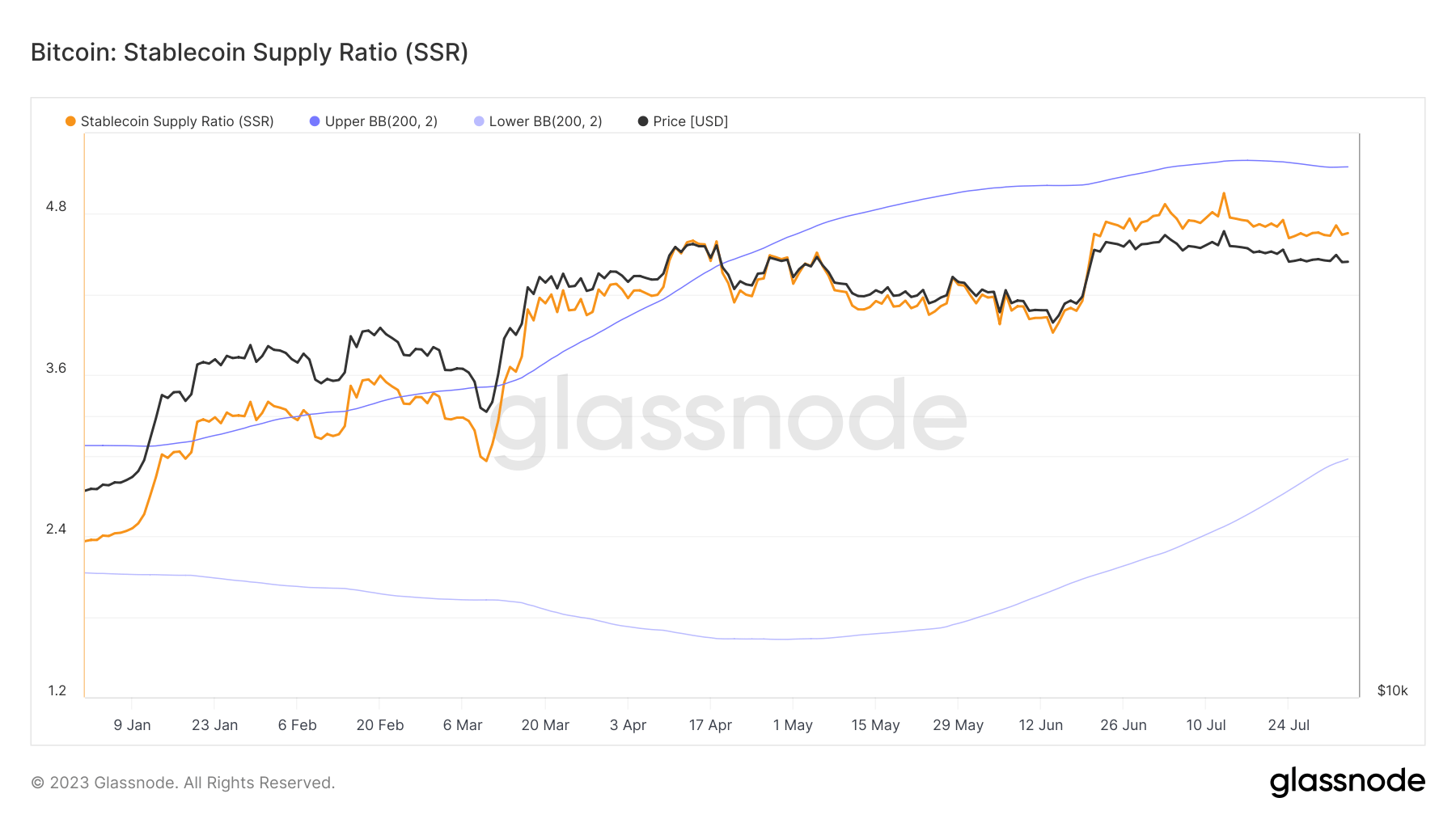

The Stablecoin Provide Ratio (SSR) is a crucial market indicator that has been steadily climbing because the begin of the yr, signifying a lower within the buying energy of stablecoins.

The SSR is a metric that gives perception into the availability and demand dynamics between Bitcoin (BTC) and the U.S. greenback. The calculation of SSR entails dividing the entire provide of stablecoins by the market capitalization of Bitcoin.

When the SSR is low, it signifies that the shopping for energy of stablecoins is excessive. Which means for every greenback represented by stablecoins, there’s a bigger portion of Bitcoin’s market cap accessible for buy.

However, a excessive SSR means that the shopping for energy of stablecoins is low. On this situation, every greenback represented by stablecoins can purchase a smaller portion of Bitcoin’s market cap.

The SSR is a crucial indicator as a result of it gives a snapshot of the potential shopping for energy of stablecoins within the Bitcoin market. It helps merchants and buyers perceive whether or not the market is at the moment dominated by these holding dollar-pegged stablecoins or Bitcoin holders.

From the start of the yr, we’ve seen the SSR rise from 2.36 to 4.65. This sharp enhance signifies a big decline within the buying energy of stablecoins. This development has occurred in tandem with the rising value of Bitcoin.

