The European Central Financial institution is pushing forward with plans to launch a digital euro, aiming to offer a pan-European digital cost resolution that enhances money, in accordance with Piero Cipollone, Member of the Govt Board of the ECB. Talking on the Convegno Revolutionary Funds convention, Cipollone outlined the elemental design selections and rationale behind the digital euro mission, in accordance with notes released on March 13.

As evolving cost tendencies mirror individuals’s rising choice for digital funds, the ECB seeks to make lives extra accessible by providing a public digital technique of cost that can be utilized freed from cost for any digital transaction within the euro space. Cipollone emphasised that the digital euro would carry cash-like options to the digital world, being obtainable offline, free for fundamental use, and respectful of privateness whereas having a pan-European attain.

Nonetheless, some critics have raised considerations concerning the privateness implications of the digital euro. In a recent post, WalkerAmerica, the host of Bitcoin Bitcoin-focused Titcoin Podcast, expressed skepticism concerning the ECB’s claims of privateness:

“ECB plans to roll out digital Euro CBDC beginning in 2025 They declare it’ll be ‘non-public,’ nevertheless it won’t be, given Lagarde already needs to throw you in jail for a 1000+ euro nameless money cost. Research #Bitcoin & choose out of this totalitarian surveillance token.”

The launched slides recommend the digital euro is designed to be accessible to everybody, together with people and companies, overlaying all retail cost eventualities within the euro space wherever digital funds are accepted. Cipollone highlighted the shortage of a present European digital technique of cost overlaying all euro space nations, with 13 out of 20 nations counting on worldwide schemes for digital funds, settling 69% of all digital transactions within the EU. The digital euro goals to fill this hole by offering a standardized digital cost platform for your entire euro space.

Addressing inclusivity considerations, Cipollone famous that digital euro funds is also made utilizing a bodily card, with money getting used for funding and defunding. Customers would have entry to face-to-face technical help and the choice to change intermediaries simply. Chosen public entities would additionally function intermediaries for customers with out financial institution accounts.

Knowledge safety and privateness are mentioned to be key priorities for the digital euro mission. The Eurosystem would implement safeguards to make sure excessive knowledge safety requirements, together with inner knowledge segregation and auditing. Revolutionary privacy-enhancing strategies can be adopted when prepared and examined for giant cost techniques, fostering increased privateness requirements for digital euro customers.

Nonetheless, the crypto business has additionally been less optimistic about this, with individuals akin to Bitcoin writer Quinten Francois commenting that “Money is nameless and never censorable. Digital euro isn’t.” Additional, in February, Cipollone spoke in entrance of the European Parliament’s Committee on Financial and Financial Affairs to allay concerns concerning the safety of the digital euro.

