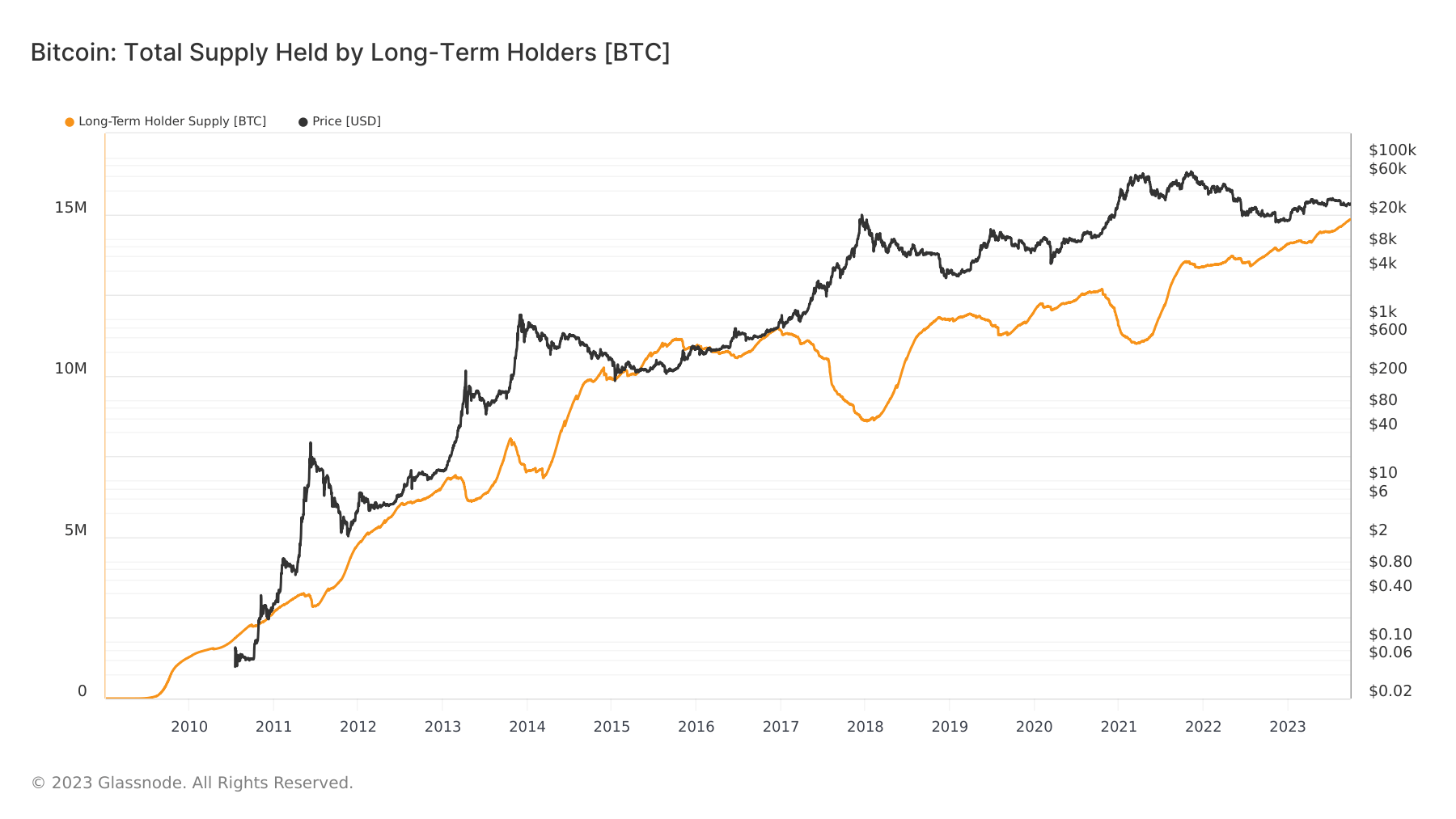

Bitcoin’s long-term holders are addresses which have held onto their Bitcoin for over 155 days. And whereas 155 days may not sound like a number of time within the context of Bitcoin, addresses which have held onto their belongings for longer than which have a statistically decrease likelihood of promoting their BTC.

Subsequently, the actions and selections of this explicit entity can considerably affect the crypto market and Bitcoin’s worth trajectory. Traditionally, long-term holders have proven resilience throughout Bitcoin’s worth fluctuations, typically holding onto their belongings throughout downturns and promoting throughout peaks.

Lately, Bitcoin’s worth has proven a comparatively flat buying and selling sample, hovering across the $26,200 mark after reclaiming its $26,000 assist simply final week. This stabilization comes on the heels of a tumultuous month, the place Bitcoin’s worth plummeted to lows of $25,000, a stark distinction to the previous months of sideways motion between $29,000 and $30,000.

