This yr, the Stablecoin Provide Ratio (SSR) has proven vital developments, providing deep insights into Bitcoin’s market conduct. The SSR, calculated by dividing Bitcoin’s market cap by the market cap of main stablecoins, is a barometer for the relative monetary energy and buying energy of stablecoins in opposition to Bitcoin.

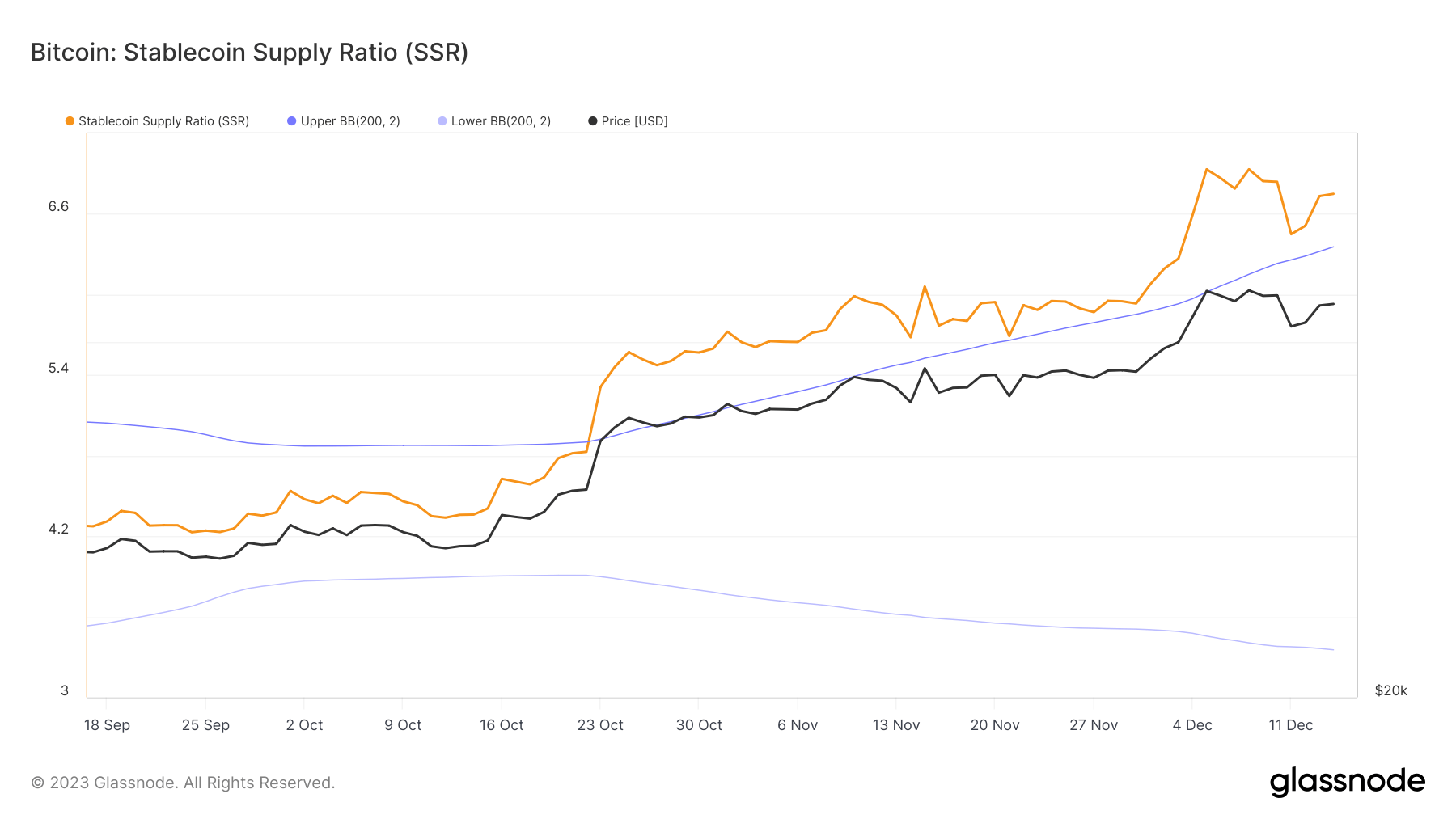

This yr, a marked enhance in SSR has been noticed, with the ratio climbing from 2.36 on Jan. 1 to six.74 by Dec. 14. This rise signifies a rising market cap of Bitcoin relative to stablecoins, hinting at shifts in market liquidity and investor choice.

To completely perceive these developments, it’s essential to look at the SSR in relation to Bollinger Bands. Bollinger Bands are a set of pattern strains plotted two customary deviations (positively and negatively) away from a easy transferring common (SMA) of a specific asset or metric. They assist determine the diploma of volatility out there. When the SSR crossed the higher Bollinger Band at 4.90 on Oct. 23 and remained above it, it signaled an uncommon market situation: Bitcoin’s market cap grew considerably in comparison with stablecoins, indicating a possible shift in investor conduct or market sentiment.

A file excessive SSR of 6.93 on Dec. 8 additional underscores this pattern, although the next slight lower following Bitcoin’s value dip from $44,200 to $41,200 reveals that as Bitcoin’s value fluctuates, the relative energy and influence of stablecoins in the marketplace modify accordingly, influencing the SSR.