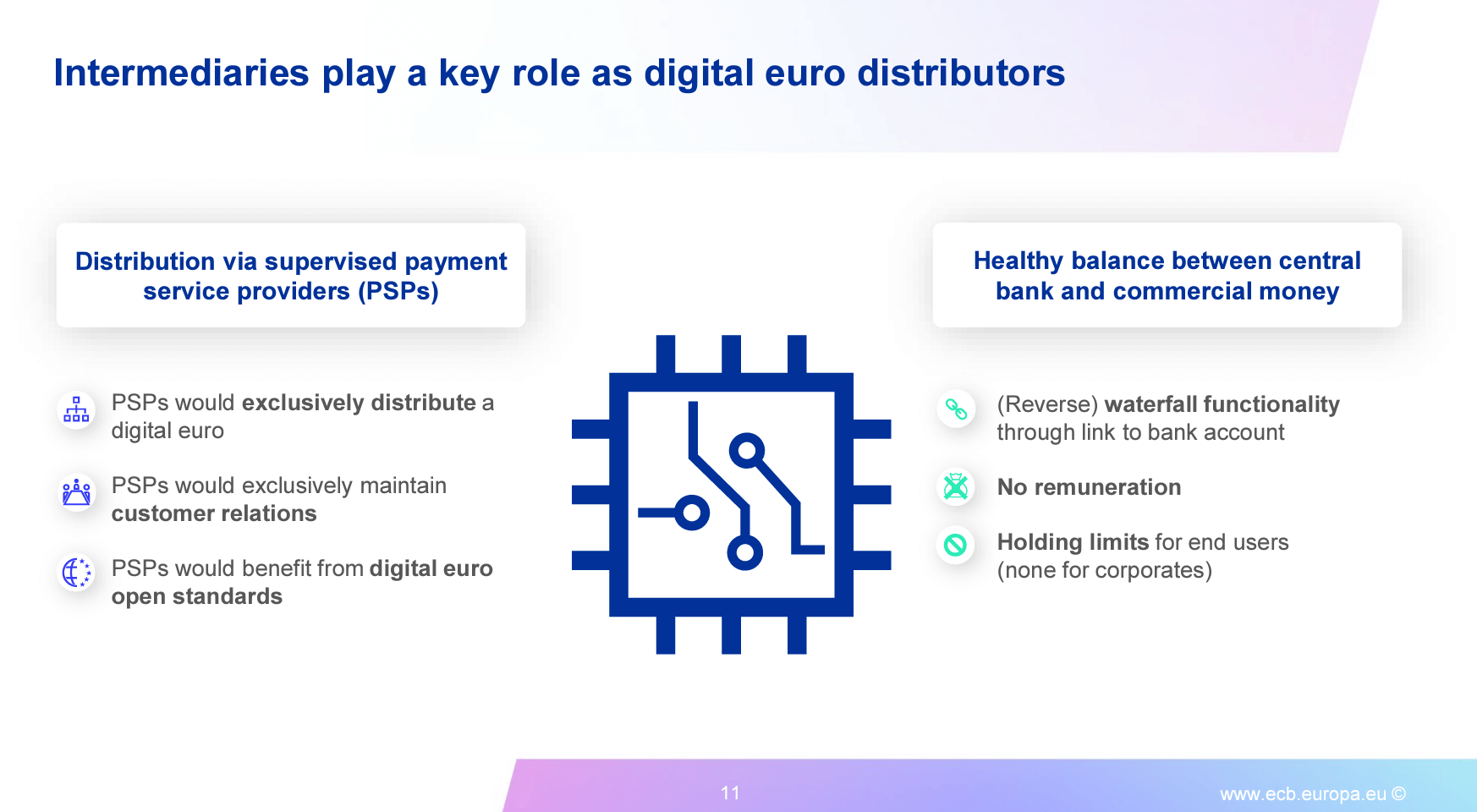

The presentation additionally asserts that the digital euro can be distributed through supervised cost service suppliers, sustaining a wholesome stability between central financial institution and business cash. PSPs would completely distribute the digital euro, strengthen buyer relations, and profit from open requirements. A digital euro rulebook, drafted with the involvement of market individuals, would set up widespread requirements to make sure pan-European attain and a harmonized cost expertise whereas giving the market freedom to develop progressive options.

Notably, the above slide showcases how there will likely be “holding limits” for finish customers. Nonetheless, there are none for “corporates,” suggesting that retail customers could have a restrict on how a lot of the digital euro they are going to be capable to custody, however corporations could have no restrict. Such options goal to create a “wholesome stability between central financial institution and business cash,” in accordance with the presentation.

