If there’s one factor that we are able to say about this technology of Nvidia graphics playing cards, it is that they have not all been well-received.

And whereas there are a number of that simply slot into our best graphics card checklist, the numbers don’t lie: the GPU market has been reasonably chilly this technology, and gross sales of each AMD and Nvidia’s newest GPUs have not been stellar.

That is all of the extra shocking given how few avid gamers have been capable of purchase the last-gen Nvidia Ampere playing cards because of the cryptobubble and cryptominers shopping for up all of the GPUs to crunch ineffective math all day lengthy within the hopes of incomes a token earlier than the token’s worth plunged.

No matter the reason for the GPU stoop for Nvidia, it is shocking that whilst its shopper GPUs have struggled to promote at instances, the corporate shocked many by popping out of nowhere and briefly joining the Trillion Dollar Club as the corporate’s market worth soared over the previous couple of months.

How is that this attainable? Two letters: AI. See, Nvidia’s GPU hardware is especially well-suited to machine learning tasks that energy generative AI fashions like ChatGPT and Midjourney. In order the AI growth has accelerated, demand for Nvidia silicon has likewise shot into the stratosphere, returning record-breaking earnings to the corporate whilst its shopper GPU gross sales have lagged.

The truth that AMD and Intel are as far behind Nvidia as they’re has successfully given Nvidia a monopoly on AI chips, at the least till all of the inventory of Nvidia silicon is purchased up and trade giants like Microsoft, Amazon, and Google need to look to less-efficient options for compute energy.

These two diverging traits clearly level to a brand new future for Nvidia, one which depends a lot much less on shopper GPUs, and I would not be shocked if Nvidia exits the patron graphics card market totally within the subsequent decade.