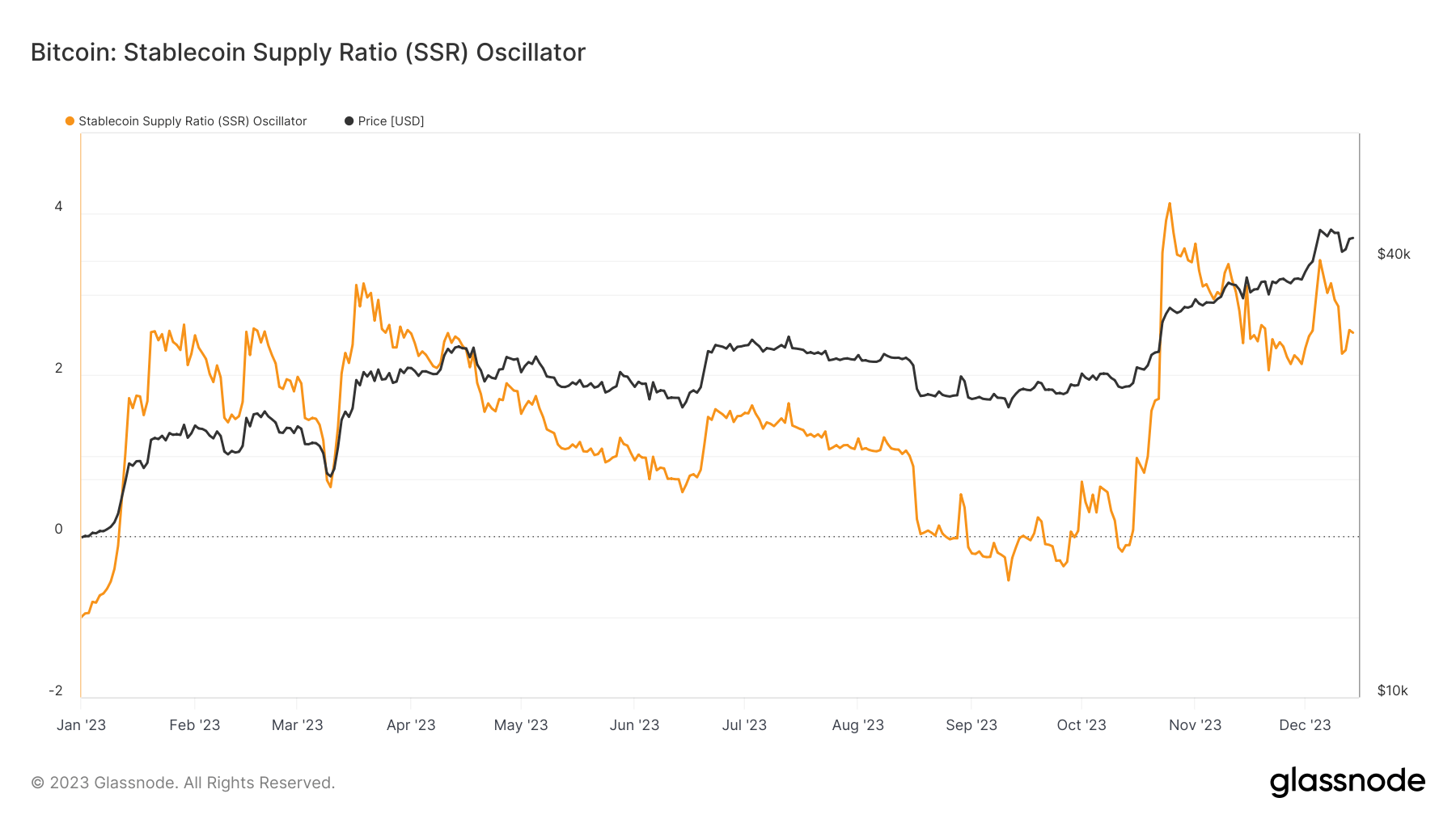

The Stablecoin Oscillator, a by-product of the SSR, tracks how the 200-day SMA of the SSR strikes inside its Bollinger Bands, offering a extra nuanced view of market developments. Between Dec. 8 and Dec. 14, the oscillator fell from 3.13 to 2.52 as Bitcoin’s value dropped and partially recovered. This reveals a balancing act between Bitcoin’s direct market efficiency and the comparative worth and utility of stablecoins. As Bitcoin’s value adjustments, it influences the SSR, which in flip impacts the oscillator, highlighting the continual and complicated relationship between these two essential elements of the cryptocurrency market.

The year-to-date (YTD) excessive for the oscillator was marked on Oct. 25, reaching 4.13, contrasting with a YTD low of -1 at first of the yr. The oscillator’s YTD excessive and low factors replicate the market’s altering sentiment and the evolving function of stablecoins in relation to Bitcoin.

An growing SSR, particularly alongside a rising Bitcoin value, factors to a diversified funding panorama. Bitcoin’s market cap development outpacing that of stablecoins might be pushed by varied components, together with direct fiat investments, conversions from stablecoins to Bitcoin, and speculative buying and selling the place stablecoins are retained as a hedge whereas Bitcoin is actively traded.

The put up Bitcoin outpaces stablecoins in market cap growth appeared first on CryptoSlate.

Discussion about this post