Traditionally, the 10-year Treasury yield has been a dependable barometer of broader financial sentiment. Nevertheless, latest knowledge suggests a weakening correlation between this yield and one other key asset: gold. This divergence, not seen in many years, has profound implications for traders and the broader market.

The ten-year Treasury yield represents the return on funding for U.S. authorities bonds with a 10-year maturity. It’s a vital metric for a number of causes.

Firstly, it’s a mirrored image of investor confidence. When the yield rises, it signifies optimism concerning the U.S. economic system’s prospects. Conversely, a falling yield can sign financial pessimism. Secondly, as a result of the U.S. authorities backs these bonds, they’re seen as nearly risk-free, making their yields a benchmark for different rates of interest, together with these for mortgages and company bonds.

Then again, gold is taken into account a retailer of worth. Its worth typically strikes inversely to the 10-year Treasury yield. Traders flock to gold as a protected haven when yields are low, indicating financial uncertainty. Conversely, when yields rise, signaling financial optimism, gold typically turns into much less engaging than income-generating belongings.

Latest market tendencies and world occasions have disrupted this traditionally inverse relationship.

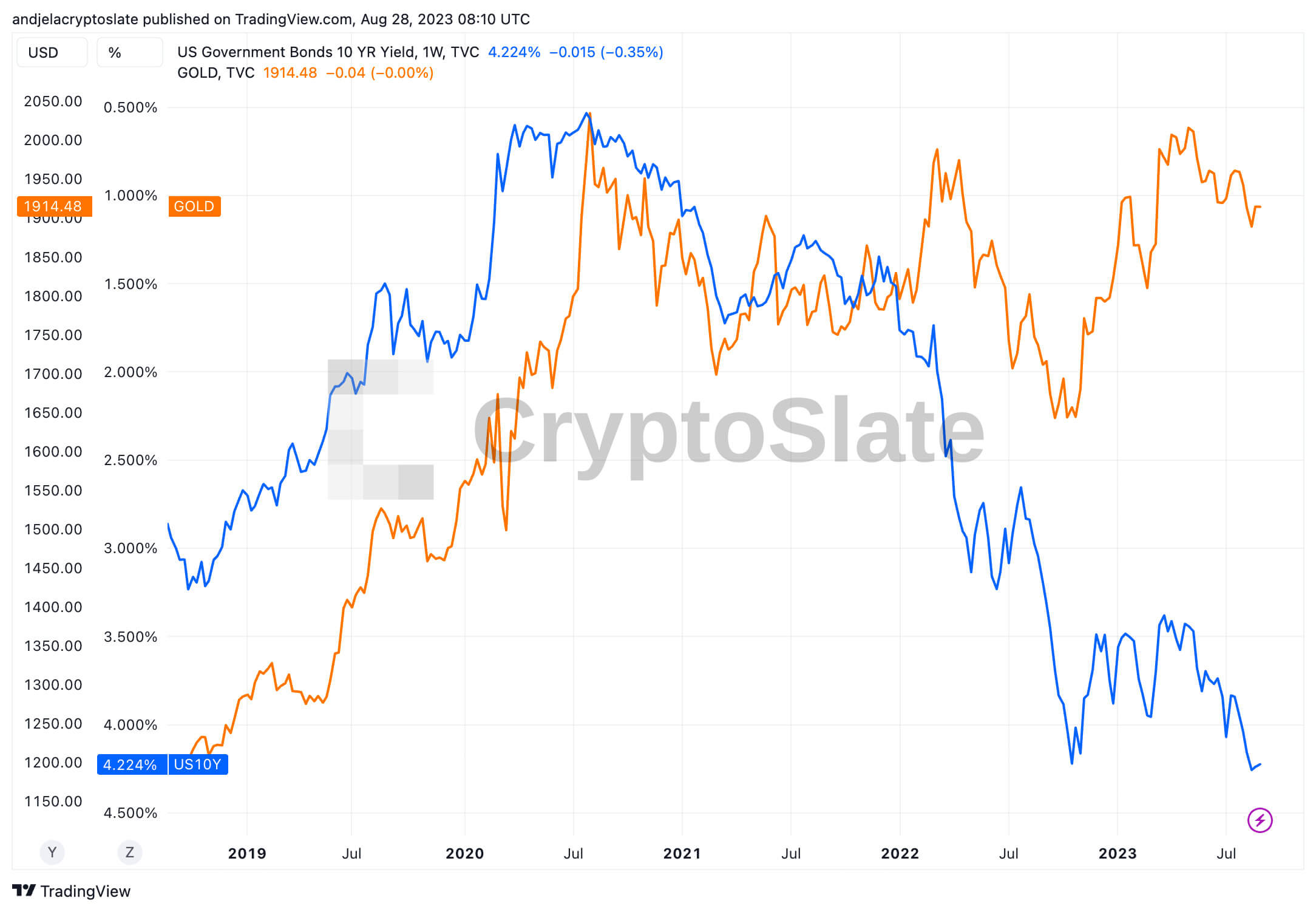

In July 2020, the 10-year Treasury yield plummeted to 0.5%, its all-time low. Since then, it has climbed considerably, standing at 4.22% on Aug. 28. Such an increase sometimes suggests rising financial confidence, which might normally be accompanied by a dip in gold costs. But, gold has defied expectations. After peaking at $1,974 in July 2020, it soared to an all-time excessive of $1,991 by Apr. 3, 2023, and stays sturdy at $1,914 as of Aug. 28, 2023.

This divergence is critical, and its causes might be multi-faceted, involving numerous world occasions and market tendencies influencing investor habits. Whereas the rising yield signifies optimism about U.S. financial development or potential inflation, the resilient gold costs trace at different world elements sustaining its demand and point out a possible instability of U.S. Treasurys. Elements equivalent to geopolitical tensions, monetary policies, fluctuations within the worth of the U.S. dollar, or ongoing concerns about inflation may all contribute to this development, making gold a extra engaging hedge for traders.

This divergence presents challenges and alternatives for the market, creating a brand new paradigm for traders. They need to navigate an atmosphere the place conventional correlations, important for guiding funding methods, are much less sure. This shift may demand new methods, equivalent to diversifying portfolios or focusing extra on particular person asset dynamics.

The publish Breaking traditions: Why gold prices defy 10-year Treasury yield movements appeared first on CryptoSlate.

Discussion about this post