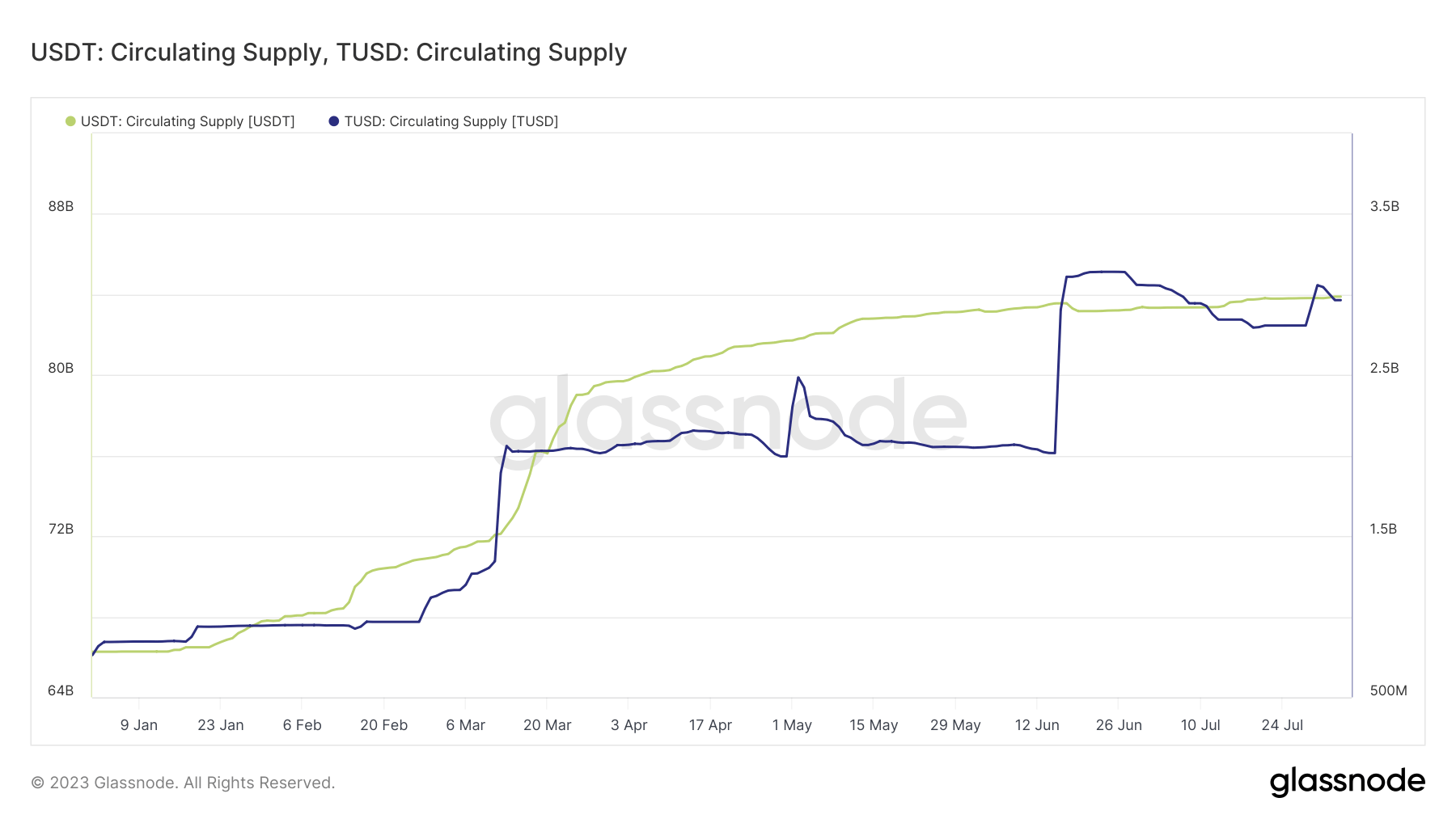

Given the latest surge within the SSR, it’s price noting the marked enhance within the provide and prominence of sure stablecoins. As lined in earlier CryptoSlate analysis, Tether (USDT) and TrueUSD (TUSD) have seen their circulating provides attain all-time highs this yr.

On the finish of July, Tether’s provide hit an all-time excessive of $83.89 billion, whereas TrueUSD’s provide peaked at $3.04 billion. These two stablecoins are significantly vital as they represent the vast majority of crypto to stablecoin buying and selling pairs on centralized exchanges.

The implications of this rising SSR are multifaceted and require cautious evaluation. On one hand, the rising provide of stablecoins signifies a sturdy demand for these belongings, which are sometimes used as a protected haven during times of market volatility.

However, the rising SSR means that the shopping for energy of stablecoins relative to Bitcoin is reducing. This might doubtlessly result in a lower within the demand for Bitcoin, which in flip may exert downward stress on its value.

The submit Growing supply diminishes stablecoin Bitcoin buying power appeared first on CryptoSlate.

Discussion about this post