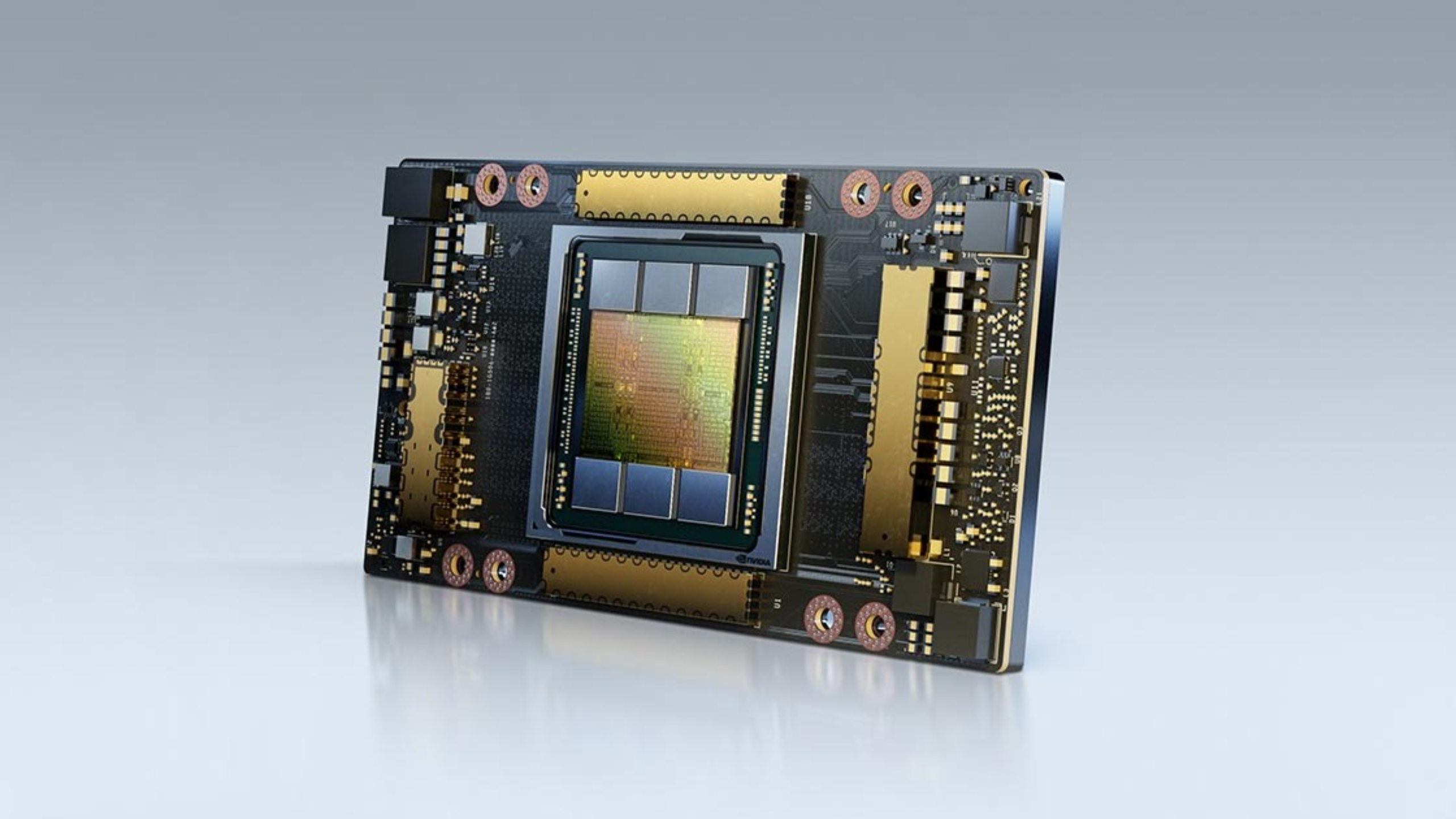

Nvidia slows manufacturing of its shopper Lovelace GPUs to deal with Hopper

Final week, information got here down that Nvidia had essentially put its Lovelace GPUs on ice, which should not shock anybody contemplating that there’s nonetheless numerous inventory of Nvidia graphics playing cards on the market, with numerous playing cards even getting some fairly great graphics card deals from retailers — one thing that was extraordinary final technology.

With gross sales of its GPUs falling method under expectations and retailers apparently ticked off that they now have loads of GPU inventory taking over warehouse house, slowing manufacturing of recent shopper GPU inventory would not make a lot sense.

However there’s one thing else at play right here, based on the information reviews. Particularly, Nvidia was pivoting itself in direction of producing extra Hopper chips as an alternative, and these are the chips that energy datacenters and generative AI networks and fashions that energy ChatGPT, Midjourney, and others.

These are the chips which can be in demand proper now, and with firms like Google and Amazon coming in with deep pockets and an primarily insatiable want for extra superior GPUs, Nvidia can successfully title its value.

Sadly for avid gamers, in contrast to the cryptobubble (which produced nothing of actual worth), generative AI truly makes stuff. Helpful stuff. The type of stuff that may save companies numerous time and expense, so the generative AI growth we’re seeing now could be more likely to be enduring in the long run as everybody expects demand for these fashions to solely improve from right here.

Will Nvidia ultimately pivot to AI {hardware} totally?

I’ve stated various instances now that with the rise of generative AI, the Nvidia GeForce GPU is probably going in its remaining few generations. Often I get bewildered appears once I do, and I completely perceive that. Graphics card sales make up more than 80% of Nvidia’s revenue, with most of these being shopper graphics playing cards. How do you simply pivot away from not simply your core enterprise mannequin, however your core product?

Properly, it isn’t arduous to fathom when you have shareholders, and Nvidia has tens of millions of them that its board is answerable to. In a world of scarce silicon and primarily insatiable demand for AI devoted {hardware} within the subsequent decade (with considerably increased value premiums per silicon chip that Nvidia can cost), it could be company malpractice for Nvidia to proceed to make shopper graphics playing cards its core product.

The market stress on Nvidia to shift its focus away from avid gamers and dedicate its restricted quantity of silicon to feeding the AI datacenter demand from Google, Microsoft, Amazon, and some different trillion-dollar firms will grow to be irresistable.

