Yield farming platforms and protocols surged 8% during the last 24 hours, with a complete sector market cap now north of $10 billion.

What are yield farming cash?

The yield farming token sector refers to a subset of the decentralized finance (DeFi) ecosystem that focuses on offering incentives to customers for offering liquidity to varied DeFi protocols.

Yield farming tokens are sometimes governance tokens that present holders with voting rights and a share of the charges generated by the protocol. These tokens may be earned by staking or offering liquidity to varied DeFi platforms, which in flip permits customers to earn a yield on their funding.

The rally has benefited mid-cap tokens like Uniswap and Aave, up 3.7% and 4.3%, respectively, nevertheless it has not essentially come from them.

Up rather more are lower-cap tokens like Landshare.

Home flipping on-chain

The sector rally seems to be largely led by the newly launched mission Landshare, a token totally built-in with the Binance Sensible Chain, which has surged +44% within the final 24 hours.

The mission permits for tokenized actual property property to be flipped on-chain, a platform that merges the capabilities of DeFi and actual property funding, a platform that provides direct publicity to property on-chain like Tokenized Belongings and Crowdfunded Home Flipping.

Badger DAO accelerates

One other low-cap token that has surged over the previous 24H is Badger DAO, a mission that goals to construct merchandise and infrastructure essential to speed up Bitcoin as collateral throughout different blockchains.

Badger has risen in value +6.75% over the previous 24H, with a market cap of $72 million, the token value of Badger is now $3.79.

On Feb. 22., Badger DAO launched an eBTC, a decentralized Bitcoin powered by Ethereum staking.

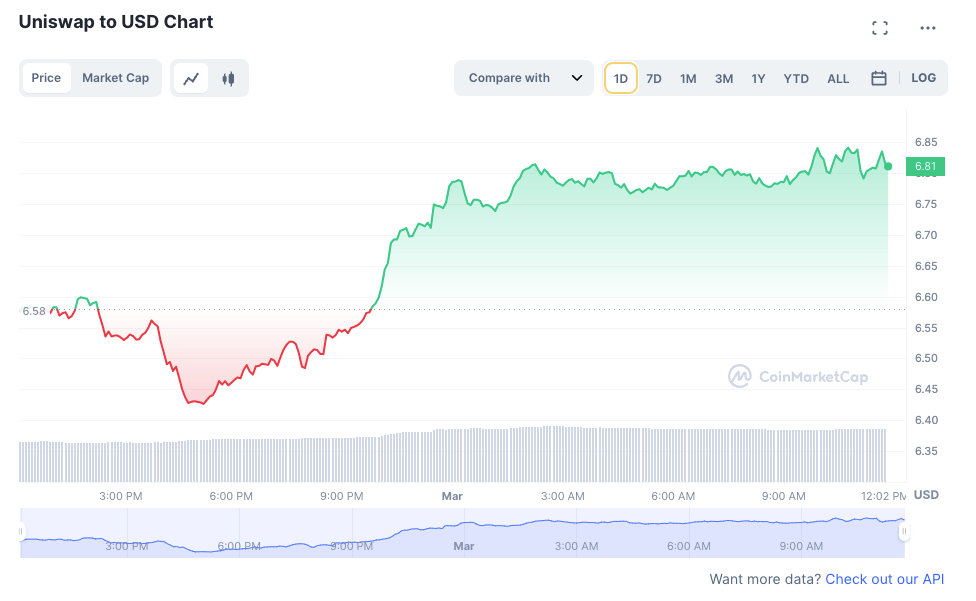

Uniswap rises

Uniswap is a decentralized cryptocurrency alternate that operates on the Ethereum blockchain and makes use of an automatic market-making system. It has its personal governance token referred to as UNI and is taken into account a outstanding participant on the earth of decentralized exchanges.

The present buying and selling value for Uniswap is $6.81 USD, the token has seen a 3.31% improve within the final 24 hours, and at the moment holds the #18 rank on CoinMarketCap with a dwell market cap of $5 billion.

