A brand new report by the Community Contagion Analysis Institute (NCRI) means that social media exercise, particularly from inauthentic accounts, could have considerably amplified the worth of sure cryptocurrencies listed on the now-defunct FTX alternate.

In line with the report, Twitter exercise surrounding FTX-listed tokens like Gala (GALA) and ImmutableX (IMX) typically featured many bot-like and inauthentic accounts, comprising round 20% of whole on-line chatter about these belongings.

Additional evaluation revealed that for half of the FTX-listed tokens studied, this inauthentic Twitter exercise appeared to forecast subsequent worth modifications.

The report notes that “inauthentic networks efficiently and intentionally deployed to affect modifications in FTX [listed] coin costs.”

Bot exercise adopted FTX listings.

Whereas the NCRI report doesn’t straight accuse FTX of deploying bots, a few of its findings level to suspicious exercise round tokens after they have been listed on the alternate.

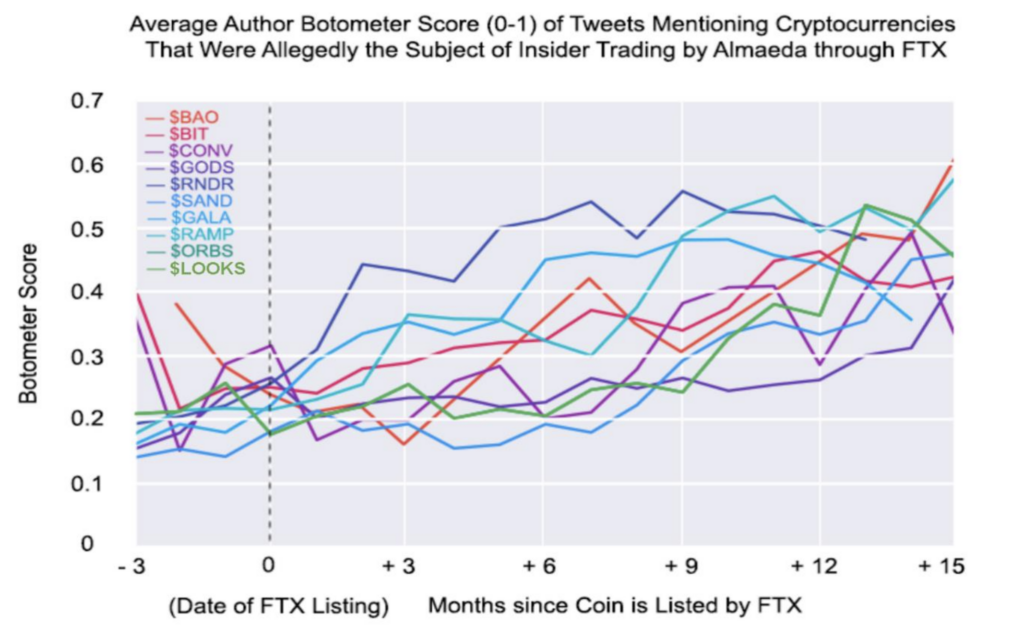

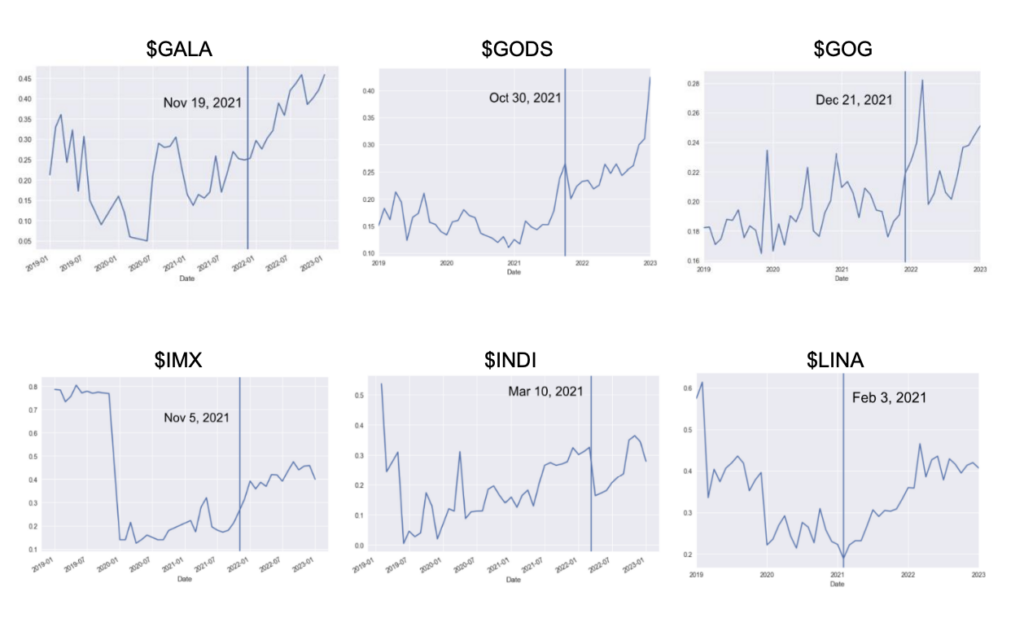

The researchers discovered that the promotion of a coin by FTX was typically adopted by an increase in common bot scores for accounts tweeting about that coin over time, with inauthentic exercise reaching 50% of whole quantity after 15 months in some instances. The beneath charts present how bot exercise elevated following FTX listings, remarked by the vertical line.

Analyzing a pattern of FTX-listed tokens, the researchers discovered a big rise in bot-like exercise after these belongings acquired a promotion from FTX’s Twitter account. For tokens like GALA, IMX, GODS, LINA, SAND, DODO, and others, the proportion of tweets from inauthentic, bot-like accounts grew steadily over time following the FTX itemizing announcement.

The report states that throughout the FTX coin pattern, inauthentic chatter forecasted worth modifications for half of the belongings.

Whereas not conclusively implicating FTX within the coordinated bot exercise, the timing of the surge in inauthentic tweets about its listed tokens is doubtlessly suspicious. Because the report particulars, promotion by FTX appeared to behave as a catalyst for attracting bot amplification round these tokens.

Whether or not directed by FTX/Alameda itself or not, the researchers argue the information signifies an orchestrated effort involving bots to control market sentiment after the alternate listed doubtlessly and marketed sure cryptocurrencies.

Ongoing bot exercise

Nevertheless, the report cautions that this phenomenon is ongoing, citing an evaluation of meme cash like PEPE and PSYOP, which not too long ago reached billion-dollar market capitalizations. NCRI additionally discovered important bot exercise round these tokens, with inauthentic chatter showing to foretell PEPE worth modifications in some checks.

Whereas noting that additional analysis is required, the report concludes that as cryptocurrencies grow to be extra mainstream, the prospect of market manipulation by means of coordinated social media exercise poses substantial dangers to traders and monetary stability.

Larger transparency and oversight of cryptocurrency markets are wanted, in response to the researchers. Nevertheless, latest limits on information entry for exterior analysts could create boundaries to figuring out doubtlessly fraudulent actions on social media that might impression costs.

“It’s additionally value noting the alarming pattern of social media firms, together with Twitter and Meta, limiting information accessibility to researchers.

This motion could impede exterior observers from figuring out fraudulent and consequential actions, making a barrier for transparency in monetary markets.”

The report advises that regulators, platforms, and the general public ought to concentrate on the potential for manipulation and develop strategies to counter such ways.

Discussion about this post