Fast Take

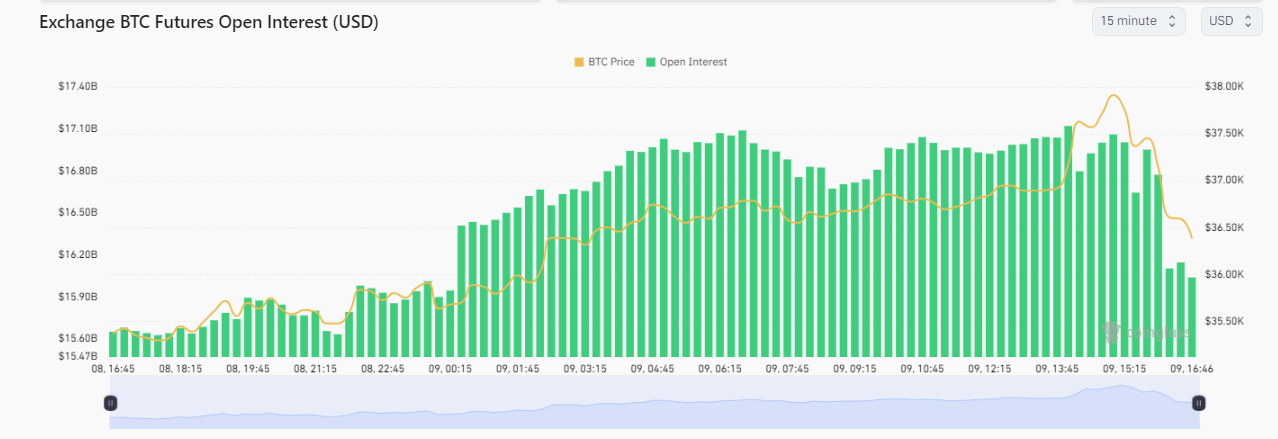

Bitcoin’s trajectory on Nov 9 presents a compelling case examine in market volatility. Briefly touching $38,000, Bitcoin’s worth has since dialed again to settle at $36,500. This short-lived surge drove Bitcoin’s market cap from an preliminary $715B to a zenith of $740B, earlier than receding again to $715B.

The noteworthy side is the day-to-day market cap improve, the place on the peak, Bitcoin’s market cap soared by roughly 4.5%, escalating from $697B to $729B. This stood at one of the vital one-day proportion change will increase in Bitcoin’s storied market cap historical past, simply outdoors the highest 10.

Nonetheless, this surge was not with out repercussions. Liquidations during the last 24 hours have surpassed $440M within the crypto market, a direct consequence of the abrupt market flush.

| Time | Liquidation Quantity |

|---|---|

| 1 hour | $147M |

| 4 hours | $262M |

| 12 hours | $334M |

| 24 hours | $446M |

Supply: Coinglass

Concurrently, open curiosity has seen a discount by over 5%, successfully eradicating $1B of open curiosity in Bitcoin.

Considerably, this turbulence has resulted in a shifting panorama concerning trade open curiosity. Chicago Mercantile Change (CME) has now ascended to turn into the most important trade on this regard, following a considerable wipeout of open curiosity from Binance.

The submit Bitcoin’s whirlwind day sees $440M in market liquidations as CME overtakes Binance in open interest appeared first on CryptoSlate.

Discussion about this post