Fast Take

The Accumulation Pattern Rating, an instrumental indicator of lively coin accumulators’ relative measurement, has just lately pointed in the direction of a sturdy accumulation interval for Bitcoin. This sample of accumulation, representing each the scale of the entities’ steadiness and the quantity of recent cash procured/offered over the previous month, has been paralleled sometimes since March 2020.

Often, such peaks in accumulation are observable throughout bear market bottoms of cycles, such because the downturns skilled following the FTX and Luna collapse, the COVID-19 pandemic, or throughout bull market zeniths like 2021.

At present, the Accumulation Pattern Rating edges nearer to 1, suggesting that bigger community entities are actively accumulating. This development offers a glimpse into market members’ steadiness measurement and their accumulation habits over the previous month.

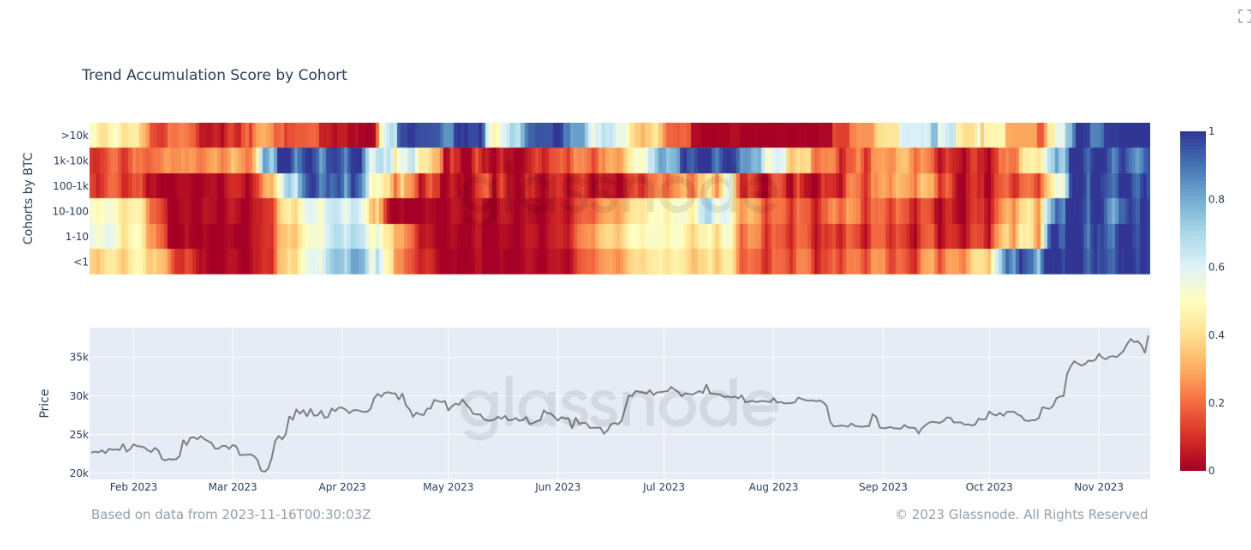

Curiously, an in-depth examination of the buildup development rating by cohorts additional bolsters the narrative of aggressive accumulation by all cohorts. This phenomenon hasn’t transpired all yr; all cohorts have moved in live performance.

Since Oct. 2023, there have been 12 days recorded the place the Accumulation Pattern Rating reached exactly 1.

Inside Bitcoin historical past, which spans 4,870 days, there have been 449 days the place the Accumulation Pattern Rating has been 1, equating to about 9.22% of the noticed interval.

The put up Recent on chain data points to an all-cohort Bitcoin accumulation appeared first on CryptoSlate.

Discussion about this post