That’s the place the utmost revenue is, and the market will demand that Nvidia leverage its industrial benefit to herald the best return to buyers as attainable. And that is not in making gamer gear, I hate to say.

Whether or not Nvidia likes it or not, whether or not we prefer it or not, Nvidia will quickly grow to be an AI-first firm, with a vestigial gaming division that’s primarily if not overwhelmingly dominated by its cloud gaming service GeForce Now (which can also be a quicker rising revenue phase than producing gaming GPUs for desktops and laptops).

What number of generations of GeForce graphics playing cards do we now have left? If we get an RTX 7000-series, I would be shocked. Orders for 5000-series silicon are already being negotiated most definitely, and work on chip design for 6000-series GPUs might be additionally nicely underway at this level, so the inertia would possibly win the day there, however that is no assure.

However past that, it is arduous to argue in favor of manufacturing a gaming graphics card with a revenue margin of 10% to twenty% when a Hopper chip might presumably web you a revenue of 40% to 50%, and you may promote them in bulk to datacenter prospects.

There’s solely so many silicon wafers that may be produced by TSMC, Samsung, or Intel, and Nvidia is not going to be their solely buyer. So if Nvidia can solely purchase a set quantity of silicon, it might want to maximize the revenue it makes on each, and gaming graphics playing cards for particular person sale is not the place you will discover it.

If we do ever see a 7000-series GPU, will probably be as a cloud service possibility, not one thing you should purchase on the shop shelf. If we get an RTX 5000 collection and RTX 6000 collection, they most likely will not be getting the love and a focus from Group Inexperienced that its previous generations have gotten, so how good will they actually be in the long run? Who is aware of.

It isn’t all doom and gloom for avid gamers although.

Players will nonetheless have choices

Nvidia GeForce playing cards could be an endangered species sooner or later, however in case you’re fearful that AI will spell the loss of life knell for PC gaming, worry not.

AMD solely simply launched AI accelerators to its RDNA 3 graphics playing cards, so it’s so far behind Nvidia when it comes to AI {hardware} that it isn’t more likely to catch up any time quickly, so its graphics {hardware} will not be in demand for the AI growth in the identical method (though AI will still take a bite out of supply)

Intel, in the meantime, has its personal equivelent of tensor cores in its Arc GPUs referred to as XMX render engines, so that you would possibly assume that they’d be aggressive within the AI {hardware} house. However Intel’s Arc GPUs are nonetheless on their first technology, and whereas Intel XeSS actually does present how highly effective its {hardware} XMX engines will be, it is nonetheless inferior to Nvidia’s, so if something will probably be a distant second.

Plus, Intel additionally has a whole datacenter division that’s completely huge, so it would not want Arc GPUs to compete with Nvidia. Additional growth of Intel Xeon can do this. Intel additionally has its personal foundries, so it isn’t restricted by what number of silicon wafers TSMC can produce. If it desires to make graphics playing cards and datacenter chips, it completely can and can do this.

In the long run, it strikes me as inevitable that by the top of the last decade, Nvidia may have transitioned to creating AI chips full-time, with its GeForce model side-stepping into cloud gaming the place GeForce graphics tiers will proceed, however with far fewer shopper graphics playing cards (if any). That is simply the place the cash goes to be, and if Nvidia would not make that pivot, a shareholder revolt would possibly drive the difficulty.

As an alternative, the present AMD vs Nvidia rivalry in GPUs will transition into an AMD vs Intel one, just like how it’s with the best processors, with each attempting to get their very own piece of the AI pie by way of their datacenter divisions and largely failing to dislodge Nvidia.

I might say that every one of this needs to be taken with a grain of salt, that its speculating on expertise in seven years time (which could as nicely be a geological epoch given the advance of issues), and all of that’s true.

However in the long run, no matter 2030 appears like shall be radically totally different from how issues look in the present day, because of AI. That a lot I can assure, and Nvidia shall be a radically totally different firm when all is claimed and performed.

Discussion about this post