Fast Take

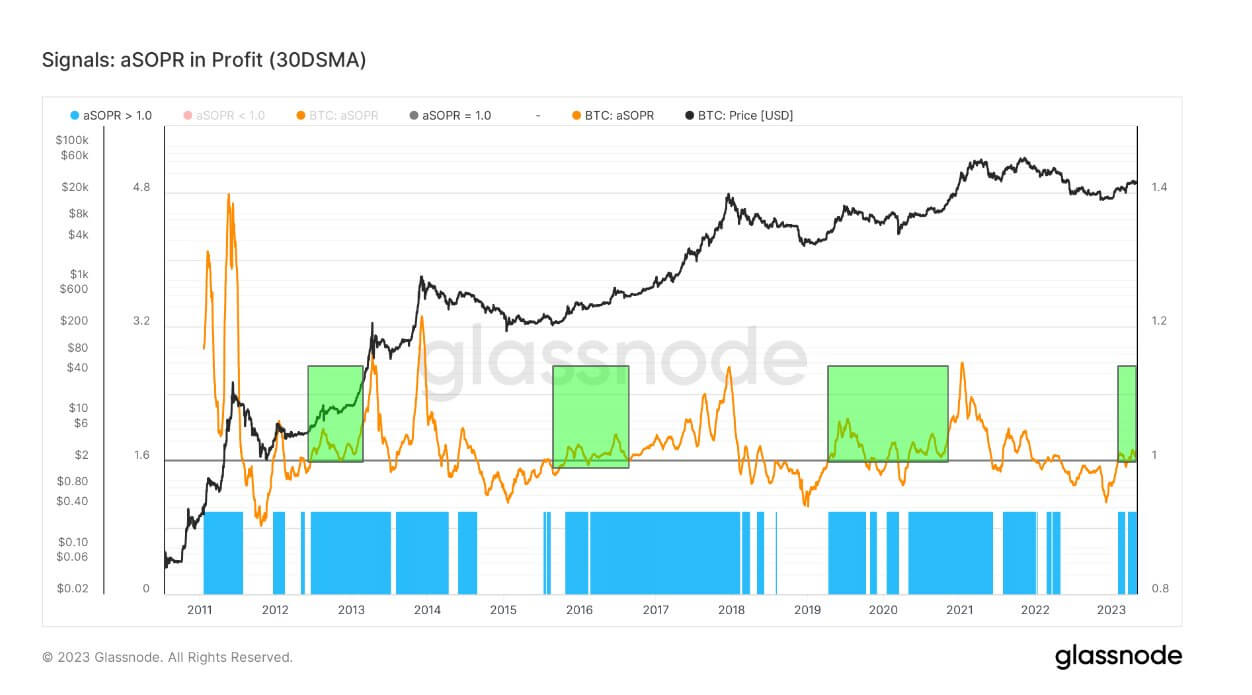

- The Spent Output Revenue Ratio (SOPR) is computed by dividing the realized worth (in USD) divided by the worth at creation (USD) of a spent output — or just: worth offered / worth paid.

- Adjusted SOPR is SOPR ignoring all outputs with a lifespan of lower than 1 hour.

- aSOPR has been holding above 1.0 because the SVB collapse again in March. This signifies that the market is now, on common, realizing income in on-chain spending.

- This usually aligns with a more healthy influx of demand (to soak up profit-taking) and a extra constructive opinion of the asset.

- We examined 1.0 on the finish of March, and I anticipate to check it a couple of extra instances — just like earlier bear markets. We are able to undershot 1.0 to flush out leverage, just like 2019.

- Whereas each lengthy and short-term holders realized income for the primary time since Could 2022, this was in a downtrend in worth. So we’re in an identical interval to early 2020 concerning worth ascending.

The publish Profit realization on the rise: aSOPR holds steady above 1.0 since March’s SVB collapse appeared first on CryptoSlate.

Discussion about this post