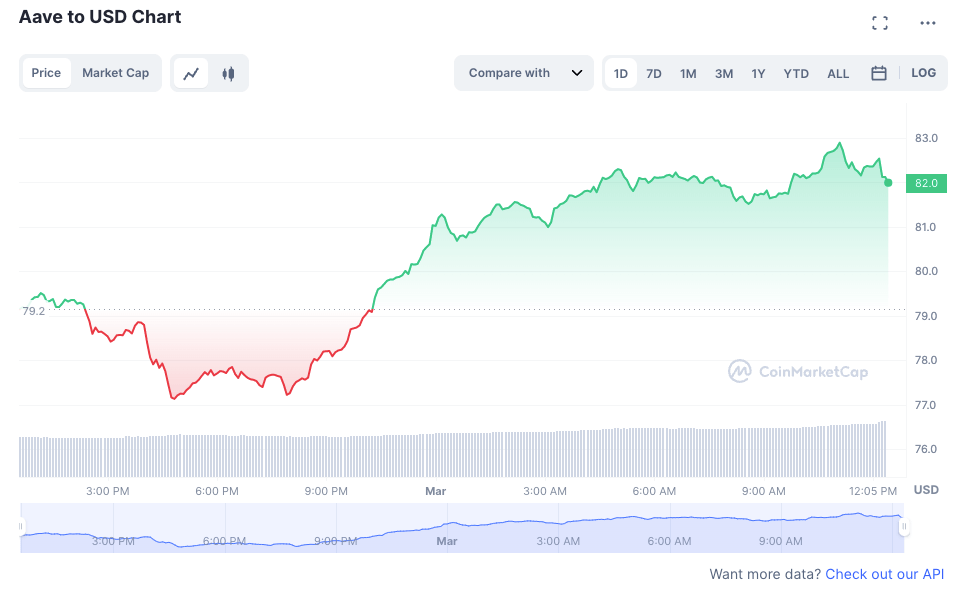

Aave good points too

One other yield farming token, Aave, can also be up right now. Aave is a decentralized finance protocol enabling customers to lend and borrow cryptocurrencies by depositing their digital property into liquidity swimming pools, permitting debtors to make use of crypto as collateral to acquire flash loans.

The present buying and selling value of Aave is $82.32 USD, with a 24-hour buying and selling quantity of $82,338,720 USD. The token has skilled a 4.26% improve within the final 24H.

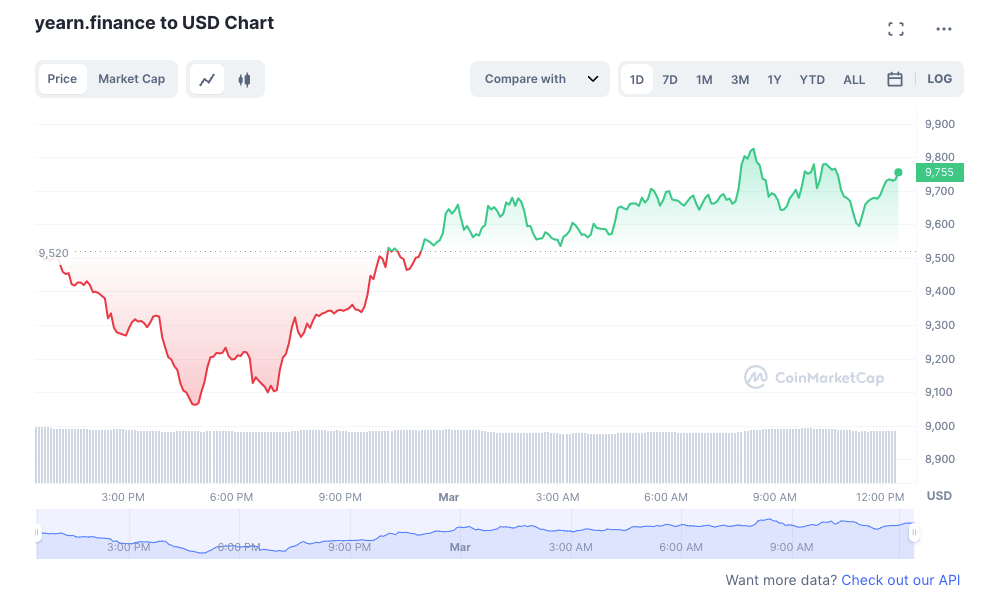

Yearn Finance sees modest good points

yEarn.finance is a DeFi lending protocol constructed on Ethereum, as an aggregator service designed for traders in DeFi that leverages automation to assist them maximize income from yield farming. The platform goals to simplify the advanced DeFi panorama for much less tech-savvy traders or these in search of a much less intensive method than that {of professional} merchants.

The present value of yearn.finance is $9,735.50 USD, it has skilled a 2.86% improve in worth over the previous 24H. Its present market cap is $356 million, making it the 116th hottest token on Coin Market Cap.

Discussion about this post