Grayscale’s Bitcoin Belief (GBTC) has develop into an important instrument within the cryptocurrency world since its launch by Grayscale Investments. As one of many pioneers in offering a bridge between the normal funding panorama and the nascent cryptocurrency area, GBTC permits traders to faucet into the Bitcoin market with out instantly shopping for, storing, or managing it. Monitoring GBTC’s value motion has develop into paramount, particularly for analysts aiming to gauge market sentiment.

Crafted within the mildew of a standard funding belief, GBTC’s distinctive proposition lies in its methodology of holding Bitcoin. As an alternative of particular person traders grappling with cryptographic keys and wallets, Grayscale centralizes the holding course of, utilizing high-security measures, together with chilly storage mechanisms, to make sure the security of the belongings.

GBTC shares, representing possession of a fraction of the belief’s underlying Bitcoin, are traded on the OTCQX market. The OTCQX, or the Over-The-Counter QX, is a top-tier, regulated market for shares and securities that don’t commerce on standard, large-scale exchanges. It affords a platform for corporations to entry U.S. traders whereas complying with excessive monetary requirements and disclosure practices.

One distinguishing characteristic of GBTC, setting it other than some ETFs (Alternate Traded Funds), is its lack of a redemption mechanism. In easy phrases, traders can’t trade their GBTC shares instantly for Bitcoin. As an alternative, they’ll solely commerce these shares on the open market. This design alternative aids in offering extra value stability, stopping giant traders from abruptly cashing out and considerably affecting the market dynamics.

The individuality of GBTC lies in its premium, a time period denoting the distinction between the market value of GBTC shares and the precise worth of the Bitcoin it holds, referred to as the Internet Asset Worth (NAV).

This premium arises attributable to a number of elements. Initially, GBTC was one of many scarce channels for institutional gamers to entry Bitcoin publicity, particularly in restricted jurisdictions. This exclusivity led to GBTC buying and selling at a considerable premium. Furthermore, GBTC’s liquidity and comfort added to its attraction, driving a wedge between its value and the precise Bitcoin worth. Nonetheless, this premium isn’t static and may oscillate primarily based on market circumstances and rework into a reduction.

