On blockchain networks like Ethereum, decentralized validation underpins your entire ecosystem. But paradoxically, the highly-technical means of setting up the blocks that retailer transactions could also be quietly accruing affect within the palms of just some.

In response to an analysis by Ethereum researcher Thomas Thiery, block constructing has advanced right into a high-stakes strategic enviornment. Specialised builders now make the most of proprietary algorithms, privileged partnerships, and micro-optimized arbitrage methods to maximise income and the chance of block rights.

By quantifying bid timing, latency optimization, order movement sources, and transaction bundles, Thiery’s work exposes the aggressive dynamics eroding Ethereum’s decentralized ethos.

The info proves that financial incentives drive builders towards consolidation, cooperation, and specialization within the relentless quest for income.

In response to Thiery, left unchecked, these traits stand to undermine Ethereum’s core worth proposition – a world laptop operated by a distributed internet of stakeholders, not an oligarchy of elites.

Thiery’s analysis illuminates the fact of block constructing as we speak, setting the stage for knowledgeable dialogue on potential options. The approaching sections distill very important insights from his evaluation into an accessible synopsis for the crypto group.

The profitable world of block creation

Creating new blocks on blockchain networks like Ethereum is carried out by builders who compete to package deal transactions into blocks and earn income in two major methods:

Amassing Transaction Charges

The primary income stems from packaging transactions right into a block and gathering the related charges. When customers submit transactions to the community, they’ll optionally specify a “fuel value,” which compensates the builder for executing their transaction. The entire charges collected from all transactions in a block characterize one income stream for builders.

Optimizing this requires effectively packing in as many worthwhile transactions as doable from the general public mempool queue. Builders develop algorithms and techniques to maximise the cumulative payment income from every block they assemble.

Taking advantage of Arbitrage Bundles

The second, extra profitable income supply entails arbitrage alternatives that exploit market inefficiencies. Specialised “searchers” determine arbitrages like value discrepancies between exchanges, then bundle the transactions required to capitalize on the chance.

These unique bundles, typically involving a centralized trade, are transmitted on to the builder relatively than the general public mempool. Builders can accumulate a portion of the worthwhile unfold by together with arbitrage bundles in a block.

Some builders kind unique partnerships with searchers to achieve entry to those non-public bundles, which research point out present roughly 80% of complete builder income. The most typical and worthwhile arbitrage recognized entails exchanges between centralized and decentralized platforms.

Methods for Block Constructing Supremacy

By leveraging technical experience and strategic partnerships, blockchain builders make use of complicated methods to optimize income from block building.

Understanding the incentives and aggressive dynamics gives insights into centralization dangers and informs mechanisms to enhance system decentralization.

In response to Thiery’s examination of block building dynamics, builders make the most of numerous approaches to maximise their income and chance of successful block rights. Thiery’s work elucidates builder habits and its implications by analyzing bid timing, effectivity optimizations, order movement sources, and worthwhile arbitrage methods.

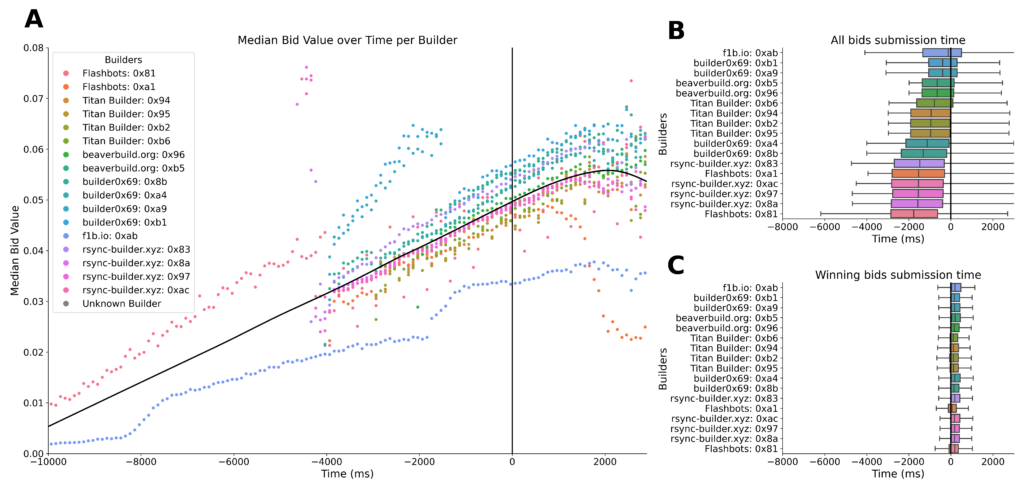

Builders enhance their bids as Ethereum’s 12-second slot progresses to include extra transactions and extractable worth. Nevertheless, most successful bids happen towards the top of the slot, in step with consensus protocols.

Builders optimize latency and effectivity in another way – some entities submit bids steadily to beat opponents, whereas others give attention to seamless block meeting. Occasional bid cancellations additionally seem to function a tactic for concealing or adjusting worth.

Quantifying Centralization Danger

Unique transaction bundles from searcher companions account for round 80% of builder income, outweighing public mempool transactions. Particularly, Thiery wrote,

“Unique transactions characterize 30% of the transaction rely, however account for 80% of the full worth paid to builders. This helps the speculation that almost all of worthwhile transactions producing MEV are packaged into bundles and transferred completely from searchers to builders.”

This highlights the significance of strategic partnerships and vertical integration achieve proprietary order movement.

Arbitrages between centralized and decentralized exchanges proved essentially the most worthwhile among the many transaction sorts analyzed. One specialised builder received over 60% of those transactions, exemplifying the maximization and centralization dangers of over-optimization.

Thiery concludes that quantifying the methods and behaviors of builders can inform the development of profiles that consider and tackle centralization tendencies.

The info proves that incentives lead builders towards consolidation, cooperation, and specialization – limiting decentralization. Mechanisms that encourage range of strategies and suppliers might counteract these forces.

Total, the traits recognized by Thiery spotlight that prospering on this high-stakes atmosphere necessitates exploiting latency, partnerships, exclusivity, and focus – with implications for world community construction. Understanding these points can enlighten options.

Builders’ Behavioral Profiles (BBPs)

By peering behind the scenes of Ethereum’s block-building ecosystem, Thiery’s work sounds an alarm for the group.

Financial forces and incentives usher this area towards larger centralization, cooperation, and consolidation amongst worthwhile entities. Left unaddressed, the drift contradicts the guiding imaginative and prescient of a decentralized world laptop.

But hope stays – armed with data-driven insights into builder habits, Ethereum builders and researchers can illuminate the way in which ahead. Thiery posits a Builders’ Behavioral Profiles (BBPs) mannequin with many metrics. These encapsulate bid timing, developments in latency, bid withdrawal, entry to order movement, and MEV methods and lengthen to features like on-chain and CEX-DEX arbitrages, sandwiches, and liquidation.

Thiery additionally expressed his hope that the group will amplify the utility of BBPs by integrating new metrics and traits to make clear the operate of builders of their interactions with searchers, relays, and validators. In response to him, it is a essential transfer in direction of creating sturdy mechanisms that curb tendencies in direction of centralization and foster an equitable and proficient provide community.

The Ethereum group is but to answer the analysis.

Discussion about this post