The distribution of Bitcoin’s provide throughout varied cohorts — shrimps, crabs, fish, sharks, and whales — will help us perceive how every market section behaves. Shifts in Bitcoin’s provide amongst these teams are closely correlated with worth actions and broader market traits, which is why understanding them is important when analyzing the market.

Shrimps symbolize retail buyers holding lower than 1 BTC, a measure of grassroots participation within the Bitcoin market. Crabs embody retail-sized buyers with holdings between 1 and 10 BTC, usually thought to be knowledgeable, long-term holders.

Fish to sharks embrace higher-net-worth people and institutional buyers with holdings starting from 10 to 1,000 BTC, a class that displays each early adopters {and professional} buying and selling operations.

Lastly, whales maintain between 1,000 and 10,000 BTC, whose actions are intently watched attributable to their vital market affect.

Monitoring the availability distribution modifications throughout these cohorts offers invaluable insights into Bitcoin’s liquidity and strategic positioning of various investor lessons.

From Jan. 1 to March 13, shrimps have elevated their Bitcoin holdings from 1.335 million BTC to 1.368 million. This constant progress, regardless of worth volatility, suggests a dollar-cost averaging technique, the place small, common purchases are made whatever the asset’s worth.

This habits signifies a deep-rooted perception in Bitcoin’s long-term worth amongst retail buyers, seen by their continued funding regardless of market uncertainties.

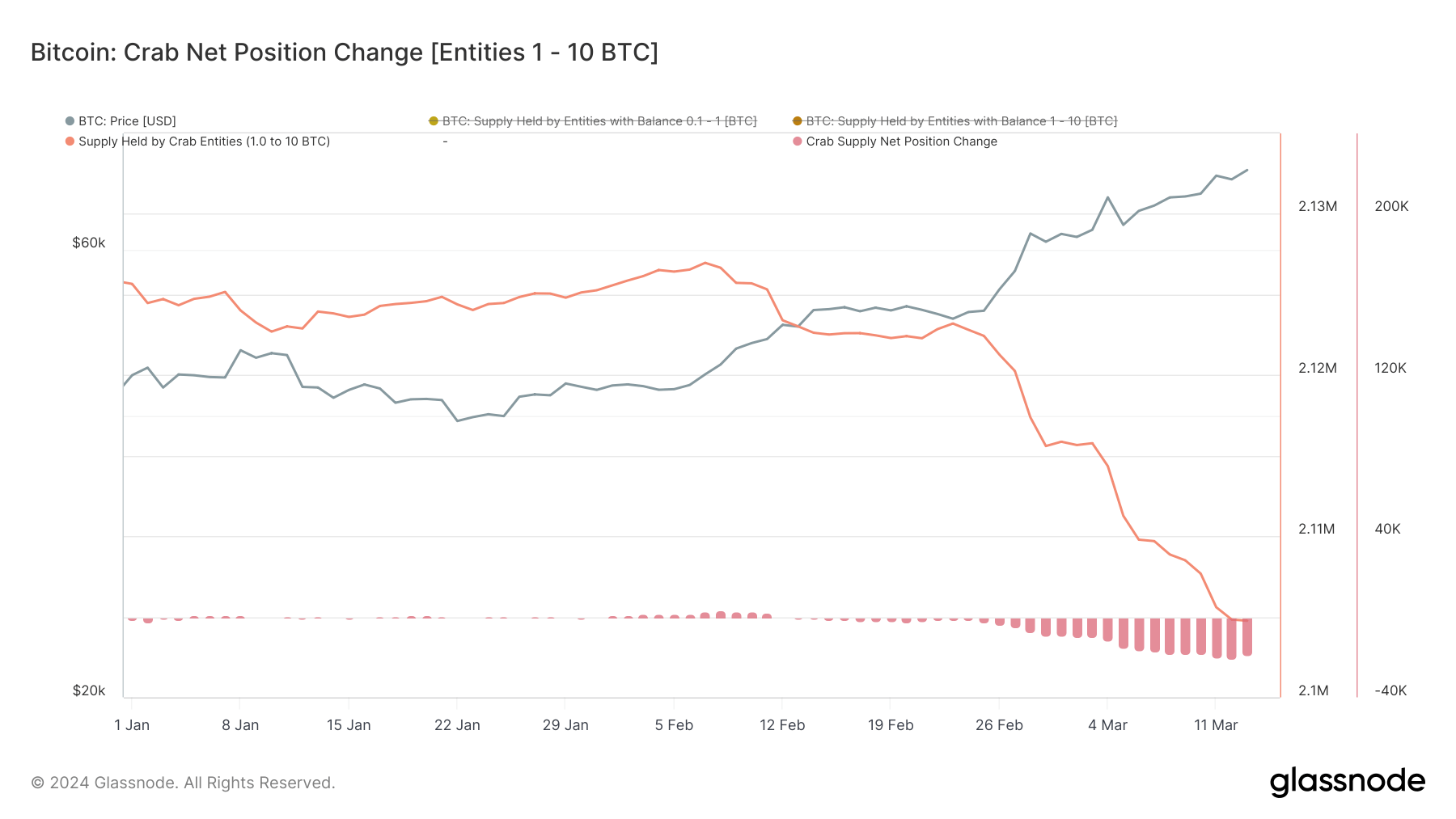

The crab cohort — usually retail buyers with extra substantial capital or those that have been accumulating over time — noticed their holdings barely lower from 2.125 million BTC to 2.104 million BTC.

