Fast Take

From mid-October, the Chicago Mercantile Alternate (CME) has maintained its place because the premier change for Bitcoin futures, augmenting its Open Curiosity by roughly 45,000 BTC via to the top of November.

Nevertheless, this shift was marked by roughly 20,000 Bitcoin contracts being closed from CME since Nov. 28. In a notable downturn, Dec. 11 recorded some of the vital one-day drops in futures Open Curiosity, with 10,500 Bitcoin contracts closed. This development shouldn’t be unprecedented, as year-end durations usually witness contracts rolling over. With companies reluctant to carry vital publicity over the vacation interval, such a development could possibly be thought of a strategic de-risking transfer.

Historic evaluation helps this, displaying an identical sample on CME final 12 months in Nov. 2022, when Bitcoin futures peaked at 97,560 and subsequently dropped under 70,000.

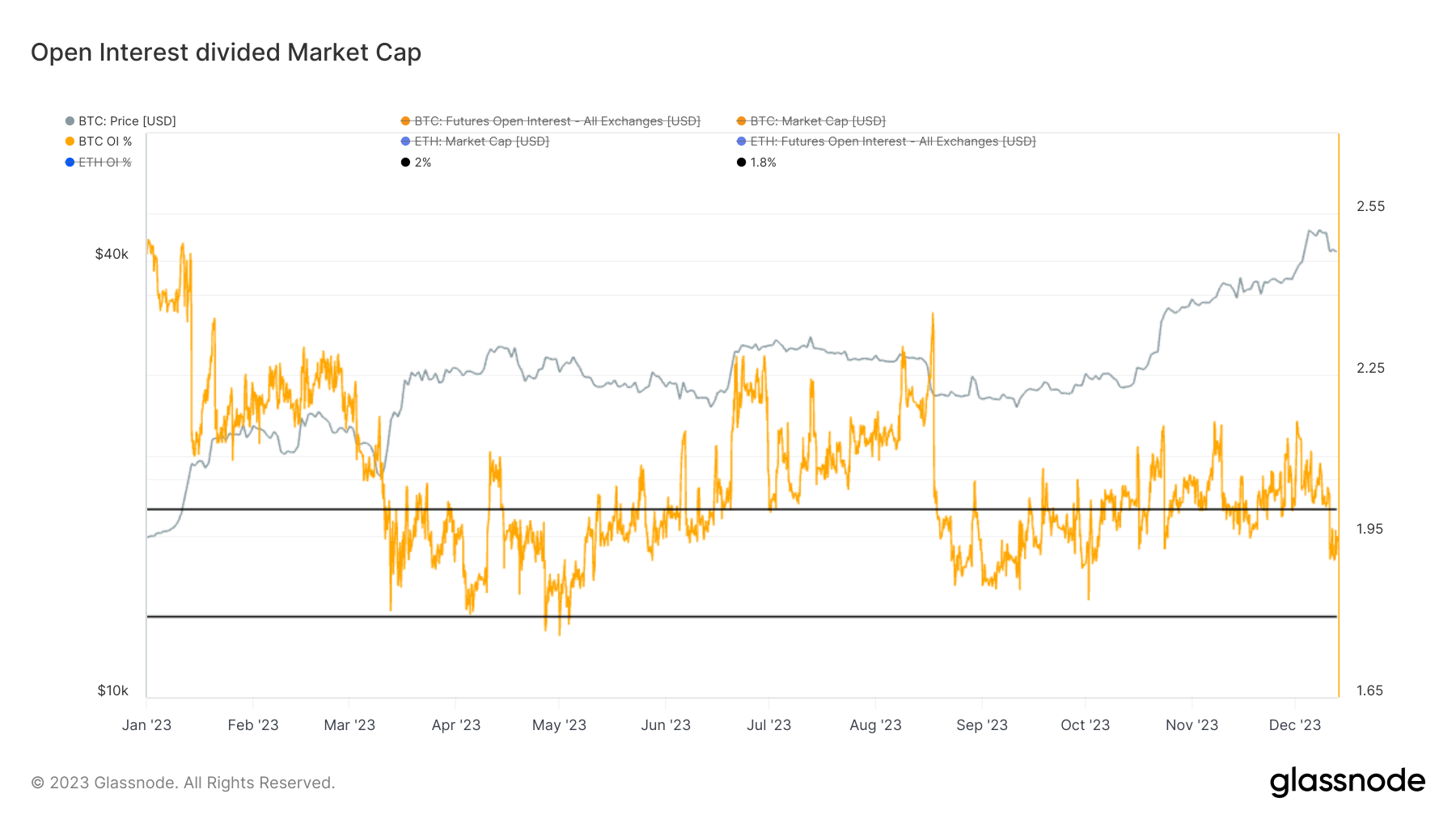

Amid the substantial liquidation cascade noticed on Dec. 11, Open Curiosity noticed a consequent decline. When inspecting Open Curiosity in relation to market cap—a measure used to gauge the overheating or over-leveraging of the derivatives market in comparison with the general market—it’s noteworthy that it has returned to under 2%, an indication of a balanced and wholesome market. This contrasts with the interval when Bitcoin soared to its Yr-To-Date highs at $45,000, throughout which the Open Curiosity/Market Cap (OI/MC) ratio stood at 2.15%.

The publish Chicago Mercantile Exchange Bitcoin futures Open Interest falls as year-end approaches appeared first on CryptoSlate.

Discussion about this post