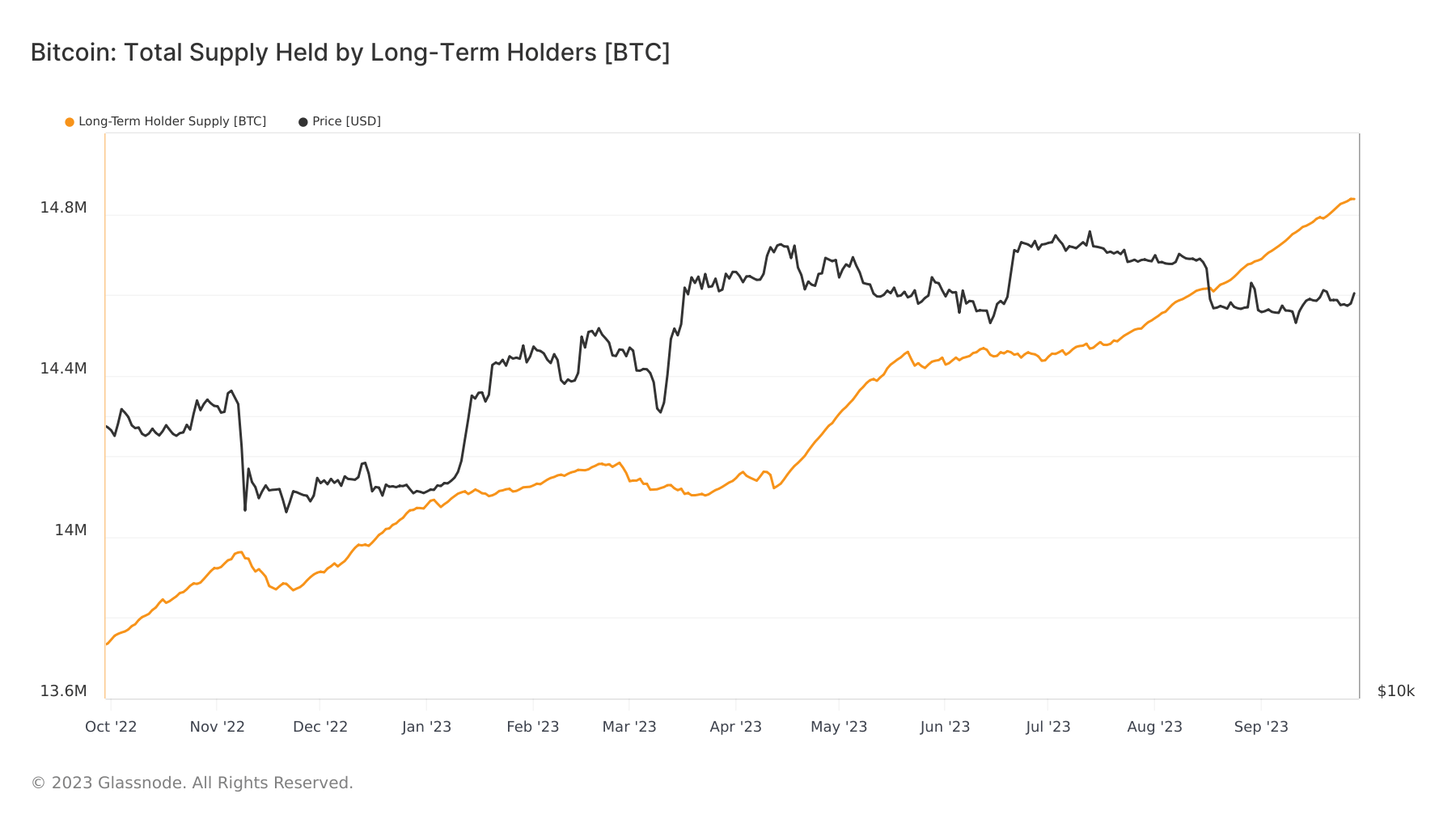

Regardless of the value volatility, the Bitcoin provide held by long-term holders has surged to an all-time excessive.

The long-term holder provide now stands at 14.83 million BTC. Because the starting of 2023, this provide has seen an addition of 757,177 BTC. Over the previous 12 months, it has grown by 1.07 million BTC, with 152,216 BTC added in simply the final 30 days.

This surge in long-term holder provide underscores these holders’ confidence in Bitcoin’s long-term potential. Even amidst worth fluctuations, their willingness to carry suggests a perception within the cryptocurrency’s enduring worth. Furthermore, with such a good portion of Bitcoin’s provide being held long-term, there’s diminished liquidity out there, which may result in elevated worth volatility.