The discount, notably round March 12, reveals a response to cost volatility, probably taking earnings or minimizing losses. It means that whereas crabs are dedicated to their Bitcoin investments, they continue to be delicate to market fluctuations, prepared to regulate their positions in response to perceived dangers.

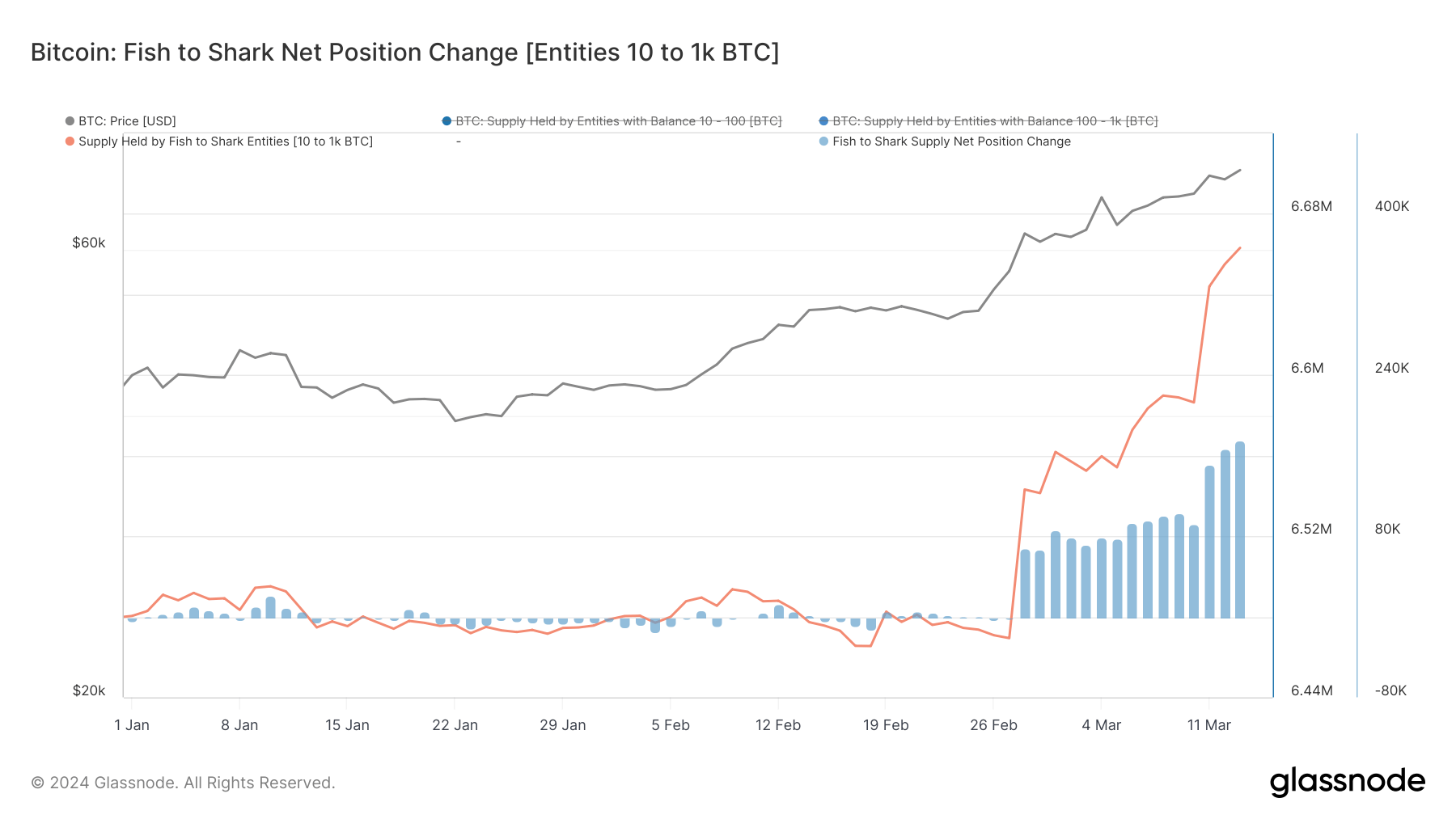

The fish-to-shark cohort noticed a rise in holdings from 6.480 million BTC on Jan. 1 to six.663 million BTC by March 13, with a major constructive change in the course of the month.

This means strategic accumulation by higher-net-worth people and establishments, probably leveraging the spot Bitcoin ETFs’ introduction and anticipated market progress. This group’s habits displays the actions of financially vital gamers whose confidence can sway the market.

