Fast Take

This previous week has been chock-full of serious occasions inside the monetary and cryptocurrency markets, with potential world ramifications. In an episode earlier this week, Cointelegraph erroneously introduced the approval of BlackRock’s spot Bitcoin ETF, which despatched Bitcoin from roughly $27,500 to $29,000.

Grayscale Bitcoin Belief (GBTC) skilled a contraction in its low cost to internet asset worth (NAV), decreasing it to 12%. This motion means that traders are probably anticipating approval of a spot Bitcoin ETF within the close to future.

Within the meantime, Bitcoin has made headlines with substantial outflows from exchanges, resulting in a year-to-date low. This, together with the cryptocurrency surpassing the milestone $30,000 stage, signifies a shift in investor technique in the direction of a long-term holding sample.

Notably, this week has marked Bitcoin’s fifth greatest week this yr, with the cryptocurrency surging roughly 9%. These good points, spectacular in their very own proper, assume better significance given the backdrop of geopolitical uncertainty and monetary instability.

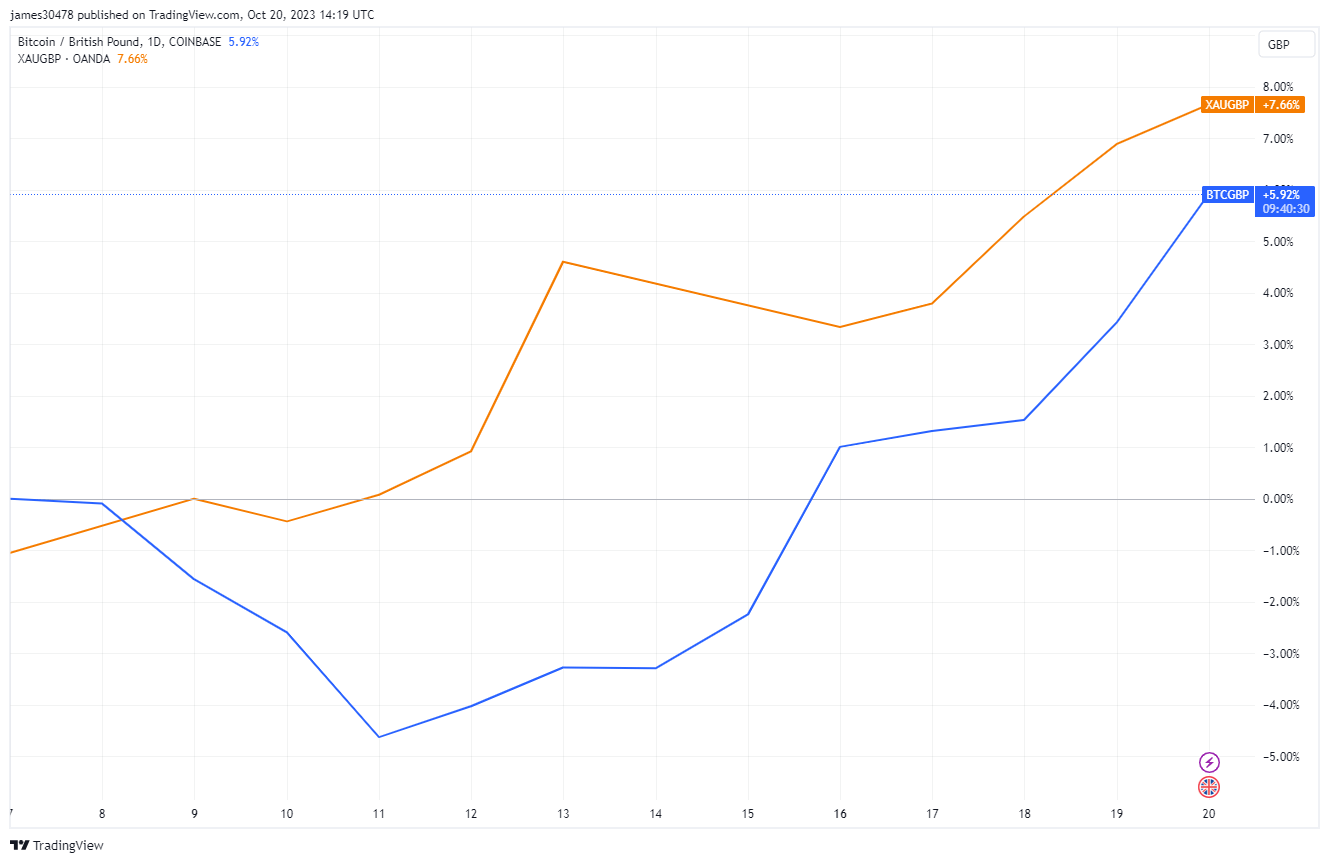

Within the broader world context, the battle in Israel has left its mark on the markets. Bitcoin and gold, usually thought-about safe-haven assets, have appreciated roughly by 6%, indicating their resilience in unsure occasions. Concurrently, U.S. treasuries are making new cycle highs unseen in 15 years.

The submit Bitcoin stays resilient as global instability looms appeared first on CryptoSlate.

Discussion about this post