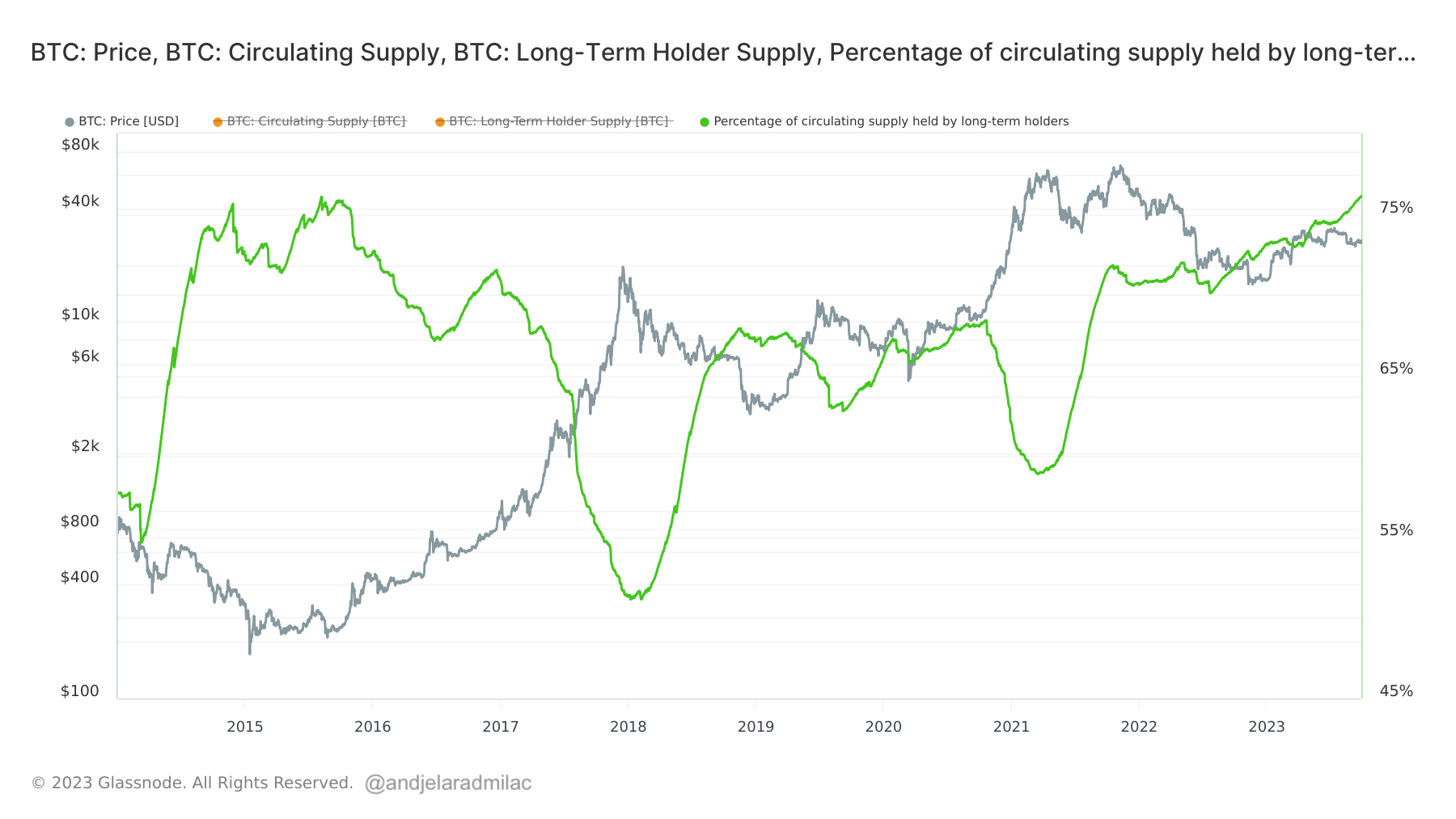

Presently, the long-term holder provide constitutes a whopping 76.09% of Bitcoin’s circulating provide. The final time this share was surpassed was in August 2015, when it briefly exceeded 76%. This means that almost all of Bitcoin’s circulating provide is now within the arms of those that imagine in its long-term worth proposition.

