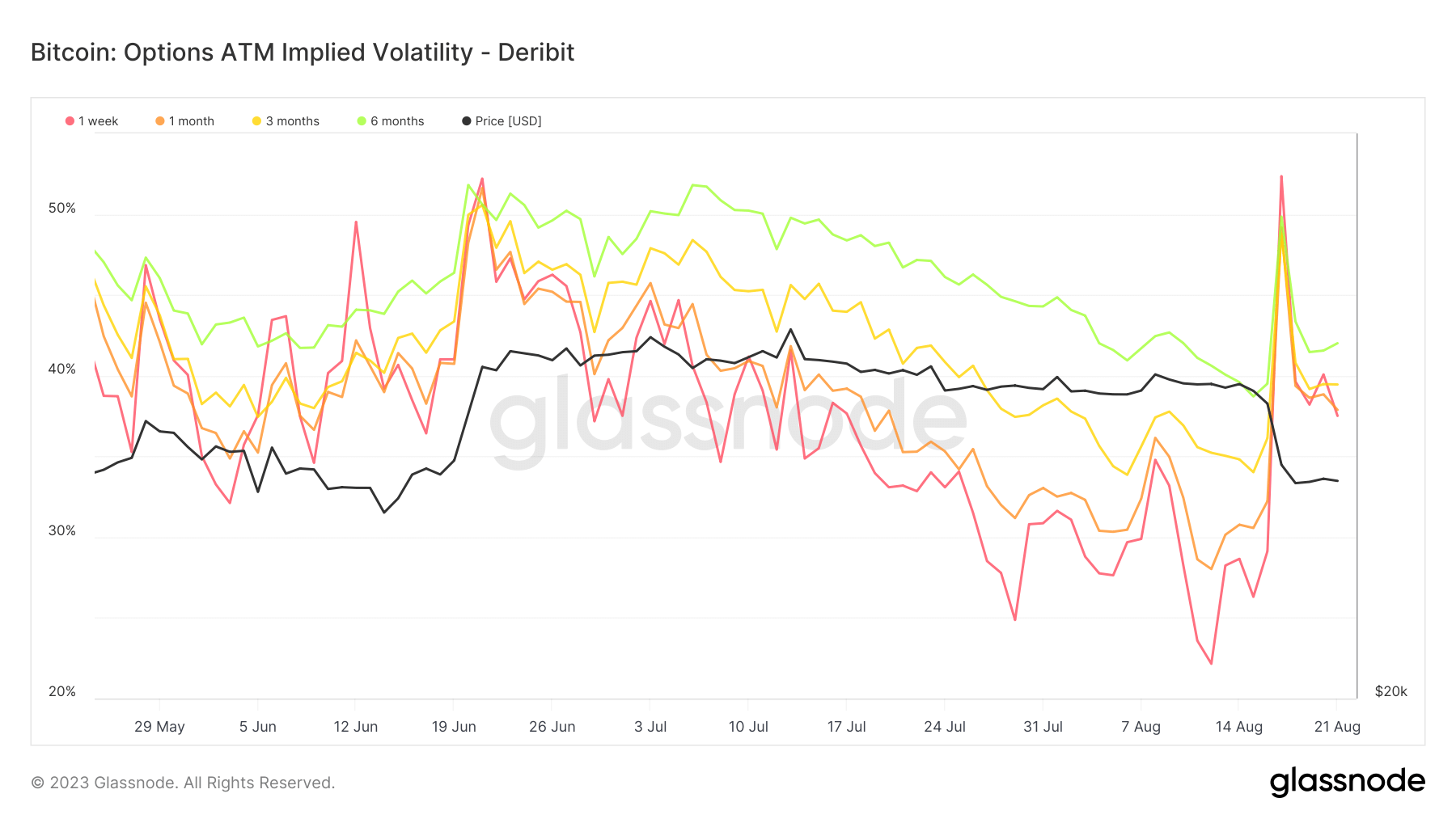

Implied volatility, a market metric that predicts the potential magnitude of asset value fluctuations based mostly on choices costs, has been unprecedentedly low all through the summer season. Implied volatility is a crucial metric to observe because it supplies insights into future value fluctuations, influencing buying and selling methods.

The tranquility in implied volatility was worn out final week throughout Bitcoin’s value stoop. Bitcoin’s drop to $25,000 induced the implied volatility for choices set to run out in every week to almost double. Particularly, it surged from 22.15% on August 12 to 52.35% on August 18.