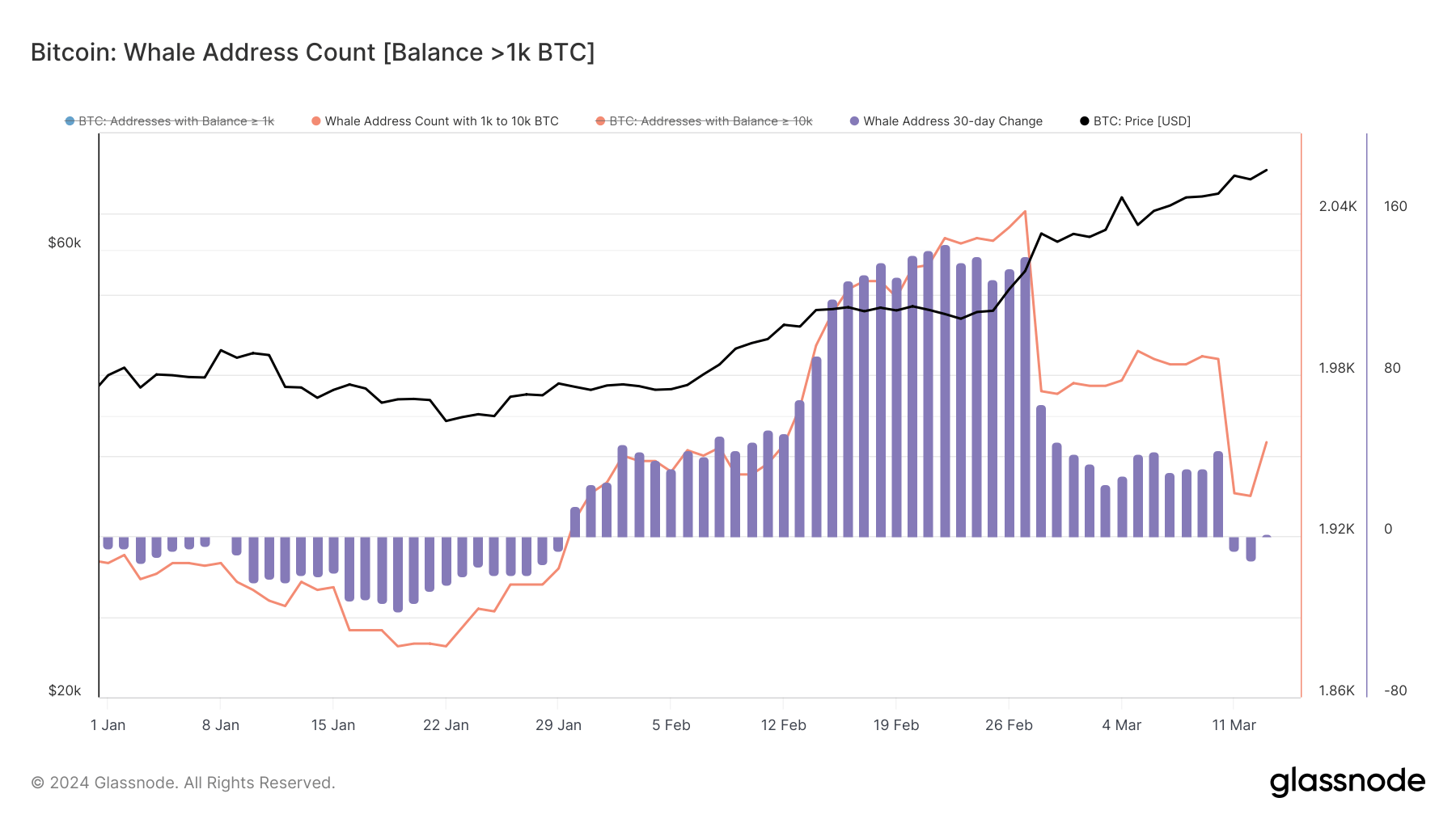

Whale entities noticed their numbers fluctuate, peaking at 2,041 in February earlier than dropping to 1,955 by March 13. This variation suggests profit-taking or portfolio changes in gentle of the bullish market pattern.

Whales’ actions are essential to market route, given their vital holdings and the affect they wield on market liquidity and sentiment.

Knowledge from Glassnode confirmed distinct methods throughout these cohorts, displaying their various perceptions of threat, funding horizon, and response to market actions.

Surprisingly, shrimps demonstrated unwavering perception in Bitcoin, persistently rising their holdings. In the meantime, Crabs, who’re usually regular, confirmed a readiness to react to market alerts, adjusting the scale of their positions in response to cost actions.

Fish and sharks appear to have been the cohort that capitalized essentially the most on the launch of spot ETFs within the US. The market optimism that adopted the long-awaited buying and selling product considerably altered the scale of the availability held by these cohorts, displaying the rising confidence establishments and high-net-worth people have in Bitcoin.

In the meantime, whales confirmed attribute strategic flexibility, with the slight lower of their numbers pointing to a cautious method in a bullish state of affairs.

The publish From shrimps to whales: Who’s buying and selling during this rally? appeared first on CryptoSlate.

Discussion about this post