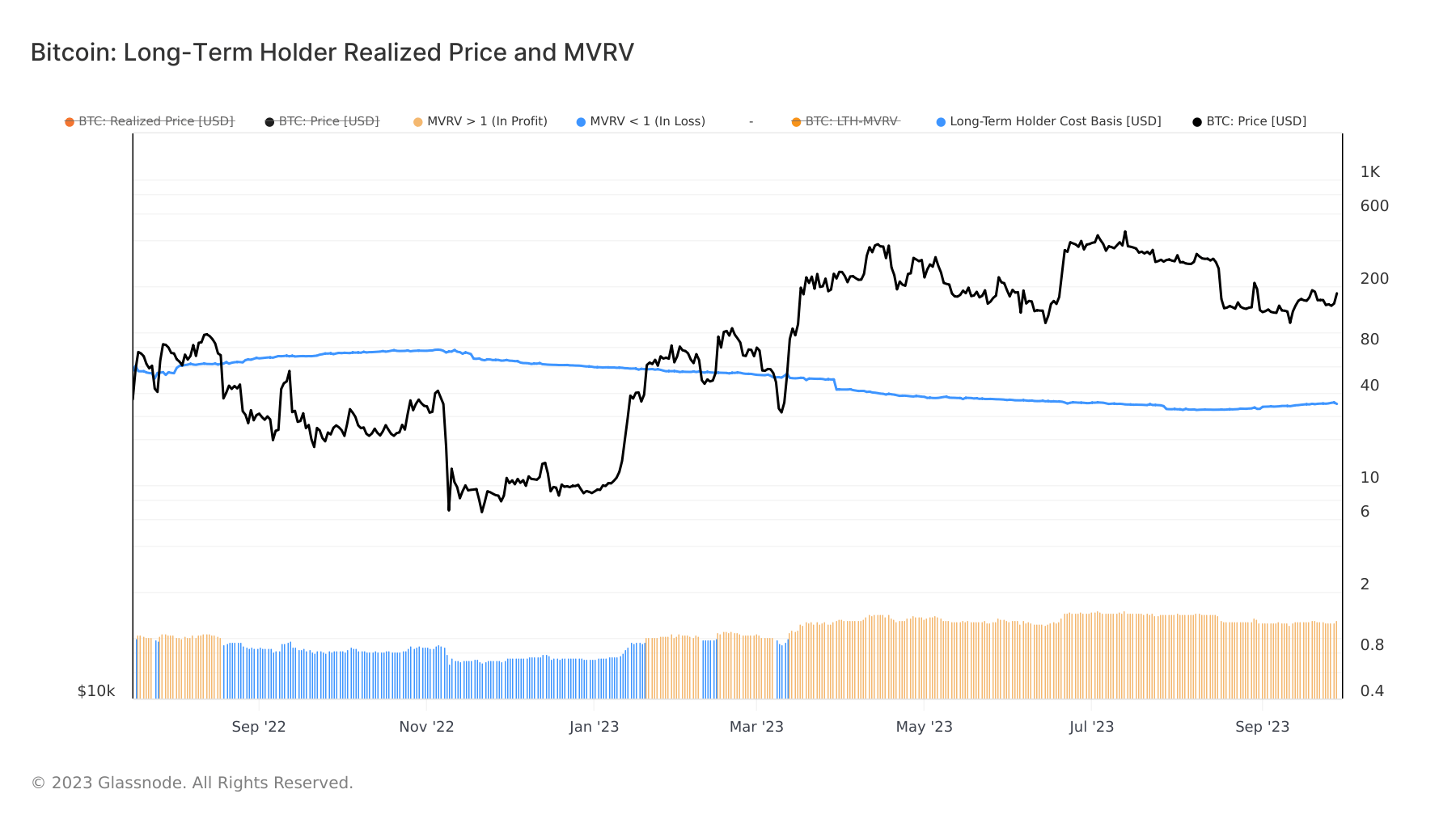

The long-term holder realized worth and the MVRV ratio provide additional insights. The realized worth is the common worth of the long-term holder Bitcoin provide, calculated based mostly on the final transaction date of every coin on-chain. It’s typically considered as this group’s ‘on-chain price foundation.’ Information from Glassnode reveals that the realized worth for long-term holders is at present $20,599. This has declined since November 2022, when it was pegged at $23,500.

The MVRV ratio, then again, is a measure of the market worth (spot worth) relative to the realized worth (realized worth) for the long-term holder cohort. An MVRV ratio of 1.311, because it stands now, means that the present worth is 31.1% above the common price foundation for long-term holders.

These metrics point out that a good portion of Bitcoin’s provide is at present in revenue. The MVRV ratio, particularly, could be a precious device to gauge market sentiment. Excessive excessive or low values can sign intervals the place the market is overheated or undervalued.

The surge in Bitcoin’s long-term holder provide, coupled with the insights from on-chain metrics, paints an image of a market that continues to be optimistic about Bitcoin’s future. Whereas worth volatility is a given within the crypto realm, the steadfastness of long-term holders suggests a continued perception in Bitcoin’s long-term potential.

The put up Record highs in Bitcoin’s long-term holder supply signal market confidence appeared first on CryptoSlate.

Discussion about this post