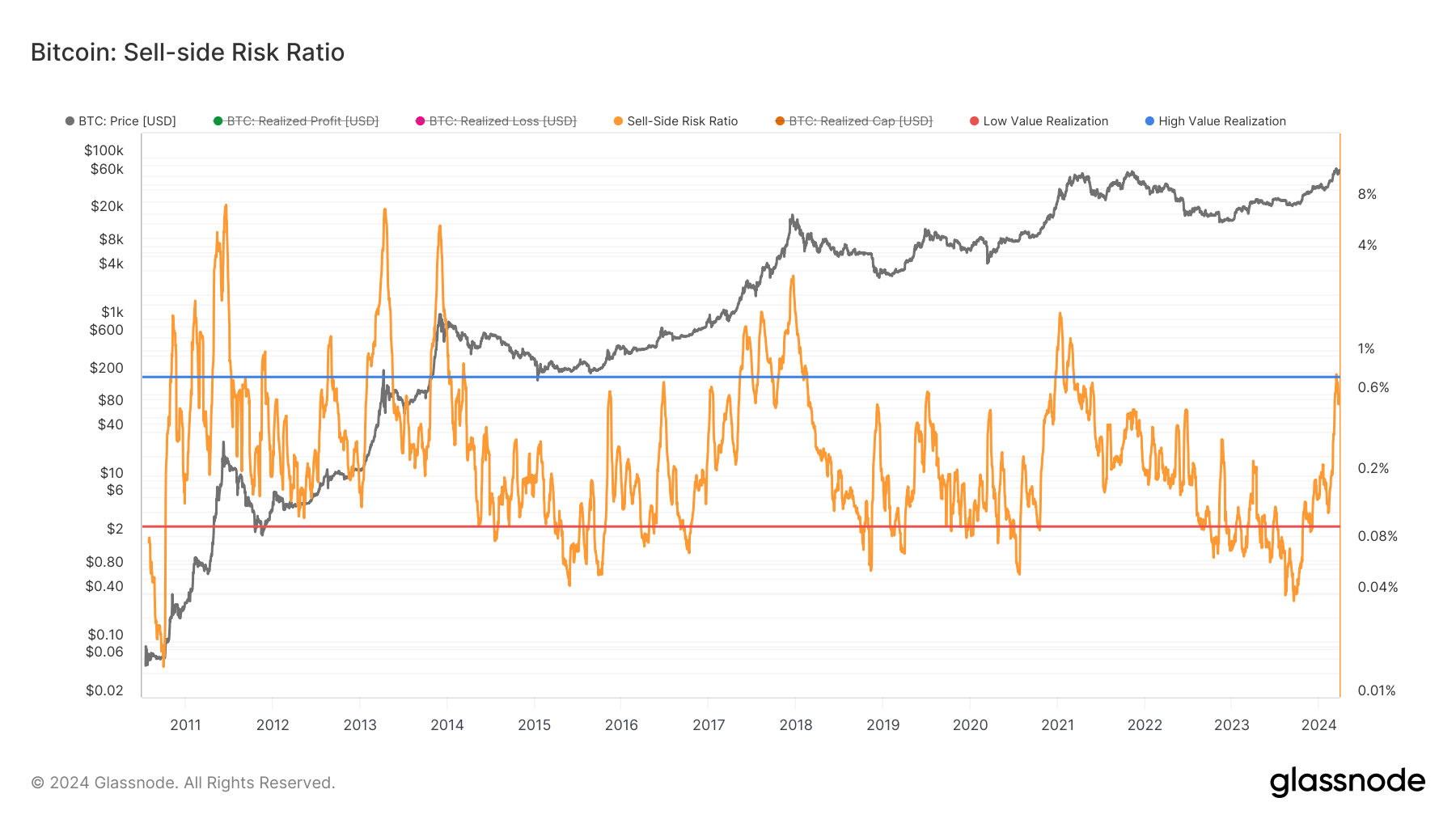

The Bitcoin sell-side danger ratio is calculated by dividing the sum of all earnings and losses realized on-chain by the realized capitalization, providing a comparative view of day by day investor exercise in opposition to the whole market capitalization adjusted for real-time inflows and outflows.

An increase on this metric signifies a better probability of sell-side stress, doubtlessly resulting in elevated market volatility.

Between Feb. 8 and March 13, the Bitcoin sell-side danger ratio noticed a big surge, climbing from 0.12% to 0.777%. This improve adopted a big rise in Bitcoin’s value from $45,330 to $73,104. This era marked the very best sell-side danger ratio and the primary occasion of the ratio surpassing the 0.75% threshold since March 9, 2021.

Following this peak, BTC dropped to $61,860 by Mar. 19 earlier than recovering to $70,000 on Mar. 26. The sell-side danger ratio adjusted to 0.556%.

The rise of the sell-side danger ratio above its higher certain reveals a interval of high value realization amongst buyers, typically noticed throughout the late levels of bull markets or bear market capitulation occasions. Nevertheless, spikes like these may also happen at the start of bull cycles, significantly when the market undergoes preliminary corrections.

The following correction in Bitcoin’s value and the sell-side danger ratio signifies volatility. Nevertheless, this volatility isn’t with out precedent. Since 2011, the development has been towards diminishing returns with every market cycle, resulting in decrease highs within the sell-side danger ratio. That is in line with the noticed sample the place, with every cycle, buyers are realizing much less revenue, hinting at a maturing market.

The continual keep of the ratio above the 0.1% mark since Nov. 29, 2023, additional emphasizes a shift from the very low value realization noticed on Sept. 18, 2023, at 0.039%. This transition suggests a transfer away from market bottoms and accumulation phases in the direction of extra lively and probably speculative buying and selling phases.

The break above the higher certain alerts a big turning level, probably pushed by investor optimism and profit-taking. Nevertheless, the historic development in the direction of decrease highs on this ratio could point out a gradual stabilization of the market, with much less pronounced peaks in worth realization because the market matures.

The put up Sell-side risk ratio hit 3-year high as Bitcoin broke above $73k appeared first on CryptoSlate.

Discussion about this post