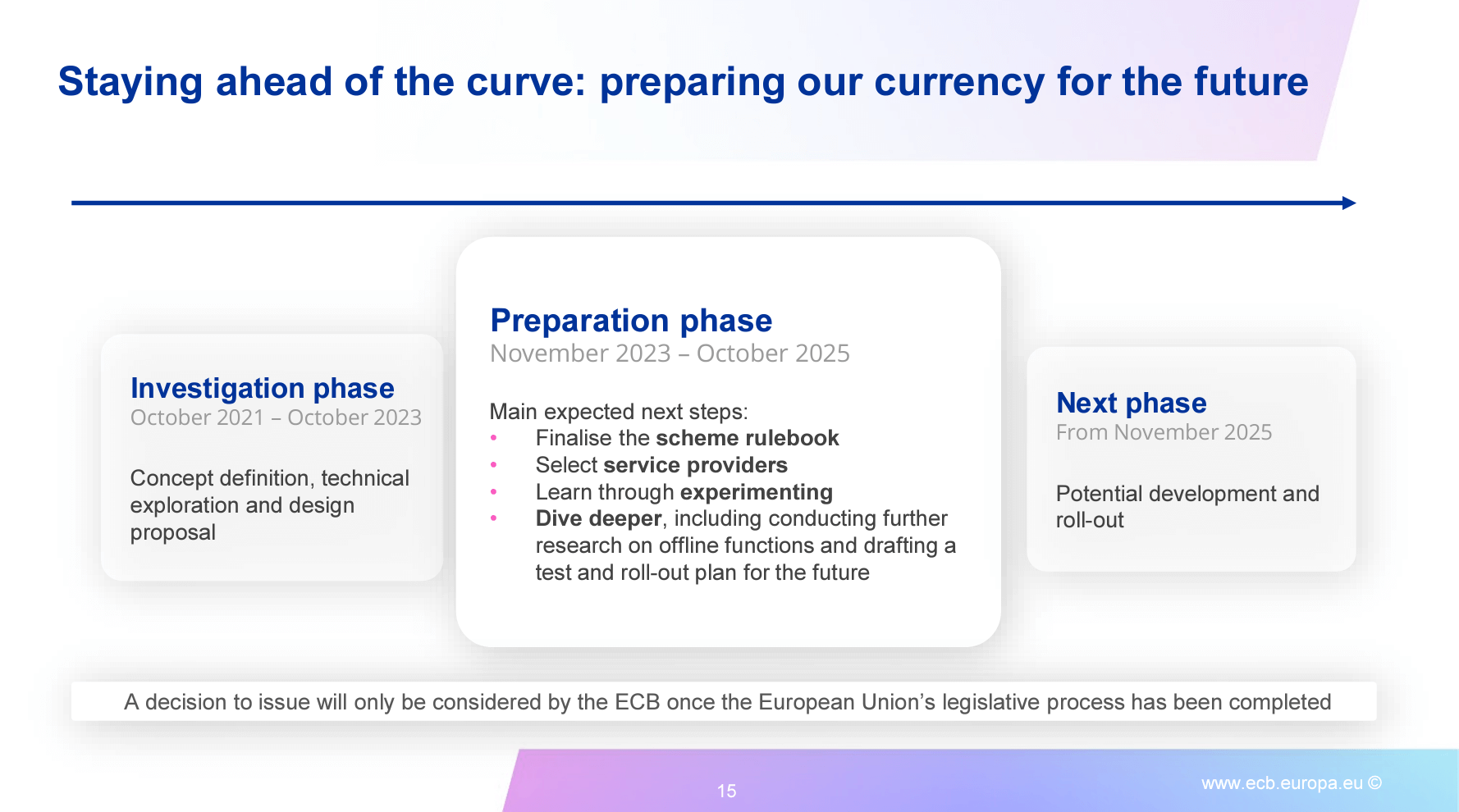

The digital euro mission has handed its preliminary investigation part (October 2021 – October 2023), specializing in idea definition, technical exploration, and design proposals. The present preparation part (November 2023 – October 2025) includes finalizing the scheme rulebook, deciding on service suppliers, studying by means of experimentation, and conducting additional analysis on offline features and take a look at and rollout plans. A call to subject the digital euro will solely be thought-about by the ECB as soon as the European Union’s legislative course of has been accomplished. Nonetheless, the doc pens a possible rollout for November 2025.

Because the ECB moves forward with its digital euro plans, the controversy surrounding privateness and the potential for surveillance continues. Critics like WalkerAmerica urge people to review Bitcoin and choose out of what they understand as a “totalitarian surveillance token.” The ECB might want to deal with these considerations and supply specific assurances concerning knowledge safety and person privateness to realize widespread acceptance of the digital euro.

Discussion about this post