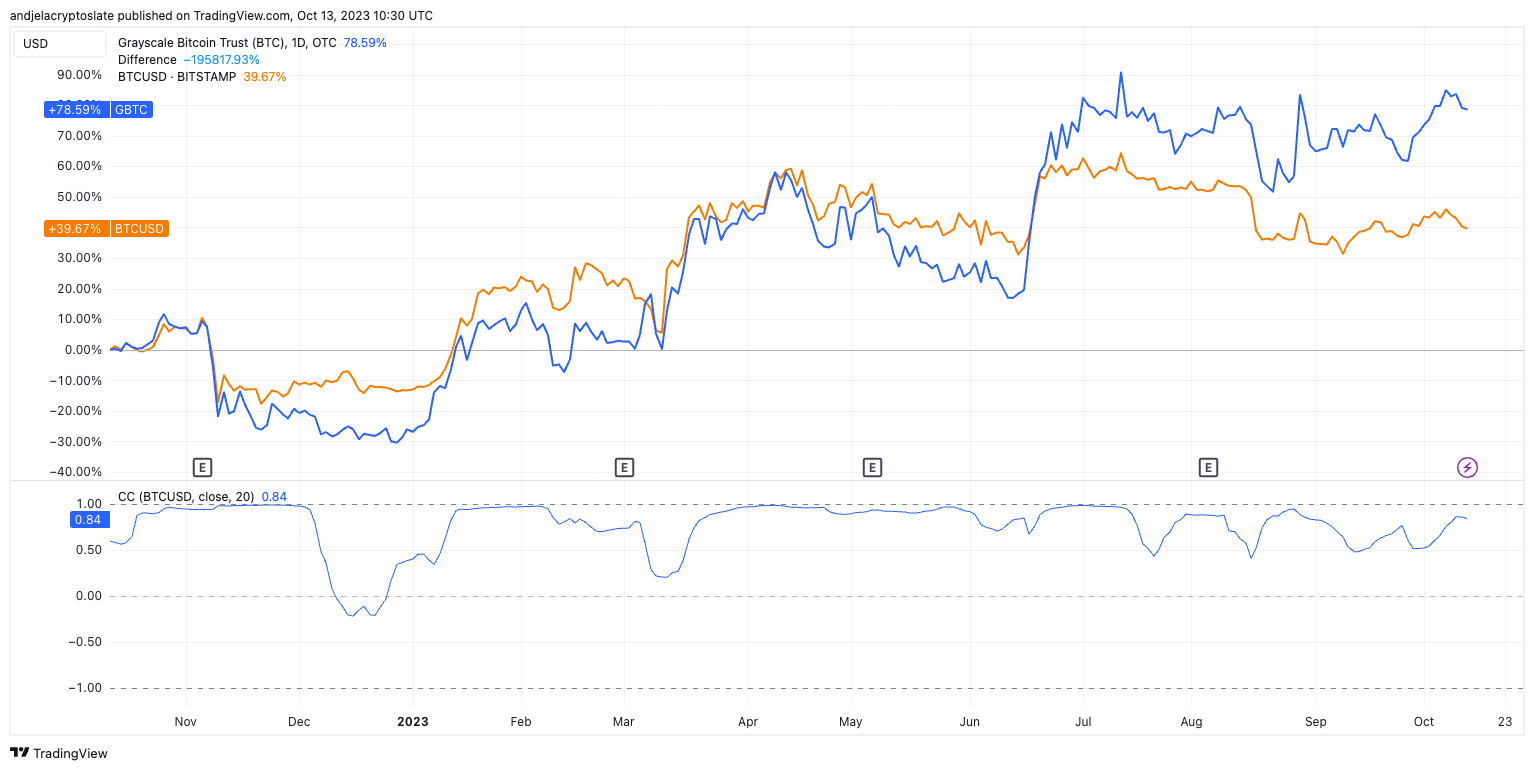

Traditionally, GBTC has proven a excessive diploma of correlation with Bitcoin (BTC). That is anticipated because the main asset underlying GBTC is Bitcoin. As BTC costs transfer, the worth of the Bitcoin held by the belief additionally shifts, influencing GBTC’s NAV. Nonetheless, the market value of GBTC, affected by provide and demand dynamics for its shares, can deviate from this NAV, resulting in the talked about premium or low cost.

If rules round cryptocurrency funding automobiles change, it may have an effect on GBTC’s attractiveness to traders, resulting in price movements independent of Bitcoin’s price. As extra cryptocurrency funding automobiles emerge, particularly these providing options GBTC doesn’t (like redemption options), it may scale back demand for GBTC, affecting its correlation with BTC.

One such looming regulatory choice is the potential approval of a Grayscale spot Bitcoin ETF. The market is abuzz with hypothesis, with many believing that Grayscale is perhaps the frontrunner in securing this approval. This transformation would deal with the longstanding premium/low cost concern and function a monumental step in integrating cryptocurrencies into mainstream finance.

The potential advantages are manifold. An ETF construction would streamline the buying and selling course of, probably bringing in a recent inflow of institutional cash. Furthermore, it will additional solidify Bitcoin’s place as a reputable and acknowledged asset class.

Nonetheless, a Grayscale Bitcoin ETF may additionally introduce heightened volatility, particularly throughout its preliminary days, because the market adjusts to the brand new dynamics. And whereas the GBTC premium has traditionally been a bellwether for market sentiment, an ETF conversion would possibly dilute this indicator’s efficiency.

The put up Grayscale’s GBTC: Understanding its premium and market impact appeared first on CryptoSlate.

Discussion about this post