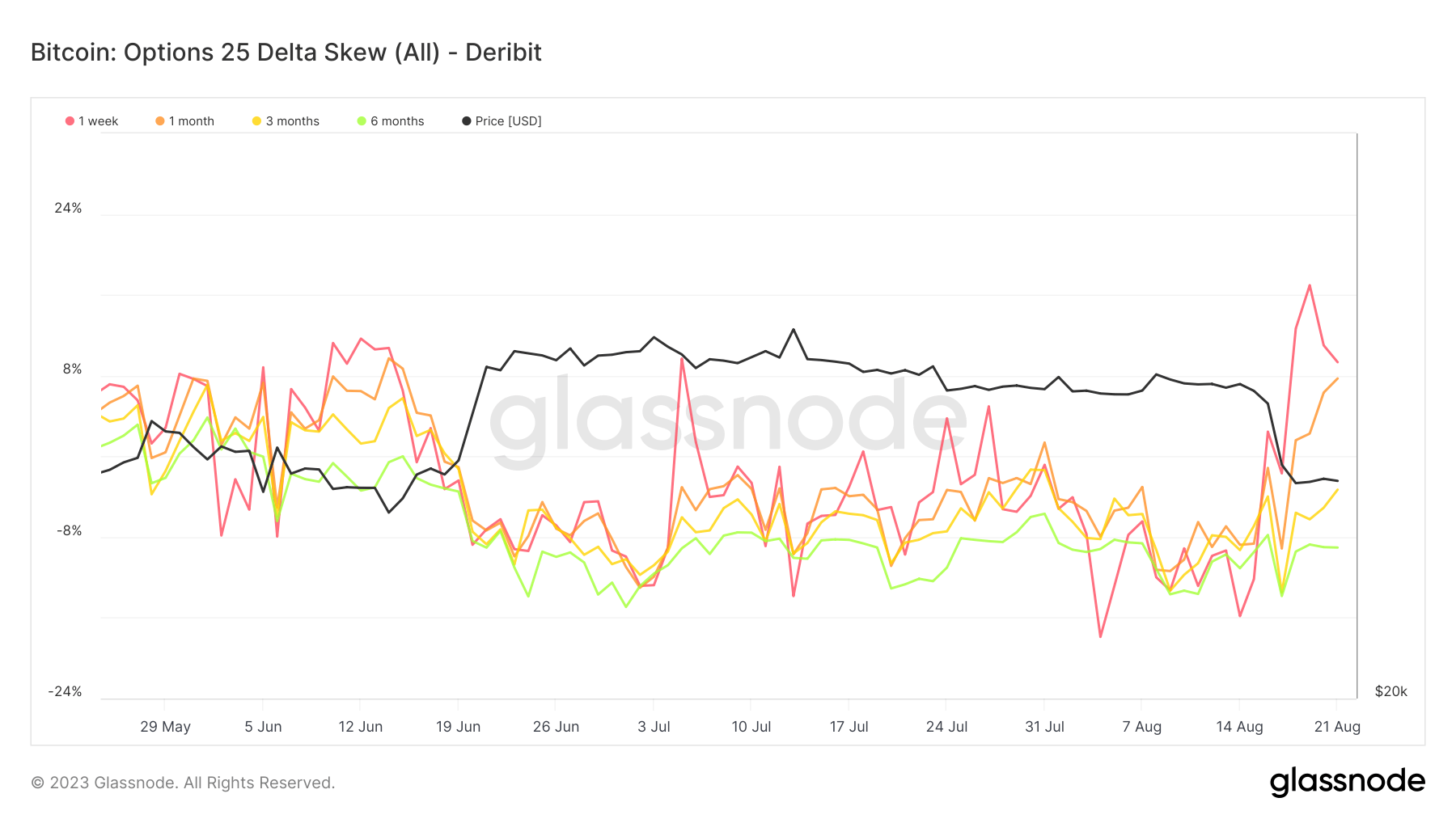

One other metric that underwent a big shift was the 25 delta skew for choices. This skew, which measures the distinction in implied volatility between out-of-the-money places and calls, leaped from -15.8% to 16.9% for choices expiring in a single week. A optimistic skew signifies that places are dearer than calls, suggesting the next demand for draw back safety and bearish sentiment.

Whereas the crypto market’s current turbulence rattled many sectors, the choices market remained a beacon of stability, no less than when it comes to open curiosity. Nevertheless, the sharp changes in implied volatility and the 25 delta skew underscore the market’s heightened sense of uncertainty and warning.

The put up Bitcoin dips but options market holds steady appeared first on CryptoSlate.

Discussion about this post