Fast Take

MicroStrategy (MSTR), the enterprise intelligence agency famend for its substantial Bitcoin holdings, skilled a big share value decline of over 11% on March 28. The corporate’s shares are at the moment buying and selling at $1,704, starkly contrasting the lately anticipated $2,000 mark reported by CryptoSlate simply days earlier. Regardless of the current setback, MSTR’s year-to-date efficiency stays spectacular, with a outstanding 150% acquire.

Analysts carefully monitor the “MSTR/BTC Ratio,” a comparative worth ratio between MicroStrategy’s inventory value and the worth of Bitcoin. This ratio illustrates how the corporate’s inventory worth developments in relation to Bitcoin’s market actions. At the moment buying and selling at 0.024, the ratio hit a current excessive of 0.028, mirroring the degrees noticed in June 2021 at roughly 0.027, in line with mstr-tracker.

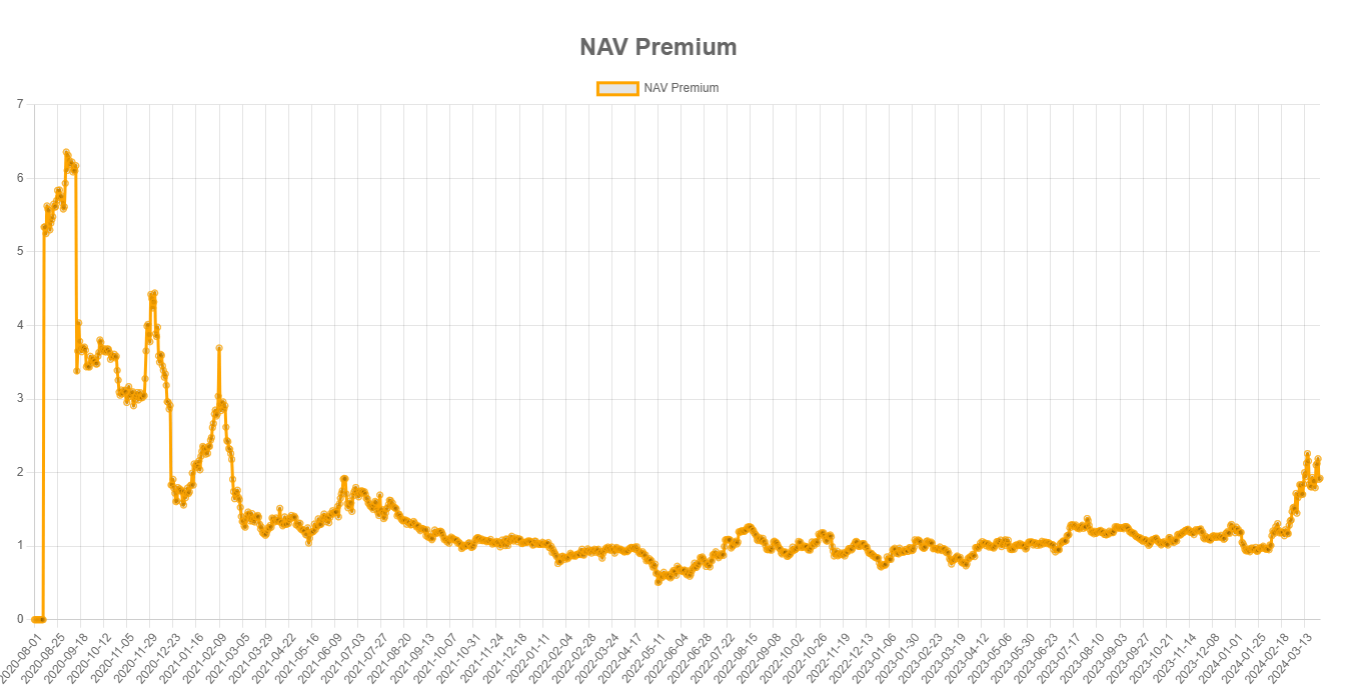

The “NAV Premium” chart, offered by mstr-tracker, which shows the premium of MicroStrategy’s inventory over its proxy-NAV in Bitcoin, signifies that the market values the corporate’s inventory at 1.92 occasions its Bitcoin holdings. The location has a singular methodology for outlining an equal NAV for MicroStrategy, which considers its Bitcoin holdings, excellent shares, share value, and market cap. Intriguingly, the present NAV determine matches the excessive noticed in June 2021, when MSTR’s share value hovered round $500-$600, and Bitcoin traded at roughly $35,000.

The publish Analysts eye MicroStrategy share price to Bitcoin holdings ratio closely as MSTR falls 11% appeared first on CryptoSlate.

Discussion about this post